Malaysia: Cut taxes for jobs

PETALING JAYA: It appears that Corporate Malaysia needs more tax incentives to accelerate private investment growth that has been trending down in recent years.

In 2019, private sector investments grew at the slowest pace since the global financial crisis, while the latest figures from the Statistics Department showed that net investments in fixed assets in the manufacturing, mining and construction sectors had declined.

The lacklustre appetite for investments has only worsened post-Covid-19, given that private investments from January-March 2020 fell by 2.3% – the first contraction since the fourth quarter of 2010.

The contraction would likely be severe in the second quarter.

Socio-Economic Research Centre (SERC) executive director Lee Heng Guie expected private investments to contract by 11.4% this year, down from a marginal growth of 1.5% in 2019.

In an economic climate rife with uncertainties, there is little reason to believe that the private sector would pump money into their businesses significantly.

Weaker investment sentiment presents a major headwind to the labour market as slower expansion of businesses would create fewer jobs.

This is a serious cause for concern, considering that job vacancies have been declining and the unemployment rate has been soaring.

Hence, a proposal has been floated by a local investment bank to cut corporate tax rate rate by adopting the Indonesian model.

According to Maybank IB Research, the government could consider allowing corporate tax reductions for Bursa Malaysia-listed companies listed that have a free float of at least 40%.

The proposed temporary tax cut, which was one of the ideas in the research firm’s latest strategy note, could double up as an indirect stimulus for companies that were affected by the Covid-19-induced crisis.

“A reduction in tax rate to 20% would imply a worst-case (if all corporates qualify) foregone fiscal revenue of around RM4bil or a 20 basis points increase in the fiscal deficit.

“In actuality, net revenue loss to the government will be lower as the tax cut will spur economic activity or growth (hence, generating tax revenues). Not all Bursa Malaysia companies will qualify for the lower corporate tax rate as compared with our 100% compliance assumption. As such, we expect relatively limited fiscal stress from this measure, ” said Maybank IB Research.

It added that the proposed measure would help achieve multiple fiscal and capital-market objectives.

One of the intentions is to spur private investments.

“With most of the large listed corporates qualifying for the tax reduction, this will be a substantial boost to corporate profitability and investment appetite (as well as investor sentiment).

With returns on invested capital now higher, there will be a greater incentive for many of the largest companies to put broadly-healthy balance sheets to work, translating into a powerful, private sector-led economic stimulus, ” it said.

Maybank IB Research said by tying the corporate tax break to the companies’ free-float, it would encourage non-compliant companies to improve available trading liquidity in their shares.

“This would be particularly impactful in the small-mid market segment, where many of the faster-growing companies tend to be family-owned and tightly-held i.e. barely satisfy Bursa Malaysia’s minimum 25% public float requirement, ” it said.

In addition, the proposal is also expected to encourage new listings as the corporate tax concession is restricted to listed companies only.

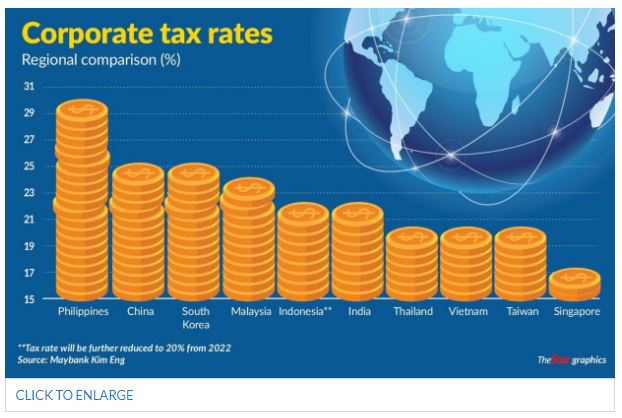

For context, the corporate tax rate in Malaysia is one of the highest in the region at 24%. In comparison, Singapore’s corporate tax rate is capped at 17%.

Several countries in the region have recently been reducing their corporate taxes to spur investment and growth. India reduced the rate sharply from 30% to 22%.

Meanwhile, Indonesia will be cutting its corporate tax rate from 25% to 22% for 2020-2021, with a further reduction to 20% from 2022.

The proposal to cut Malaysia’s corporate taxes, particularly at a time when tax revenues are expected to decline, is not preferred by Alliance Bank chief economist Manokaran Mottain.

Speaking to StarBiz, Manokaran said “the timing is not right”, for Malaysia to revise its corporate tax rate.

“Instead, if there is really a need to lower taxes, the focus should be on the small-and-medium enterprises (SMEs), not the big corporates.

“SMEs, subject to certain thresholds, are currently paying a lower corporate tax rate compared to the larger companies. Perhaps what can be done is to raise these thresholds so that more SMEs will enjoy lower taxes and the benefits will eventually trickle down fast to the larger economy, ” said Manokaran.

Last year, former Prime Minister Tun Dr Mahathir Mohamad said that the corporate tax rate for SMEs will be reduced to 17% from 18%.

The reduction will only be applicable for SMEs with paid-up capital of below RM2.5mil and businesses with annual taxable income of below RM500,000.

Taxation expert Veerinderjeet Singh pointed out that the government had introduced some tax incentives under the Penjana stimulus package, which was announced in June.

“There are also other existing tax exemptions and incentives that the companies could tap into.

“These are adequate at the moment without corporate tax cuts, ” he told StarBiz.

Source: https://www.thestar.com.my/business/business-news/2020/07/22/cut-taxes-for-jobs

Thailand

Thailand