Optimism for next six months on the rise in Singapore’s manufacturing, services sectors

BUSINESS optimism in Singapore’s manufacturing and services sector continues to rise, with more firms seeing better conditions in the six months ahead, according to quarterly surveys released on Friday.

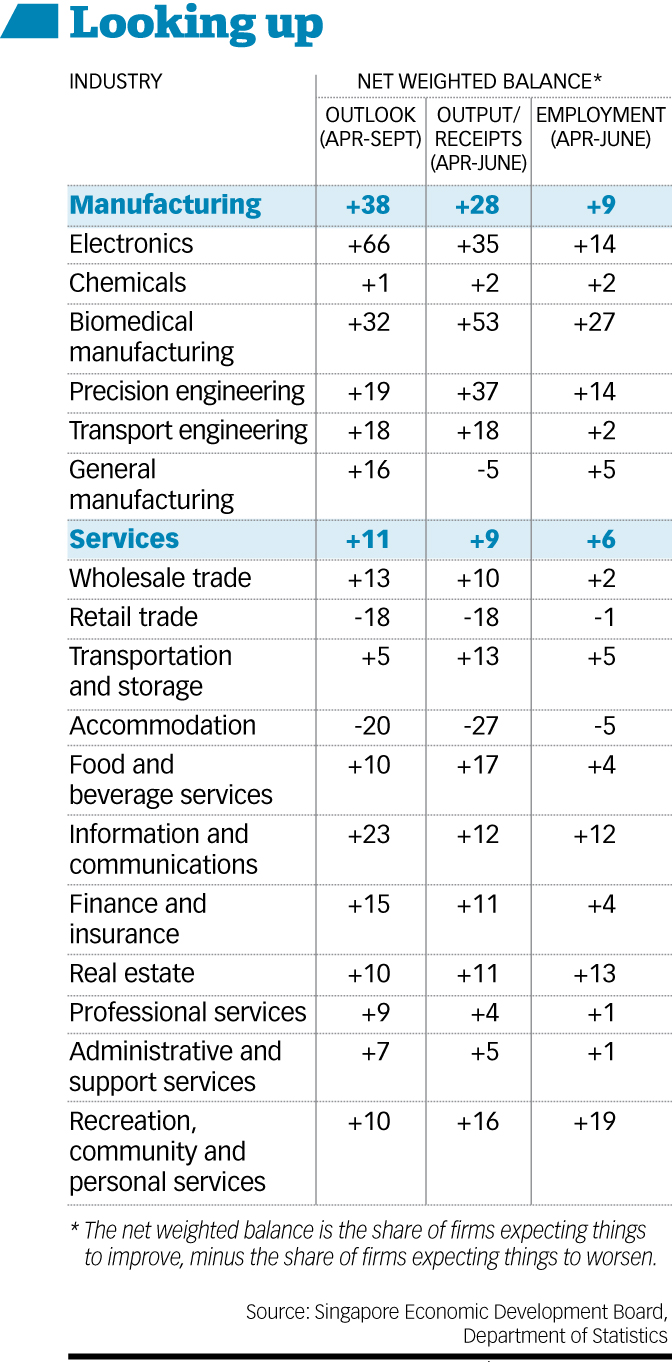

In the manufacturing sector, a net weighted balance of 38 per cent of firms expect favourable business conditions for the six-month period from April to September, compared to the first quarter of the year. This was up from 36 per cent in the previous quarter’s survey.

The net weighted balance is the difference between the weighted percentages of positive and negative responses – in this case, 41 per cent and 3 per cent respectively, in the survey by the Singapore Economic Development Board (EDB).

Though marginal, this rise is still an improvement – and is in fact the highest reading since Q1 2004, said UOB economist Barnabas Gan.

More importantly, all clusters had positive net weighted balances, even those – transport engineering, general manufacturing, and chemicals – which contracted last year, he added.

In the services sector, 20 per cent of firms expect improved business conditions in the next six months, while 9 per cent expect weaker conditions, making for a net weighted balance of 11 per cent being optimistic, the Department of Statistics (Singstat) survey showed.

This was a further improvement from a net weighted balance of 7 per cent in the previous quarter’s survey, which had marked a return to optimism after four straight quarters of overall negative sentiment.

All clusters in the manufacturing sector were optimistic about the next six months. This was led by electronics, with a net weighted balance of 66 per cent seeing a positive business outlook – a large improvement from 37 per cent in the previous quarter’s survey.

“This sanguine sentiment is mainly driven by the semiconductors and other electronic components segments, which project higher export orders on account of robust demand from 5G markets,” said the EDB.

This was followed by biomedical manufacturing, with a net weighted balance of 32 per cent being optimistic, in anticipation of higher overseas orders in both the pharmaceuticals and medical technology segments.

Optimism in the precision engineering cluster, with a net weighted balance of 19 per cent, was largely led by the machinery and systems segment, which foresees robust orders and deliveries for semiconductor-related equipment on the back of increased capital investments by global chip makers.

Sentiment was mixed in the transport engineering cluster, which had an overall net weighted balance of 18 per cent, as optimism in aerospace (25 per cent) and land (55 per cent) more than made up for negative sentiments in marine and offshore engineering (-7 per cent).

In general manufacturing industries, optimism in miscellaneous manufacturing outweighed pessimism in the food, beverages, and tobacco segment, as well as in printing, for an overall net weighted balance of 16 per cent.

The chemicals cluster was only marginally optimistic with a net weighted balance of 1 per cent, with optimism in specialties and other chemicals just making up for pessimism in petroleum and petrochemicals.

In the shorter term, a net weighted balance of 28 per cent of manufacturers expect output to increase in the second quarter of 2021 compared to the first quarter. In particular, the biomedical (53 per cent), electronics (35 per cent), and precision engineering clusters (37 per cent) expect higher output. General manufacturing was the only cluster to expect lower output levels.

As for employment, the majority of manufacturers (77 per cent) expect their employment level in the second quarter to remain similar to that in the first. Overall, a net weighted balance of 9 per cent intend to hire more workers in the second quarter, compared to the previous one.

For the next 12 months through March 2022, a weighted 72 per cent of manufacturers plan to invest in plant and machinery, of which a weighted 65 per cent expect higher or similar levels of capital expenditure compared to the last 12 months.

For services, expectations for the second quarter of the year improved for both operating receipts and employment. A net weighted balance of 9 per cent expect takings to rise, up from 5 per cent in the last survey.

While the bulk of firms (80 per cent) expect no change to employment in the second quarter, a net weighted balance of 6 per cent expect to hire more, up from zero in the last survey.

In particular, the recreation, community and personal services industry expects to hire more, driven by health services. The information and communications industry also expects more hiring, particularly for firms engaged in computer programming and consultancy.

But the accommodation industry expects lower employment levels in view of weak demand.

The accommodation industry also remains most pessimistic (-20 per cent) about the next six months, as international travel restrictions persist.

“While hoteliers also anticipate staycation demand to pick up in the June school holidays, it would not be sufficient to offset the low tourism arrivals,” said OCBC head of treasury research and strategy Selena Ling.

The only other services industry to be pessimistic was retail trade (-18 per cent), as business in the next six months is not expected to live up to the preceding October-to-March stretch, which coincided with the year-end holiday and festive season.

All other industries were optimistic, including two which turned around from pessimism in the previous quarter – real estate, and professional and administration and support services.

Information and communications was the most upbeat, with a net weighted balance of 23 per cent seeing improved conditions.

“Among them, firms engaged in computer programming and consultancy services are positive about their business outlook due to an increase in demand from clients to digitalise their business operations,” said Singstat.

Source: https://www.businesstimes.com.sg/government-economy/optimism-for-next-six-months-on-the-rise-in-singapores-manufacturing-services

Thailand

Thailand