Indonesia Expected to Extend Rate Pause in Wake of Volatile Markets

(Bloomberg) — Indonesia’s central bank will likely extend its pause on borrowing costs in the wake of global market volatility following a banking turmoil in the US and signs of stubborn inflation there.

Twenty-six of 28 economists in a Bloomberg survey expect Bank Indonesia to keep its seven-day reverse repurchase rate at 5.75% on Thursday, in line with policymakers’ outlook before markets whipsawed this week. Two predict the bank will do an about-face and raise the rate by a quarter-point to 6%.

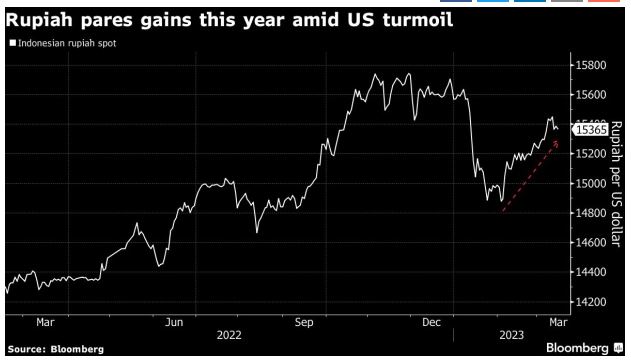

Indonesian authorities would have to weigh increasingly challenging and fluid global conditions and whether their impact on domestic settings, including the currency, would influence the country’s inflation and interest-rate path. The rupiah has weakened 0.8% against the dollar this month, the biggest decline among major Asian currencies and paring this year’s gains to 1.3%.

Bank Indonesia may adjust its monetary stance should currency pressures persist, according to six of 14 analysts in a separate Bloomberg poll last week, although all but one said it would be too soon to see a BI pivot on Thursday.

That survey was conducted after the Federal Reserve signaled it could return to outsized rate hikes to contain inflation. Since then, woes at mid-sized US lenders prompted bets the Fed could pause instead on March 22.

“BI will likely monitor the developments in the rupiah if the Fed tightens more than expected,” said Ju Ye Lee, an economist at Maybank Investment Banking Group. “The recent downward trend in core inflation provides room to pause in the March meeting,”

Here’s what else to watch for at 2 p.m. Jakarta as Governor Perry Warjiyo speaks:

Global Spillover

While Indonesia’s lenders have no direct links to Silicon Valley Bank, the government remains watchful of any possible fallout if cracks spread through the broader US financial sector. It could also hit the rupiah if risk-off sentiment leads to another bout of selling in emerging-market assets.

Combined with the typical spike in dollar requirements in the second quarter for imports, foreign debt and dividend repatriation, Indonesia may see a supply-demand mismatch in the spot market, said Satria Sambijantoro, an economist at PT Bahana Sekuritas.

“It will still be more prudent for BI to hike rates sooner than later,” he said, expecting a 25-basis point hike on Thursday and a terminal rate of 6.5% in the first half of 2023.

Dollar Stash

Renewed jitters will put Indonesia’s external buffers under scrutiny. Foreign reserves climbed to a one-year high in February, although crisis times have a way of swiftly depleting that war chest, as BI saw last year when the dollar was on the rise.

A new facility aimed at luring exporters’ dollar earnings has seen lukewarm reception so far.

Inflation Path

Inflation may be the least of investors’ concerns in Indonesia, unlike in neighbors including the Philippines where price pressures are proving persistent.

Ramadan festivities in March and April may cause a seasonal spike in headline inflation, which stood at 5.5% last month, but it’s expected to fall back within the 2%-4% goal by the second half of 2023. The central bank’s preferred core gauge remains within target at 3.1% in February.

Source: https://www.bnnbloomberg.ca/indonesia-expected-to-extend-rate-pause-in-wake-of-volatile-markets-1.1896138

Thailand

Thailand