Malaysia: Enough liquidity to cope

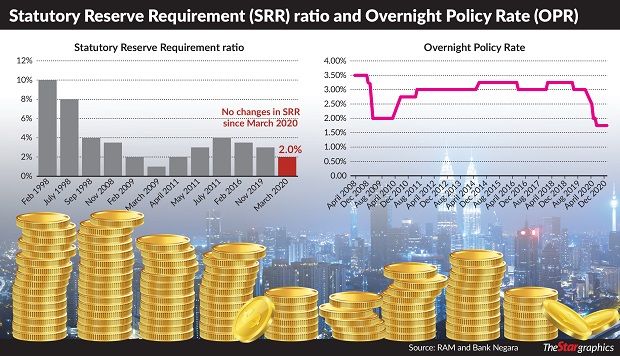

PETALING JAYA: The statutory reserve requirement (SRR) ratio will unlikely see any cut this year amid the economy showing signs of sluggishness over the next couple of months underpinned by ample liquidity in the banking system.

SRR is non-interest bearing balances that commercial banks are required to keep with the central bank. It is also an instrument to manage liquidity.

A lower SRR would mean a lower amount to be set aside and this would reduce the banks’ cost of funds as the excess funds could be used for lending purposes.

The SRR ratio was last cut in March 2020 by 100 basis points (bps) to 2%.The lowest it went down was 1.0% on March 1,2009 during the global financial crisis.

Economists on the whole feel the SRR cut would unlikely materialise this year as the banking system has enough liquidity to cope up even as the country chalked up a dismal economic growth last year.

In 2020, Malaysia faced its worst recession since the 1998 financial crisis, with a full-year contraction of 5.6%.

The gross domestic product (GDP) in the fourth quarter (October-December) 2020 period contracted by 3.4% year-on-year, greater than the consensus expectations of 3.1% and Q3’s revised contraction of 2.6%.

Fitch Solutions recently slashed its 2021 GDP forecast for Malaysia to 4.9% from 10% previously, in view of the movement control order (MCO) measures.

RAM Rating Services senior economist Woon Khai Jhek (pic below) told StarBiz it is less likely that further SRR reduction would take place this year.

Early this year, Bank Negara had announced the extension of the flexibility for banks to use Malaysian government securities (MGS) and Malaysian government investment issues (GII) to meet the SRR compliance until December 31,2022 (originally May 31,2021).

Given this flexibility as well as the sufficient liquidity in the system at present, he said it is less likely that further SRR reduction would be announced. Nonetheless, Woon said there is still room for the central bank to reduce the SRR to free up more liquidity for lending should the need arise.

On the SRR, OCBC Bank economist Wellian Wiranto (pic below) does not foresee any cut in the near term in view that there is little sign of any liquidity concern in the banking system at this stage.

Bank Islam Malaysia Bhd chief economist Mohd Afzanizam Abdul Rashid, however, felt there is a possibility for a SRR ratio cut this year as additional liqudity would mean lower cost of fund for the banks.

“This would, to some degree, incentivised the banks to extend the additional liquidity into financing assets which then would help to improve the economic activities, ” he said.

Commenting on the economic growth, OCBC’s Wellian said there is no immediate clear sign that the central bank is keen to cut the key benchmark rate or the overnight policy rate (OPR)just yet, including in the upcoming March meeting.

“But we think there is a chance for one rate cut, potentially in May if the economic recovery loses further steam. For GDP overall, we are looking at growth of 5.4% for the whole of 2021.

“Elsewhere, on the domestic front, the ongoing MCO continues to impose a heavy burden on consumption growth, even if instituted at a more forgiving form now versus before.

“However, the upside wildcard would be a faster and broader vaccination rollout for Malaysians, ” he noted.

Private consumption currently comprises about 60% of the country’s economy.

The central bank at its monetary policy meeting in January this year kept the OPR, unchanged at 1.75% after a cumulative 125bps cut last year.

AmBank Group chief economist Anthony Dass (pic below) said, the current strong ringgit against US$ and a still tame inflationary environment provides the window to reduce the policy rate in March.

At this point, he added based on the latest set of data both global and domestic, the probability appears to be a 50% chance for a rate cut with room to revise the probability when more data flows in, he noted.

“However, the economic recovery although poised to present a strong rebound in 2021, it will somewhat be inflicted in the the first quarter following the restrictive measures to contain the Covid-19.

”Due to this, he said the full year GDP outlook has been revised downwards to 5.2%–5.9% (previously 6.0-7.0%)supported by global GDP and trade growth, stable commodity prices, domestic activities, deployment of Covid-19 vaccine and containment of the virus, ” Dass said.

RAM’s Woon said the rating agency has trimmed our full-year 2021 GDP forecast to around 5.0% given the latest extension of the MCO 2.0 until March 4 March.

RAM’s previous forecast was 5.5% prior to the said extension.

“We estimate daily economic losses from MCO 2.0 at about RM500 mil-RM600mil. While this is less severe than MCO 1.0 (Government’s estimate: RM2.4 bil), it is still much higher than the RM200 mil-RM300mil projected by Bank Negara amid the conditional MCO (CMCO) in October-November.

“Hence, we should see a further deceleration in economic growth for 1Q 2021. Every subsequent day of extension beyond March 4 is estimated to further trim 0.04 percentage points off growth this year, ” Woon said.

Socio-Economic Research Centre (SERC) executive director Lee Heng Guie (pic below) does not expect a cut in OPR this year as the continued monetary payment, targeted loan repayment assistance, EPF withdrawal as well as previous rate cuts are sufficient to support domestic demand, aided by the improved sentiment throughout the rollout of the vaccination programme.

“Any further rate cut does not help much to spur new spending unless consumers are confident about the programme. Fiscal spending and public investment have to be accelerated to aid the economic recovery, ” he said.

Afzanizam is projecting 4% GDP growth this year. The extension of MCO following elevated levels of new Covid-19 cases would mean restriction on human mobility and would have immediate impact to GDP.

“We believe the external sector looks quite promising now. The rise in global semiconductor sales will mean our electrical and electronics players will stand to benefit and propel the exports for this year.

“Higher commodity prices namely Brent, CPO and LNG would mean commodities related exports, which accounted for about one fifth of Malaysia’s exports, will support the manufacturing sector.

“However, services sectors such as accommodation, food and beverages and transport would continue to be a drag, ” he noted.

Source: https://www.thestar.com.my/business/business-news/2021/02/22/enough-liquidity-to-cope

Thailand

Thailand