Singapore M&A value in first half of year lowest since 2013

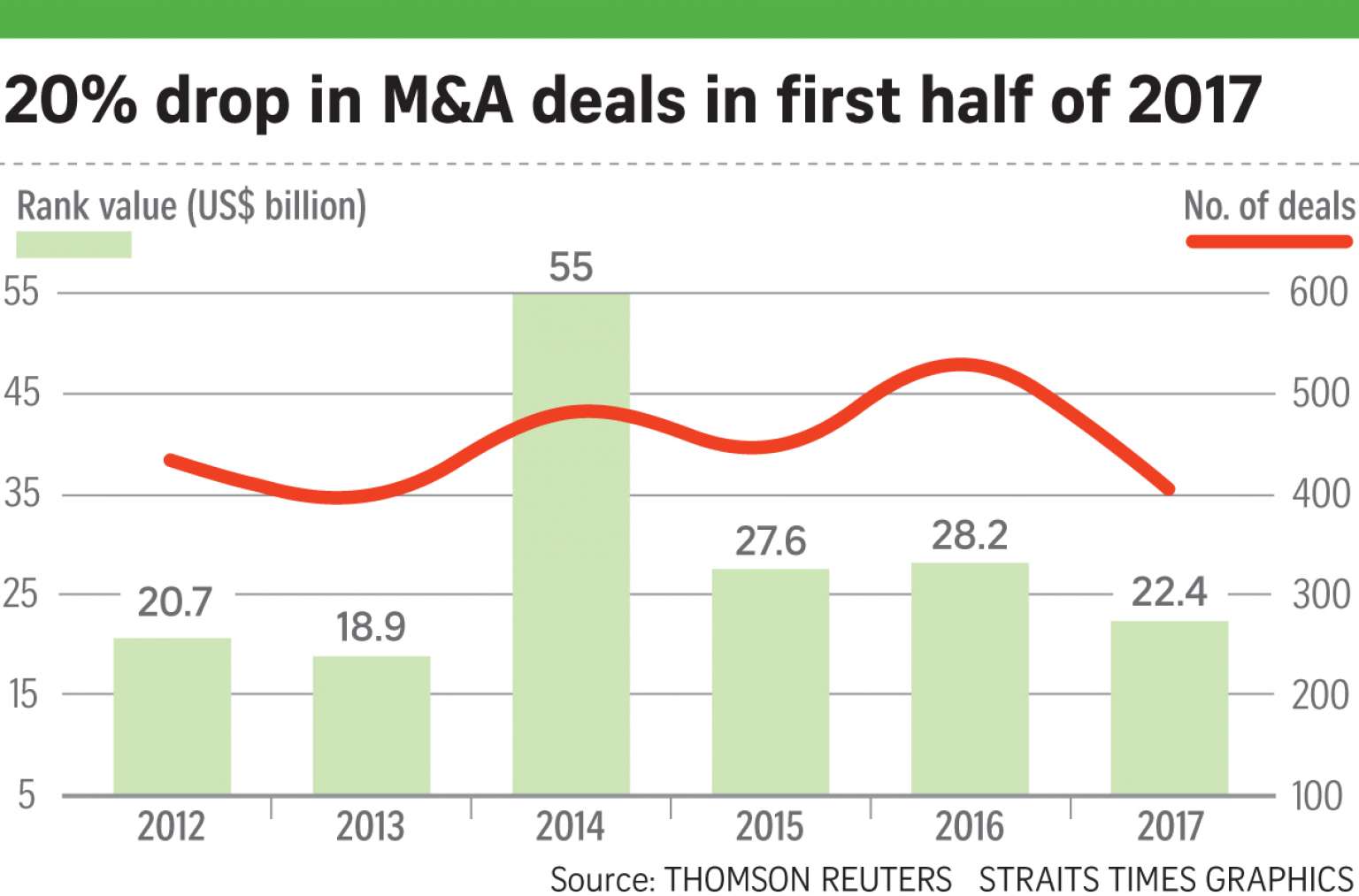

The value of mergers and acquisitions (M&A) involving Singapore firms has declined in this half of the year compared with the same period last year and sits at a level not seen since 2013, Thomson Reuters said yesterday.

Deals valued at US$22.4 billion (S$30.87 billion) have been struck so far this year, down 20.3 per cent from the first half of last year, while the number of transactions fell 23.4 per cent.

The average M&A size for disclosed deals dropped to US$89.8 million, compared with US$93.6 million in the first half of last year.

Total cross-border deal activity amounted to US$13.7 billion, a 12.7 per cent decline over the same period last year.

Domestic M&A activity also slowed to US$3.8 billion, a 41 per cent decrease from last year, with the number of domestic transactions down by 30.3 per cent.

Singapore’s inbound M&A activity fell 16.7 per cent in deal value from a year ago, as foreign acquisitions targeting locally based companies reached US$5.6 billion in the first half of the year.

The industrial sector accounted for 42.3 per cent of Singapore’s inbound M&A activity and totalled US$2.4 billion, up 49 per cent from the first half of last year.

This was driven by China-based HNA Holding Group’s pending US$1.3 billion acquisition of the entire share capital of CWT, a Singapore-based provider of integrated logistics solutions and management services.

That deal also makes China the most active acquirer in terms of deal value, capturing 30.8 per cent of Singapore’s inbound activity.

Hong Kong was next with 16.5 per cent, followed by Canada on 16.4 per cent and the United States at 15.4 per cent.

Singapore outbound M&A has reached US$8 billion so far this year, down 9.7 per cent from the first half of last year, while the number of outbound acquisitions has declined by 19.2 per cent.

The real estate industry has been the most targeted sector, capturing 54 per cent of Singapore’s outbound activity, with US$4.3 billion worth of deals.

This was driven by this year’s biggest Singaporean M&A deal: Mapletree Investments’ acquisition of the student housing portfolio of US- based Kayne Anderson Capital Advisors for an estimated US$1.6 billion.

This bolstered the US as the most targeted nation for Singaporean overseas deals so far this year in terms of value and number of deals.

Singapore’s overseas acquisitions in the US reached US$3.6 billion so far this year, up 84.3 per cent in value and accounted for 45.3 per cent of the market share.

China and India rounded up the top three most targeted nations with 13.7 per cent and 12.3 per cent market share, respectively.

Source: http://www.straitstimes.com/business/companies-markets/spore-ma-value-in-first-half-of-year-lowest-since-2013

Thailand

Thailand