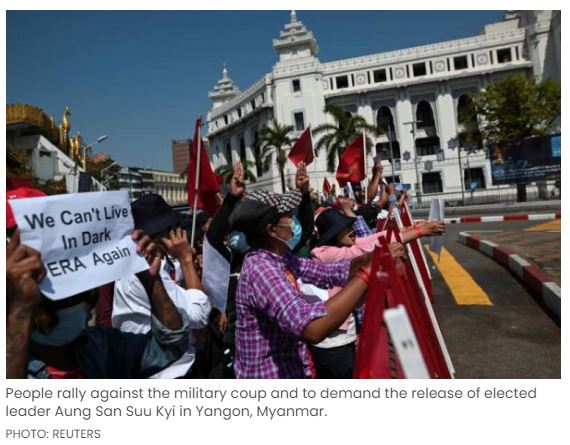

Myanmar economy expected to grow despite coup impact on FDI: analysts

MYANMAR’S recent military coup has likely slowed its economic recovery, but the main challenge will be foreign direct investment (FDI), watchers have said.

Maybank Kim Eng expects gross domestic product (GDP) to grow by 3 per cent in FY2020/21, against an earlier forecast of 4.5 per cent, while growth in FY2021/22 could come in at 4 per cent, from an expected 6 per cent before.

Meanwhile, Fitch Solutions cut its GDP growth forecast to an even lower 2 per cent for FY20/21, down from 5.6 per cent before, as well as for FY21/22, down from 6 per cent previously.

However, projections remain in positive territory.

“We do not think the economy will slip into a recession even if the US and EU impose tough sanctions,” economists Linda Liu and Chua Hak Bin said on Wednesday.

The economic impact of fresh United States sanctions could be limited by Myanmar’s growing reliance on regional trade, they added. Asia is the destination for more than two-thirds of exports, led by China and Thailand.

Still, Fitch on Monday warned that “export outlook will also come under pressure over the near term”, on the back of possible supply disruptions and higher operating costs in the wake of the coup.

That’s even though Myanmar had been poised to pick up more garment production, as rising labour costs pushed manufacturers out of China.

Already, the White House has indicated that it is reviewing possible sanctions, after the Myanmar military seized power on Feb 1.

Other potential restrictions could include the removal of Myanmar from preferential trade arrangements, such as the EU’s “Everything But Arms” scheme that enables duty-free and quota-free access to European markets.

“While Myanmar does not yet have a significant export exposure to Western economies such as Europe and the US… the ongoing manufacturing relocation trend would likely have supported growth of exports to these markets,” the Fitch analysts said in their note.

Now, they believe that “prospects for Myanmar to benefit from the ongoing apparel manufacturing relocation trend have dimmed significantly”.

Indeed, the textile and garment industry could be vulnerable to potential trade sanctions from the European Union, which makes up about 16 per cent of Myanmar’s exports, according to the Maybank KE team.

Still, Ms Liu and Dr Chua believe that there is no sign that China or Asean will respond to the coup with trade or investment restrictions or sanctions. That’s good for the military government, as Myanmar’s largest FDI investors are Singapore, China and Hong Kong.

“We expect a significant fall in FDIs in the next two years arising from the social unrest and political uncertainty, and impact from sanctions,” the Maybank KE analysts wrote in their report.

“But the impact on trade and exports will not be as large, given the likely diversion and cushion from other markets, particularly Thailand and China.”

Source: https://www.businesstimes.com.sg/asean-business/myanmar-economy-expected-to-grow-despite-coup-impact-on-fdi-analysts

Thailand

Thailand