Malaysian market sees robust inflow

PETALING JAYA: The stronger ringgit is fuelling a surge of inflow into the local bond market, driving yield on the 10-year Malaysian Government Securities (MGS) below 4% for the first time since April last year.

Analysts said the rally in the bond market still has room to continue with the strength of the ringgit supporting further gains.

“The prospect for ringgit has brightened with higher crude oil prices and the turnaround in the trend of the yuan against the US dollar,” Malaysian Rating Corp Bhd (MARC) chief economist Nor Zahidi Alias said.

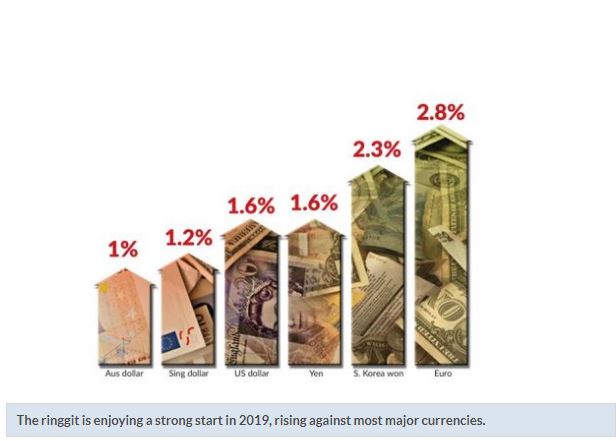

Currencies and bonds across Asia are enjoying a strong start in 2019 after a brutal 2018.

As of Friday, the ringgit was up 1.6% against the US dollar at 4.067, its highest level in seven months. The local currency gained 1.1% against the Singapore dollar, and was traded at below the 3.00 mark for the first time in four months.

The rising ringgit was in tandem with the rebound in the price of crude oil in the international market. The price of Brent crude futures contract, the global benchmark, ended the week at US$62 a barrel, up 15% since the start of the year.

Petroleum income is estimated to contribute a fifth to the government’s revenue this year, Finance Minister Lim Guan Eng said in January.

The government, in its budget for 2019, projected that the price of crude oil would averaged at US$70 a barrel.

But the main change in global investor sentiment was a surprisingly dovish statement by the US Federal Reserve (Fed) late last month that suggested the Fed is done raising interest rate, at least for the time being, after four rate hikes last year.

That statement whetted the market’s appetite for riskier assets. Analysts said clear signs had emerged to signal global investors’ return to the local market.

In January, investors from overseas added more than RM1bil worth of stocks into their portfolios, the first monthly net purchase since September last year. The total outflow last year was around RM11.65bil.

The returning tide from overseas in recent weeks has also boosted prices in the MGS market. In 2018 it was estimated that close to RM22bil of foreign money exited the Malaysian bond market.

“Foreign demand is supportive, with sustained inflow as evident from higher frequency data in the Indonesian bond market which is generally seen as the bellwether for regional flows,” said Winson Phoon, a Singapore-based fixed income analyst at Maybank-Kim Eng.

The 10-year MGS yield, which move in the opposite direction against prices, tumbled from 4.07% at the start of the year to 3.99% on Friday.

All eyes will be on Bank Negara this week, which is scheduled to released the country’s latest set of quarterly gross domestic product (GDP) figures on Valentine Day.

The market is projecting flattish growth in the fourth quarter of 2018.

“We think growth disappointment in the fourth-quarter (4Q18) GDP itself would be sufficient to motivate dovish positioning for MGS, pulling the curve lower,” Phoon said.

He expected the 10-year MGS yield to test 3.90% soon, driven by steady demand from domestic institutions and positive external backdrop with a dovish US Fed.

Phillip Capital Management Malaysia senior vice-president (investment) Datuk Nazri Khan Adam Khan told Bernama on Saturday that the ringgit was expected to strengthen further.

“We stay slightly bullish on the ringgit in anticipation of further losses in the US dollar,” he said.

After nine rate hikes since the start of the tightening cycle in December 2015, the Fed on Jan 30 has decided to stand pat. Reports indicated there is growing chance that the Fed may even hold the rate at the current level for the rest of the year.

The dovish Fed is expected to keep pressure on the US dollar, but the international focus this week will be on the trade talks between the United States and China.

The Fed, barely two weeks ago, has cited slower growth in major markets, including China, and heightened geopolitical uncertainty, including trade tensions and Brexit, for its dramatic shift.

Since then, investors have been piling into the debt market, pushing yields from Australia to Japan lower.

Back home, further growth disappointment could spur investors to seek safety in the government papers, pushing yield even lower.

Source: https://www.thestar.com.my/business/business-news/2019/02/11/local-market-sees-robust-inflow/#toJamfOUbJULkfKw.99

Thailand

Thailand