Singapore investors explore opportunities in Myanmar construction

Over the years, the Myanmar government has stepped up its efforts to bring in foreign direct investment (FDI) to the country. Being more pro-business and open to FDI, potential opportunities for foreign companies willing to invest in Myanmar are vast, particularly in the construction industry as one of the main pillars of the economy.

YCP Solidiance, an Asia-focused strategic advisory firm, recently hosted a week-long Overseas Market Workshop (OMW) visit for the Singapore Business Federation (SBF), with the aim of helping Singaporean companies in Yangon explore investments in Myanmar’s construction sector.

The workshop also coincided with the visit of Singapore’s Minister of Trade & Industry Chan Chun Sing in Yangon, highlighting the importance of greater collaboration between the two countries following the recent signing of the Singapore-Myanmar Bilateral Investment Treaty .

This treaty aims to promote greater investment flows between the two countries in many sectors, including construction, by protecting the interests of investors and providing greater certainty and confidence.

Singapore is Myanmar’s largest foreign investor with a cumulative investment of US$22.1 billion recorded as of August 2019. Bilateral trade in goods between the two countries has increased by 10 percent and reached US$4 billion in 2018.

The workshop indicated new opportunities for investment in the construction sector, following the growth rates of around 11pc in recent years. Transport infrastructure opportunities include trunk road network modernisation, expansion of interconnectivity through roadways and elevated highways, improving access to tier two and three cities via bridges and commuter rails, and alternative transport options such as water-taxi or structured bus system.

For airport infrastructure, the existing plane and cargo handling services in Myanmar require considerable technological and investment support, as the government has emphasized the importance of developing regional airports to enhance both the tourism and transport sectors.

During the event, 18 senior executives including SBF representatives had the opportunity to engage with key government agencies and firms active in the infrastructure, real estate, building, and construction sectors in the country such as Directorate of Investment and Company Administration (DICA), Shwe Taung, Yoma Group, Surbana Jurong, OCBC Bank, PEB Steel, Thilawa SEZ Management, and Asian Development Bank (ADB).

According to ADB, the infrastructure gap until 2030 is estimated at US$120 billion. It will continue to be a key driver for the construction sector in Myanmar with a projected growth of 10.7pc between 2018-2022, supported by the 251 infrastructure projects in a Project Bank launched by the government in early 2019.

All infrastructure segments such as roads, railways, harbors, and airports require considerable investments, presenting significant opportunities for international developers, contractors as well as construction material suppliers.

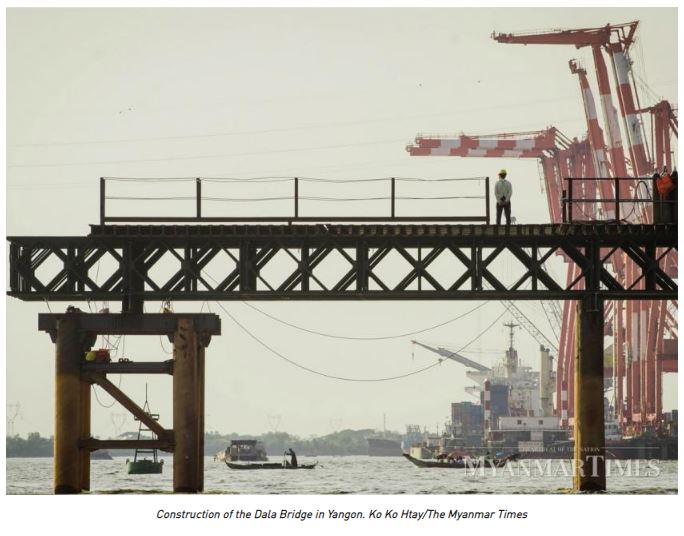

Infrastructure remains a key focus in line with rising congestion and pressure to support a growing population in Yangon. During a discussion with Colliers, a real estate consultancy firm, notable infrastructure development projects were mentioned including the Dala bridge, New Yangon City, additional phases of the Thilawa Special Economic Zone, Thilawa International Port

Terminal, Hlaing Tharyar Bridge, and the Yangon Circular Railway project.

A total of 16 industrial zones and the Thilawa Special Economic Zone in Yangon are listed as presenting potential opportunities for investors looking to manufacture in Myanmar and access the significant customer base in Yangon.

The bulk of the 113 investments in the Thilawa SEZ are focused on manufacturing – there are 89 entities accounting for a 79pc share – followed by logistics both in terms of volume as well as value of investments. Manufacturing investments in the Thilawa SEZ amount to a total of US$1.4 billion as of 31 August 2019 accounting for 81pc of the total US$1.7 billion in investment value.

The SEZ allows both 100 percent foreign investments and joint-Myanmar-foreign ventures to establish operations in Thilawa. Japan leads as an investor in terms of the number of enterprises permitted to establish their presence in the Thilawa SEZ with 39 entities as of August 2019.

However, in terms of value of investments, Singapore surpasses Japan with a total of US$646.7 million compared to US$537.7 million invested by firms from Japan.

Naithy Cyriac is Managing Director Myanmar at YCP Solidiance, an Asia-focused advisory and investment firm with 20 offices across the globe.

Source: https://www.mmtimes.com/news/singapore-investors-explore-opportunities-myanmar-construction.html

Thailand

Thailand