Philippines: High inflation and rising interest rates

High inflation and rising interest rates took center stage in the past month as these are viewed as major risks for the Philippines. Investors and economists paid close attention to the release of our country’s inflation data last week as rising prices have started to affect all Filipinos. Last Friday, the Philippine Statistics Authority reported that inflation in September reached 6.7 percent. This is above the August inflation reading of 6.4 percent, but is within the central bank’s forecast range of 6.3 percent to 7.1 percent. Given this, many are wondering when the inflation figure will peak.

BSP raises policy rate to tame inflation

One of the tools that can help tame inflation is the policy rate of the Bangko Sentral ng Pilipinas (BSP). Managing this rate allows the BSP to influence economic activity and inflation. In response to rising inflation, the BSP has raised its policy rate in the last four meetings, equating to a cumulative hike of 150 bps since May. The brisk pace of rate hikes shows the BSP’s determination to tame the rise in prices, which comes after a period of low inflation and low interest rates. Moreover, the policy rate hikes should help to check the weakness of the Philippine peso as it contributes to rising inflation.

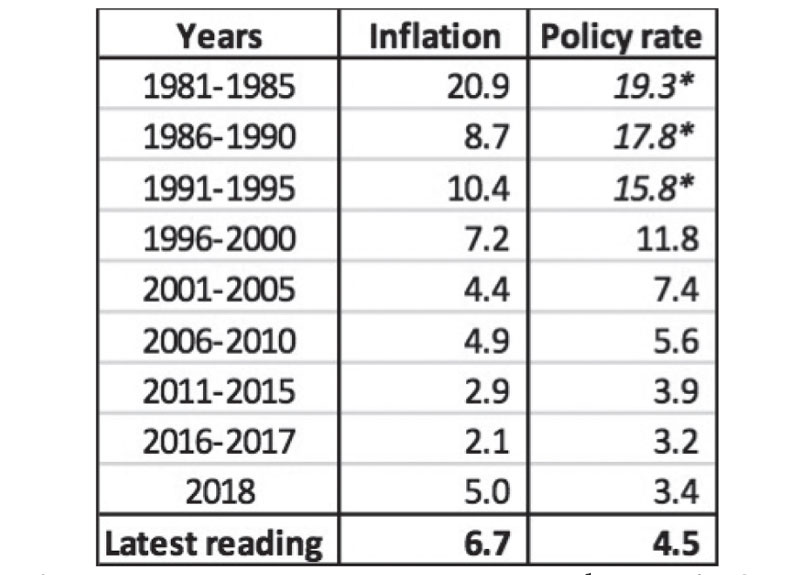

Inflation and interest rates in the Phl

The latest inflation figure of 6.7 percent represents a marked acceleration compared to low inflation readings from 2010 to 2017. Nonetheless, the current inflation print is still well below the higher rates which the country posted from 1981 to 2010. This explains why interest rates have remained high until 2010.

Ave. inflation and policy rates of the Philippines

Policy rate = interest rate on BSP’s overnight RRP facility

*Interest rate on short-term Philippine Treasury bills

Sources: Philippine Statistics Authority, Bangko Sentral ng Pilipinas, Wealth Research

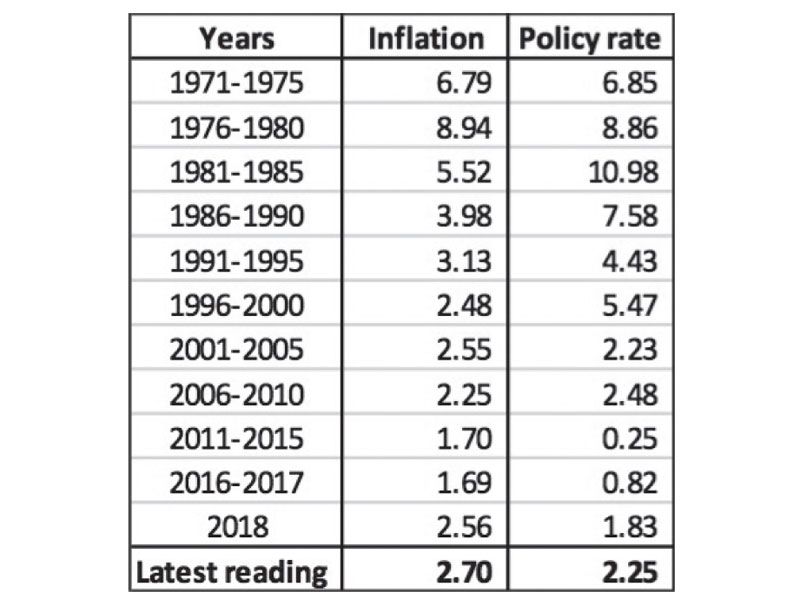

Normalization of interest rates in the US

The trajectory of inflation and interest rates in the Philippines generally tracked trends in the US. As seen in the table below, US inflation and interest rates followed a long-term downtrend. In our book “Opportunity of a Lifetime”, we explained how the Fed cut interest rates to historic lows to save the US economy from the 2008 subprime mortgage crisis. However, rates in the US have recently started to rise as the Fed normalizes its benchmark rate from ultra-low levels. The Fed has raised its policy rate eight times since 2015 as inflation has risen above two percent and US economic growth has strengthened.

Ave. inflation and policy rates of the US

Policy rate = Federal funds target rate

Sources: Bloomberg, Wealth Research

We note that the Fed’s policy normalization has contributed to the peso’s weakness and is one of the reasons behind the BSP’s policy rate hikes. Moreover, the yield on the 10-year US Treasury note touched 3.2 percent last week. This triggered a pullback in US stocks and sharp drops in emerging market equities.

Oil – one of the culprits

Higher inflation was partly caused by the surge in oil prices. Last week, Brent crude closed at $84/bbl, up 51 percent YoY and almost double from a low of $44/bbl in June last year. The recent breakout in oil may cause inflation to remain elevated as higher oil prices push transport prices up and fuel inflation expectations.

Be careful what you wish for

Rising inflation and surging oil prices have prompted calls from some lawmakers to scrap the oil excise taxes imposed by TRAIN. The government should be careful in weighing this proposal as it will result in a wider fiscal deficit beyond acceptable targets for our country. This will open our economy to dangerous risks which include 1) a wave of downgrades from credit rating agencies which may cause our country to lose its investment grade rating; 2) higher borrowing costs for the government as it seeks funding for its infrastructure program; and 3) an avalanche of breakdowns in the Philippine peso, government bonds and stock market. In this light, it is integral for our government to exercise prudence, maintain fiscal discipline, and be cognizant of the consequences of crucial fiscal decisions.

Managing the controllable factors

Rising inflation has been caused both by controllable and non-controllable factors. The rise in oil prices is not controlled by the government as it is driven by global supply and demand. Nonetheless, many of the inflation drivers can still be managed by the government. The economic managers have assured that government initiatives are underway to resolve supply-side constraints on food items and mitigate the impact of agricultural damage from Typhoon Ompong. The government has to be focused, proactive, and decisive in addressing inflation to prevent it from spiraling out of control.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

Source: https://www.philstar.com/business/2018/10/08/1858072/high-inflation-and-rising-interest-rates#1EdvxMCKoHsulgKe.99

Thailand

Thailand