Philippines: Inflation slightly eases to 6.3% in August on lower oil prices

MANILA, Philippines (Updated 11:34 a.m.) — Inflation in the Philippines slightly eased in August on lower transport costs as global oil prices started to fall, but the pressure on the Marcos Jr. administration and the central bank to tame rapid price increases remains.

Inflation, as measured in the consumer price index, accelerated to 6.3% year-on-year, the Philippine Statistics Authority reported Tuesday. This was still the fastest price growth since 2018.

The latest reading was lower than the 6.4% outturn recorded in July, and settled within the Bangko Sentral ng Pilipinas’ 5.9-6.7% forecast range for the month. At the same time, the August print was still above the government’s 2-4% target.

Data showed transport inflation softened 14.6% year-on-year in August from 18.1% in July, the biggest contributor to the slower price growth last month. Gasoline prices grew at a slower pace of 31.2% on-year in August from 45.4% a month ago, while diesel inflation eased to 70.9% annually in August from 91.3% in July.

Sought for comment, Nicholas Antonio Mapa, senior economist for ING Bank in Manila, said energy costs nvertheless played a large role in keeping consumer prices elevated.

“Price pressures continue to drive headline inflation higher with the tag team of supply and demand side factors coming into play. Pricey energy caused by the war in Ukraine and shortages in basic food items drove food inflation while transport and utility costs remained elevated as the world grapples with an energy crisis,” Mapa said in a Viber message.

“Demand side pressures also driving inflation for discretionary spending items like restaurants and recreation still strong,” he added.

Filipinos have been shouldering the brunt of rising prices of goods and services while beating back shortages of valuable commodities like sugar and onion. As it is, this rising inflationary trend was too much for the domestic economy to bear, impinging on growth back in the second quarter by crimping consumption.

Earlier this month, BSP Governor Felipe Medalla said inflation could possibly peak in September or October since global markets will start pricing in recession concerns.

A depreciating peso is likewise fanning inflation, which would compel the BSP to keep a hawkish monetary policy stance, according to ING’s Mapa.

‘Not significant’

National Statistician Claire Dennis Mapa explained that while inflation did inch down 0.1 percentage point in August, it was “not statistically different” to the July reading.

He added that there were also significant increases within other commodity groups despite the decreases in prices of some items.

Restaurant and accommodation services (4.2%) and housing utilities (6.8%) rose annually in August, forcing consumers to tighten their belts further. The costs of education likewise grew as school-aged children trooped back to classrooms, especially in Metro Manila where year-on-year education inflation stood at 8.1%.

Excluding highly volatile items like fuel, core inflation leapfrogged 4.6% year-on-year in August from 3.9% in July. Core inflation is often used as an indicator of the long term inflation trend as well as future inflation. The long- term inflation trend is primarily affected by demand conditions which, in turn, can be influenced by the BSP’s monetary policy.

“Core inflation zipped to 4.6%, up from 3.9% in the previous month, showing that second round effects and demand side pressures are clear and present. Above target core inflation suggests that price pressures are here to stay,” ING Bank’s Mapa said.

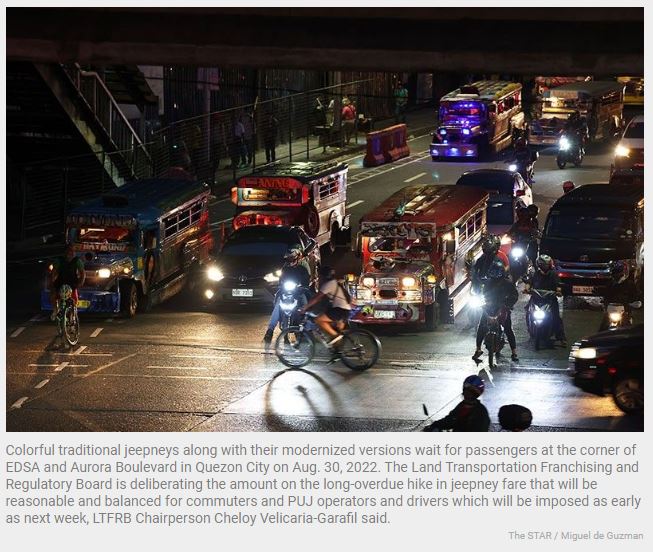

The PSA also explained that when fuel costs turn pricey, consumer goods and services like public transport fares increase two months after. ING’s Mapa is anticipating a round of jeepney fare hikes to push inflation up in the coming months.

Even then, the PSA is hard-pressed to confirm whether inflation has indeed peaked, considering the latest figures and the BSP’s statement earlier last month. The cartel of oil-producing countries said they would be trimming production by October, which could expose importers like the Philippines to a host of price increases.

The National Economic and Development Authority noted in a statement on Tuesday that global oil production remains uncertain since some developed economies are seeing their growth slow down.

The PSA said inflation could “change direction” this month depending on local pump prices.

“Today’s headline inflation dip to 6.3% may lower the odds for a 50bp rate hike at the 25bp but the substantial pickup in core inflation ensures the central bank stays hawkish,” ING’s Mapa added.

“BSP likely to sustain rate hikes for the rest of the year with the policy rate at 4.5% by December,” he said.

Source: https://www.philstar.com/business/2022/09/06/2207765/inflation-slightly-eases-63-august-lower-oil-prices

Thailand

Thailand