Singapore core inflation hits 3.3% in April

SINGAPORE’S core consumer prices have continued to climb on increases in the cost of food and other goods, as well as electricity and gas, according to figures out on Monday (May 23).

Core inflation – which excludes accommodation and private transport costs – jumped to 3.3 per cent in April, up from 2.9 per cent in March. This is its highest level since early 2012.

That’s even as the headline inflation print was stable on the month before at 5.4 per cent – and a shade under the median estimate of 5.6 per cent in a Bloomberg poll – as the growth in private transport costs eased on a smaller increase in car prices.

Still, private transport expenses were up by 18.3 per cent in April, against 21.5 per cent in March, while accommodation costs rose by 3.9 per cent year on year in April, compared with 3.5 per cent in March, on higher rents.

Private transport and accommodation inflation are expected to stay firm in the near term, according to projections from the Monetary Authority of Singapore (MAS) and Ministry of Trade and Industry (MTI).

The rising price of food continued to drive inflation in April, with costs higher by 4.1 per cent year on year, up from 3.3 per cent in March.

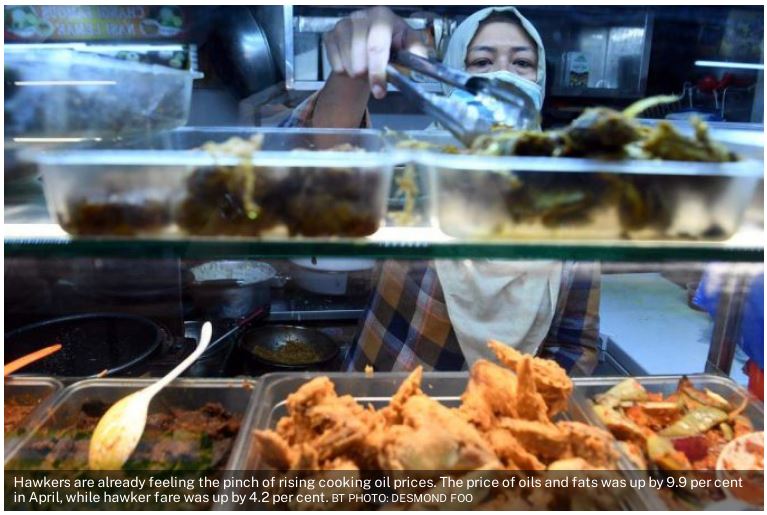

The MAS and MTI noted that “the prices of both non-cooked food and food services rose at a faster pace”. The price of oils and fats was up by 9.9 per cent in April; milk, cheese and eggs by 6.7 per cent; meat by 5.7 per cent; and fish and seafood by 5.6 per cent. Hawker fare was up by 4.2 per cent, and restaurant food, by 3.8 per cent.

Inflation in retail and other goods picked up to 1.6 per cent, from 0.4 per cent in March – attributed to an increase in apparel prices. Clothes cost 1.7 per cent more year on year.

Electricity and gas prices grew by a steeper 19.7 per cent in April, compared with 17.8 per cent in March, as household electricity and gas tariffs went up in the second quarter. Meanwhile, services inflation was 2.5 per cent in April, against 2.6 per cent in March, which was attributed to the relaxation of Covid-19 test requirements for travel.

The MAS and MTI reiterated in their latest joint statement that core inflation will be “significantly above its historical average through the year” and could continue to rise “in the coming months” before retreating towards the year-end.

Meanwhile, Prime Minister Lee Hsien Loong recently told Japanese media outlet Nikkei that, even as central bankers worldwide work to tackle rising inflation, “there is a considerable risk of doing what you need to do but as a result, provoking a recession”.

Source: https://www.businesstimes.com.sg/government-economy/singapore-core-inflation-hits-33-in-april

Thailand

Thailand