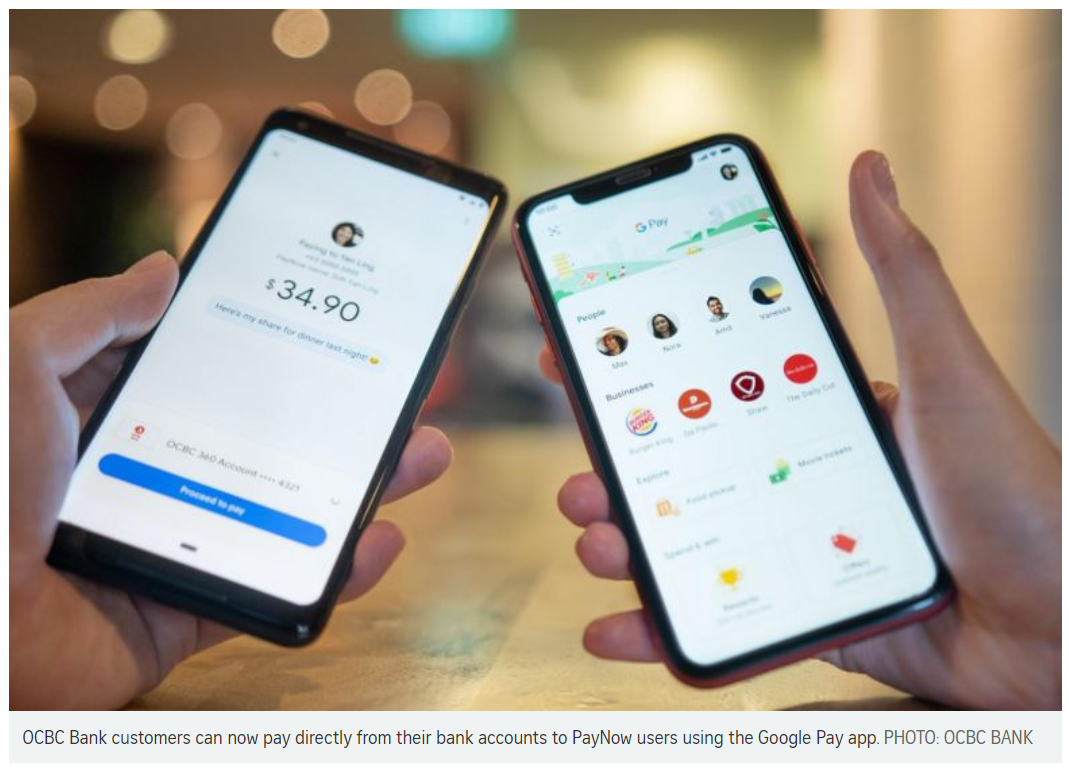

Singapore: OCBC launches PayNow fund transfers via Google Pay

SINGAPORE (THE BUSINESS TIMES) – OCBC Bank has brought Google Pay’s peer-to-peer (P2P) funds transfer service to Singapore, making the Republic the third country where this service is available.

Before this, the service was available only in the United States and India. With the new service, OCBC customers can pay directly from their bank accounts to anyone registered to PayNow using the Google Pay app.

This allows customers to make real-time money transfers to contacts who have linked their bank accounts to their mobile numbers. The Google Pay P2P service has a daily transfer limit of $1,000.

Google Pay is a digital wallet platform and online payments system developed by search giant Google.

OCBC had first revealed its tie-up with the tech giant in November 2019 to integrate Google Pay services with PayNow. This is in addition to enabling credit cards on the Google Pay app to make online and in-store payments.

Mr Ching Wei Hong, head of global wealth management and consumer banking at OCBC, said the partnership could boost the trend of more consumers using PayNow. In 2019, more than 70 million PayNow transactions worth $12.16 billion were made in Singapore.

“We have long rejected the ‘digital wallet’ approach that requires customers to top up an e-wallet and hold funds in one without earning interest. Instead, we put a lot of effort into developing OCBC Pay Anyone as an open-loop payment system, whereby customers literally ‘pay anyone’ directly from their bank accounts. This in turn became the foundation of a strategy that has led us to develop payment solutions that are seamless, convenient and secured,” Mr Ching said in a media statement.

“With Google Pay strengthening it further, we expect to see the continued rise for the adoption rate of digital payments solutions among our customers in Singapore,” he added.

OCBC shares were trading $0.13 or 1.5 per cent higher at $9.05 as at 10.45am on Tuesday (April 14).

Thailand

Thailand