Myanmar: Inflation spikes ahead of Central Bank’s rate liberalisation plans

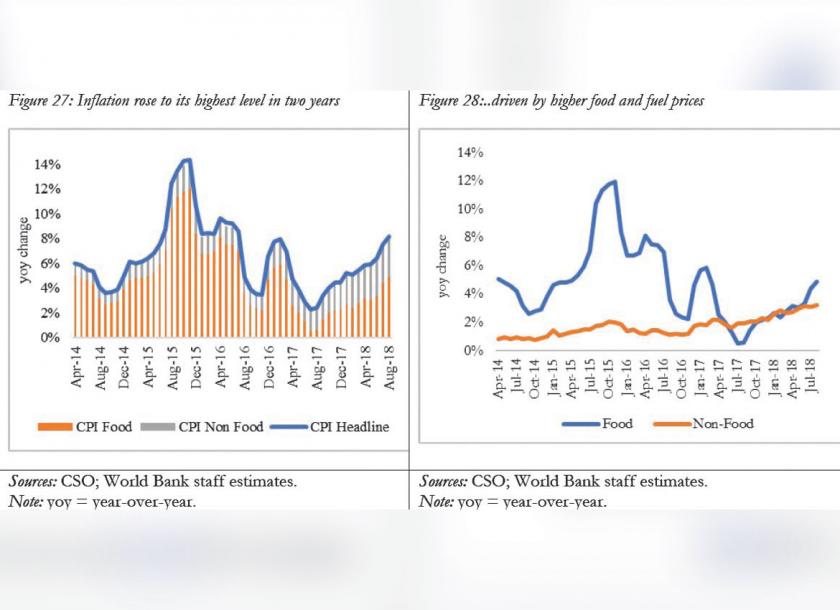

Inflation in Myanmar has hit a two-year high of 8.2 percent since August, up from 5.5pc last year as a result of a steep drop in the value of the local currency against the US dollar, rising food prices and a recent spike in global oil prices, according to the World Bank.

The higher levels of inflation come even as pressure is mounting for the authorities to restructure the country’s interest rate regime, which hinges on stable and low inflation.

The Central Bank of Myanmar (CBM) is currently preparing to release fresh directives on the liberalisation of the country’s interest rates. This will take place soon after a credit bureau tasked with providing credit data on borrowers to banks is established in the middle of next year, CBM Deputy Governor U Soe Thein said on December 11.

The five-point directive will include possible guidelines on lowering local interest rates, making it more affordable for firms to take loans in Myanmar, U Soe Thein said.

Yet, the World Bank is now expecting inflation to reach 8.8pc in the current fiscal year and remain above 8pc the following year. The International Monetary Fund is also forecasting inflation to be higher than 8pc for the year.

That might pose challenges for the CBM as it balances adjusting lending rates to boost the economy and keeping deposit rates above inflation levels to encourage savings. Currently, banks pay an 8pc interest rate on deposits and charge 13pc for loans. The Central Bank rate is 10pc.

Kyat depreciation

So why is inflation rising? More importantly, will it remain high over the longer term?

Inflation, which fell from double digits in 2016 to between 4pc and 5pc last year, spiked after the steep depreciation of the Myanmar kyat against the US dollar. Since April, the local currency has lost about 18pc of its value versus the dollar.

That drove up the prices of food, such as rice and cooking oil, by around 10pc at a time when prices were already on the rise after seasonal floods damaged crops across several states and regions earlier this year.

Meanwhile, a spike in global oil prices to US$75 a barrel in the third quarter of this year from below US$60 a barrel at the start of the year also drove up the cost of imported fuel, translating to a broad rise in the prices of everything from transport to eating at restaurants.

While the kyat has recently stabilised at around K1550 per US dollar, both the World Bank and IMF warn that further volatility may be on the cards on the back of slower global growth and simmering trade tensions between the US and China. Meanwhile, the US Federal Reserve has also guided for several more rounds of interest rate hikes.

Oil prices, too, are expected to be volatile. “We will continue to see volatility as the oil markets are still fraught with many uncertainties such as production cuts from the Organisation of Petroleum Exporting Countries, Iran sanctions, higher US shale production, the US-China trade dispute and global oil demand,” said Sushant Gupta, research director at intelligence firm Wood MacKenzie.

Mr Gupta is expecting the price of Brent crude to average US$64-US$65 per barrel in the first half of the year and end the year at US$66 per barrel.

Money supply

On the other hand, reserve money creation by the central bank has also tapered to around 18pc, which is below the 23pc CBM target. The slower reserve money growth was due to lower levels of lending to the government. Over the past two years, the central bank’s financing of the deficit has more than halved from 50pc to 19pc. By 2020, the government’s aim is to finance 100pc of the budget deficit through government bonds.

Meanwhile, lending to local banks has also decreased, with the banks borrowing less due to uncertainties arising from ongoing reforms, the World Bank said.

More recently though, the CBM has also been buying back dollars in the market, wiping up US$37.74 million between November 27 and December 6 to shore up foreign reserves. It sold some US$14.8 million between April and September to contain the kyat’s depreciation, according to government data.

Backed also by foreign direct investment flows, Myanmar’s foreign reserve coverage currently stands at around three months worth of imports, according to the IMF. “Reserves are relatively low but the authorities also don’t want to intervene much in the market, which is good,” said Shanaka Peiris, an official from the IMF.

Taken as a whole however, “the spike in Myanmar’s inflation rate should be a one-off. The underlying causes of inflation – which includes excessive money supply growth – has largely been eliminated at the moment, for example, via the reduction of CBM financing,” said Sean Turnell, Director of Research, Myanmar Development Institute and economic advisor to the State Counsellor Mr Turnell is expecting, “in the absence of other external shocks, a stabilisation of inflation to around 5pc in the year ahead.

Source: https://www.mmtimes.com/news/inflation-spikes-ahead-central-banks-rate-liberalisation-plans.html

Thailand

Thailand