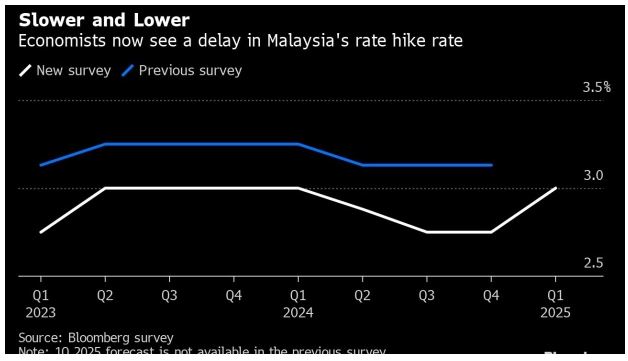

Malaysia Seen Returning to Rate Pause After a Final Hike to 3%

(Bloomberg) — Malaysia’s central bank will probably raise its key rate by another 25 basis points next quarter before it is done with tightening, according to a poll of economists.

Bank Negara Malaysia is expected to keep its overnight policy rate at 3% for at least a year after a final, quarter-point increase between April-June, according to the median estimate in a Bloomberg survey of economists. A previous poll had forecast a hike of at least 25 basis points this quarter.

The central bank last month surprised economists by holding the benchmark rate at 2.75% after four quarter-point increases last year. Economists, in the latest survey, expect BNM to hold again when it meets next month.

Forecasts for inflation were cut to 3.6% in the first quarter from 4% previously, with the the annual average projection raised to 3% this year and 2.3% next year, according to the survey. GDP growth estimate for 2023 was unchanged at 4% while next year’s view inched up slightly to 4.6% from 4.5% previously.

This was after the nation posted a stellar 8.7% expansion last year, the fastest pace since 2000.

“Malaysia’s open and trade-reliant economy remains at the mercy of global external headwinds especially from advanced economies such as the US and EU, even though China’s earlier-than-expected reopening and upcoming rebound should provide some cushion as the year progresses,” said Han Teng Chua, an economist at DBS Bank Ltd.

Exports last month is forecast to grow 9% from a year ago, according to a median estimate of economists ahead of data due Monday. While that is an improvement from about 6% in December, that would mark a second single-digit level of expansion after 16 consecutive months of double-digit growth.

Outlook remains cautiously optimistic, supported by resilient domestic demand and improving private consumption, according to Imran Ibrahim, chief economist at BIMB Securities. He sees tighter monetary policy settings worldwide, escalation of geopolitical tensions and weaker-than-expected global demand as among downside risks.

Source: https://www.bnnbloomberg.ca/malaysia-seen-returning-to-rate-pause-after-a-final-hike-to-3-1.1885833

Thailand

Thailand