Myanmar: Property taxes worth less than a cup of tea

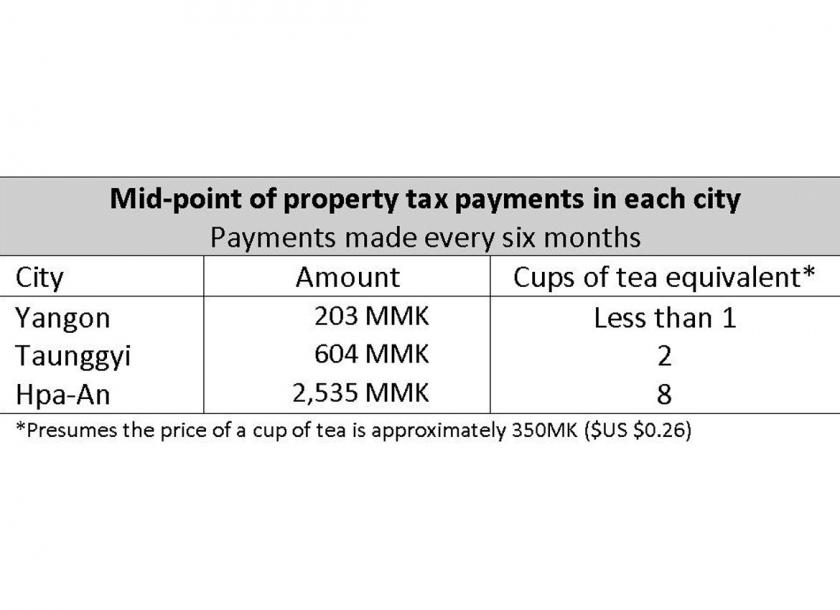

In Yangon, the amount collected over the same period is worth less than one cup of tea, assuming each cup costs K350, or 26 US cents.

The study reviews the existing property tax system of the country, discusses the areas in need of reforms and places the issue of taxation in the wider context of Myanmar’s urbanisation process.

Notably, if the country is to capture the social and economic benefits of rapid urbanisation, then a strong property tax system, under which more taxes are collected, backed by effective governance, will be necessary.

Property taxes are distinct from other taxes and charges that are levied on property such as stamp duties and capital gains tax, which are paid to the national government and triggered only by the sale or transfer of the property. Property taxes, in Myanmar, are also distinct from user fees, which are only paid if a customer uses a good or service.

“The Myanmar property tax system uses the ‘annual rental value’ approach to estimate the tax base,” Lachlan McDonald, one of the authors of the study, told The Myanmar Times.

“This property valuation system is common to former British colonies, including countries in Asia such as Singapore, Malaysia, Pakistan and parts of India,” he said.

property-graphic.jpg

In 2013, Myanmar collected the least amount of property tax in the region. Chart: Supplied

Disproportionate tax

Under the current system, property tax revenues collected in Myanmar is the lowest in the region. Most times, the property taxes collected every six months are equivalent to the price of just a few cups of tea, or less, according to Renaissance Institute.

Property tax accounts for only a small share of total municipal revenue, between 2-6 per cent in all of the cities the study examined, including in Bago, Hpa-An, Taunggyi, Pathein and Yangon. As illustrated by the case in Hpa-An, the majority of municipal funding is derived from business licenses and, in particular, auctions of monopoly licenses.

These monopolies distort economic activity by reducing upstream and downstream investments and result in unequal redistributions of wealth from rural to urban areas. In addition, rural villagers are forced to pay higher prices even though most of license revenues are typically spent on urban services.

The analysis reveals some other issues with the existing system.

In Yangon, for example, the tourism and manufacturing industries bear a disproportionate burden of property tax while the vast majority of urban residents pay next to no tax – less than one cup of tea.

Improving the system

The Renaissance Institute argued that a stronger property tax system in the country is possible through fiscal decentralisation, as it provides the opportunity for municipalities to strengthen their budgetary position and enhance the responsiveness of budgeting decisions to better accommodate the needs of the community.

More importantly, “there is a sound legal framework for property tax means that no constitutional change is required to improve the system. Many of the administrative changes that could have large positive impacts are under the control of municipalities and are technically feasible; though they are unlikely to be easy or quick to fix,” said McDonald.

In fact experiments are already being conducted in a number of cities, which should provide valuable lessons for cities around the country. Broad policy changes are also possible, but will take some time.

Over the longer term though, raising property tax revenues offers an opportunity for the country’s various municipalities to better fund their needs and expenses as urbanisation gathers pace.

“A stronger property tax system would also mean that there is less reliance on licenses. In all, a stronger property tax system could form part of a sustainable development reform agenda that also makes cities more liveable and cultivates their role as engines of growth,” the study concluded.

Source: https://www.mmtimes.com/news/property-taxes-worth-less-cup-tea.html-0

Thailand

Thailand