Myanmar: Fiscal restructuring, discipline needed as budget balloons: World Bank

Public spending is expected to balloon in the next two years leading up to the 2020 General Election, potentially taking the fiscal deficit up to 6 percent as a share of GDP over the current fiscal year, according to government data.

The K22.1 trillion Budget, which allocates more spending towards health, education and energy, is expected to lead to a doubling of the fiscal deficit this year.

However, it is likely that actual spending will not be as high as planned, the World Bank said in its latest Myanmar Economic Monitor, which is published annually. This year, the deficit is likely to be just 4pc GDP, if history is anything to go by. At 2.7pc of GDP, last year’s budget deficit was actually less than half of what the government had anticipated at 5.8pc, data showed.

That is a concern because it reflects continuing budget execution challenges, leading to under-spending on much-needed capital projects. As such, Myanmar needs to take targeted actions to boost revenues over the short term and enhance the efficiency at which it expends the Budget, the World Bank said

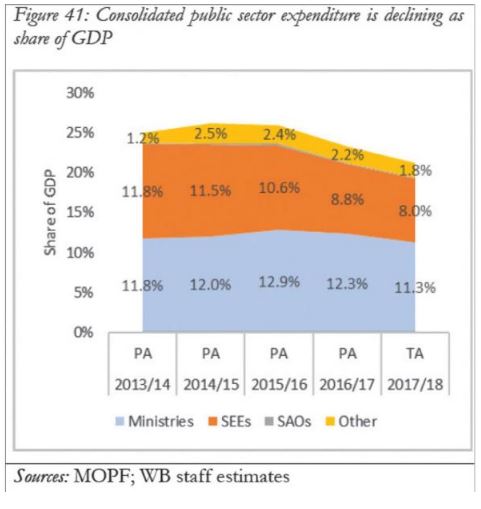

For the past four years in fact, none of the top 10 spending union ministries have fully achieved their spending targets. During the period, government capital expenditure declined to just 4.3pc of GDP last year compared to 7.6pc in 2013. Most of the funds have instead been used to pay wages and buy goods and service.

On top of that, government revenues have also been falling, undermined by stagnant tax collections and declining contributions from State Economic Enterprises (SEEs), at a time when it is relying less on Central Bank financing of the deficit.

Government revenues between the 2013 and 2017 fiscal years have declined from 20.3pc to 16.5pc, despite reform efforts, the World Bank said. Despite a slew of reforms taken by the Internal Revenue Department (IRD) recently, this year, the government is expecting to collect just K15.9 trillion in revenue, representing a 1.2pc year-on-year decrease to 15.3pc as a share of GDP.

In fact, Myanmar collects the lowest amount of taxes as a share of GDP across the region as well as globally, the World Bank said.

Stagnant revenues

Why are tax revenues declining? Among the reasons are poor compliance and a narrow tax base: Myanmar has only 25,000 registered corporate income tax payers, although that has already grown by 40pc over the past four years.

Corporations, which account for 85pc of the country’s tax collections, also enjoy many exemptions and incentives, including tax holidays, reduced rates, tax credits and specific incentives, such as in Special Economic Zones.

Yet, the tax incentives are not targeted at sectors that have high economic returns, but low private returns.

Furthermore, the country does not have a system of assessing and balancing revenues foregone, while tax incentives are not targeted and administered in a fragmented manner. According to the World Bank, revenues foregone for large corporate income tax payers alone could be as high as 1pc-1.5pc of GDP.

The other reason is declining profitability of the electricity sector. Due to rising costs and loses arising from tariff subsidies, the sector has gone from contributing up to 4.5pc of total tax revenues in 2014 to hardly any taxes at all as of last year. Now, the sector contributes just 1.5pc of total corporate income taxes.

Meanwhile, SEE profits have also declined, driving tax payments to just 0.5pc of GDP last year from 1pc in 2014. Royalty payments from the oil and gas sector have also tapered on the back of fewer discoveries and less production.

Options and reforms

For Myanmar, both the declining tax revenues and inefficiency in expending public funds are a key concern to growth and fiscal sustainability, especially at a time when it is borrowing much less from the Central Bank . Nevertheless, the country still has several options it can deploy to mobilise revenues over the short term.

According the World Bank, Myanmar can raise revenues by 2pc-3pc of GDP in the short term by rationalising the country’s tax incentive scheme. By consolidating a national list of the current incentives and conducting a cost-benefit analysis in terms of revenue foregone, the government can better target high social return sectors and taper incentives for others, it said.

The other option is to reduce the Commercial Tax and Specific Goods Tax exemptions. While this may require legislative changes, it would help to boost tax productivity to a level on par with the rest of the region, the World Bank said.

The World Bank has also recommended policy reforms in oil and gas tax administration. A large volume of funds can be freed up for public needs if SEE revenue retention rules are reviewed and audit and policy units are set up to facilitate immediate revenue needs, it said.

If taken, those measures could help the government shore up revenues and allocate sufficient funds to areas such as education and healthcare while relying less on the Central Bank to finance the resulting deficit.

Over the past two years, Central Bank financing of the deficit has more than halved from 50pc to 19pc, and should “remain on a downward trajectory in the future,” officials of the International Monetary Fund (IMF) said last week. Meanwhile, financing through Treasury bills and bonds has risen to 81pc from 49pc over the same period.

“Right now we think the deficit can go up a bit even as Central Bank financing continues to go down. We think the tax reforms in Myanmar are going OK and there is also greater scope for the government to issue securities to the local banks,” they said.

Over the next two years in fact, the government’s aim is to finance 100pc of the deficit through government bonds and other funding options.

Source: https://www.mmtimes.com/news/fiscal-restructuring-discipline-needed-budget-balloons-world-bank.html

Thailand

Thailand