Investor-friendly environment and human capital essential for Myanmar’s success in the Belt and Road Initiative

The Belt and Road Initiative: interview with Jonathan Woetzel, McKinsey senior partner and MGI director

Jonathan Woetzel, senior partner of McKinsey & Company and director of the McKinsey Global Institute (MGI), told The Myanmar Times that success of the Belt and Road Initiative (BRI) in Myanmar would depend on the country creating an investor-friendly environment and developing sufficient human capital.

In July 2016, McKinsey predicted that the future of trade in Asia could depend heavily on China’s expansive Belt and Road Initiative (BRI), which called for massive investment in and development of trade routes in the region.

According to Kevin Sneader, McKinsey’s chair in Asia, the BRI has the potential to be the world’s largest platform for regional collaboration. There are two parts to the scheme: the belt and the road. The belt is the physical road, which takes one from China all the way through Europe to somewhere up north in Scandinavia. That is the physical road. What the Chinese government calls the road is in fact the maritime Silk Road, in other words, shipping lanes, essentially from China to Venice. The ambitious scheme covers about 65 percent of the world’s population, about one-third of the world’s GDP, and about a quarter of all the goods and services the world moves. The core of all these is an extensive trading network.

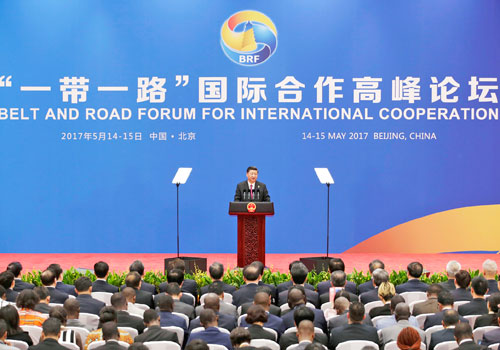

Given its geographical proximity, ASEAN is an important player in this scheme. According to Mr Sneader, for example, the Indonesians are clearly excited about how is this going to play out. Jakarta Globe reported that Indonesia sought to draw up to US$28 billion worth of investment from Chinese investors from hundreds of projects put on the table during the Belt and Road Forum for International Cooperation in Beijing last month.

Despite all the discussions and hype surrounding the scheme, in Myanmar there has not been much information or clarity about how the BRI is going to make a difference, apart from some developments in Kyaukphyu.

On June 1, The Myanmar Times interviewed Jonathan Woetzel, senior partner of McKinsey & Company and Asia-based director of the McKinsey Global Institute about the BRI, its implementation obstacles, its finances and its priorities in Myanmar. He is an expert on many China-related issues, including the BRI and the country’s urbanisation development.

First of all, it is unclear who is running the initiative. Every province has its own BRI investment plan, as do hundreds of SOEs. Mr Woetzel said there wasn’t one single person in charge of the scheme. The leadership in Beijing has set out the vision but most of the actual project is implemented by individual provinces, regions and companies.

“There is a One Belt One Road office associated with National Development Reform Commission. But it’s much more of a coordinator and a facilitator than a decision-maker. That is very typical of China’s central government management: They set the idea out, they try to set up institutions to support the idea, but then they allow most of the project development and initiative to become bottom-up,” he said.

The MGI’s report China’s role in the next phase of globalisation published in April 2017, of which Mr Woetzel is a joint-author, suggests that the country has opportunities to build on the momentum of the BRI by placing its capital and expertise into international infrastructure projects.

Bernard Chan, grandson of Chin Sophonpanich, late founder of Bangkok Bank, also told The Myanmar Times that infrastructure, and specifically Chinese state-owned enterprises-led infrastructure development, would be the scheme’s priority at this stage.

But the McKinsey expert pointed out that most of the investments made across the economy would be made through industry and manufacturing because there was more activity. Infrastructure has bigger numbers in terms of investments for large-scale projects. However, the big picture would not be dominated by infrastructure.

“Even China understands that investing in infrastructure, by itself, doesn’t get you anything – it doesn’t do anything for an economy, only economic activity does that.

“There’s going to be at least as much investment in developing economic activity as there will be in infrastructure, largely made by large companies and not by state-owned enterprises,” he explained.

The lion’s share of funding from the private sector

The BRI region, including Myanmar, has been promised a significant boost in the financing available for infrastructure development. But the plethora of institutions is confusing: the Asian Infrastructure Investment Bank (AIIB), the Silk Road Fund, the China Development Bank, the Export and Import Bank of China and many organisations. In terms of outstanding loans or equity investment by the end of 2016, the big four state-owned commercial banks had provided $150 billion, China Development Bank $110 billion, the Silk Road Fund $4 billion, Export-Import Bank of China $24 billion and the AIIB and New Development Bank (aka BRICS bank) $2 billion each, according to the Financial Times.

The Myanmar Times asked Mr Woetzel whether the major funding source will be multilateral institutions, bilateral ones or the private sector. He said all of the organisations would be a part of it but the private sector will take the lion’s share.

“I don’t think there will be one source of funding available that will cover all the infrastructure or economic development needs of the country. Historically, financing has come from the government’s own revenues – the borrowing capacity. Additionally, multilateral funding, whether it’s from the AIIB or other sources, will be a part of it.

“But, by far, the biggest investment opportunity is from the private sector again, whether it’s through PPPs [public-private partnerships], institutional investors, IPOs [initial public offerings] or even equity funding – creating an environment which is business and investor-friendly is a big part of capturing the very large amount of additional capital that’s available for investments, inside and outside of China.

“There’s clearly more money out there looking for investment projects than projects that are fundable,” he said.

According to the McKinsey Global Institute, from 1992 to 2013 China invested more in its economic infrastructure – transport, water, power and telecommunication systems – than North America and Western Europe combined: an average of 8.6 percent of its annual GDP. The Belt and Road Initiative seeks to replicate this infrastructure development momentum along the region. Photo – Shutterstock

According to the McKinsey Global Institute, from 1992 to 2013 China invested more in its economic infrastructure – transport, water, power and telecommunication systems – than North America and Western Europe combined: an average of 8.6 percent of its annual GDP. The Belt and Road Initiative seeks to replicate this infrastructure development momentum along the region. Photo – Shutterstock

BRI implementation obstacles in Myanmar

There are two main challenges of implementing the BRI in Myanmar, according to Mr Woetzel. The first one is creating an investor-friendly environment with transparency, the rule of law, stable operating conditions and more.

The second challenge is about human capital.

“If we look at where investments which are made by China, Africa, for example, shows that 80 percent of the employees of Chinese companies in Africa are local. But only 50pc of the managers are local. Clearly, the capacity to develop local managers, and to employ local people, is scaled to the local population.

“That’s going to be the biggest, or second biggest, challenge to sustainable investment flows.

“Engaging the business community, both inside and outside of Myanmar, will be critical to work together with the business community to increase the skills of the local population,” he explained.

What about sending huge numbers of the Chinese workforce to set up and operate projects? He did not think that would be sustainable or feasible financially.

“Unfortunately, I don’t think that it’s a sustainable model. For some things which require large, upfront deployments, such as building a complex steel plant or a one-off capital investment, you could probably send over a workforce to do that, but they would come home again, back to China. Again, with our African research, 80pc of employees are local,” he said.

More significantly, the McKinsey senior partner told The Myanmar Times that the human capital issue poses a bigger challenge than the financial issue and would determine how the country fares compared to the rest of ASEAN.

“Myanmar, given its size, population and proximity, would be very well-positioned to benefit from those investment flows. Whether it in fact it does, depends on the investor-friendly environment and the availability of human capital for support.

“I don’t think financial capital is the big issue here – there’s more than enough money around – but how to put to good use in getting good projects, earn a return, and can be sustainably managed by a local workforce determines how much of that capital actually comes to Myanmar,” he said.

Mr Woetzel also said that the BRI is a multi-decade event and it would take time before the scheme bears fruit in a visible way. Export performance, infrastructure development and household income are important yardsticks by which success could be measured.

“In the short-term, we can start looking at economic activity as indicators – there’s no better indicator than export performance. You can look around the world for BRI countries and see some that are making a lot progress fairly quickly and others which are not so much.

“In addition to the infrastructure investments, we should be able to measure the development of electricity, electrification, road access, the time to market, logistics cost etc.

“Those are the two things that I would look at: export performance and physical progress in infrastructure, and finally also employment,” he said, adding that ultimately people should look at how the local people are benefited from the scheme by indicators such as changes in wages and household income.

Mr Woetzel wrapped up the interview by offering an advice to how the Myanmar government and businesses can capture the opportunity. He again emphasised the importance of having an investor-friendly environment. All in all, the key to securing success in the BRI for Myanmar is not so different from the solutions needed to woo international investors.

“To that point, I think that the government needs to take a clear stance – it’s not enough to say it’s not against business, but to say ‘I am for business’. I think that is required, given the lack of a market and investor-friendly environment.

“There has to be a clear statement of change: ‘Myanmar is open for business’,” he stressed.

The government supporting and actively engaging the investment sector would send a signal to private sector companies to do likewise – that they should be aggressive in reaching out and finding ways to bring in technology, “to modernise their operations to build new distribution channels using the internet, using better factories and better trucks.”

“It is a great opportunity for the people of Myanmar to realise their potential by a new and a more market-driven approach. Other approaches have been tried, but now it is the chance to take a new approach for the Myanmar based on an investor-friendly environment,” he concluded.

Source: http://www.mmtimes.com/index.php/business/26259-investor-friendly-environment-and-human-capital-essential-for-myanmar-s-success-in-the-belt-and-road-initiative.html

Thailand

Thailand