Global manufacturers speed up FDI diversion and relocation from China to Vietnam

The Hanoitimes – Vietnam remains an attractive market, stated the report. Trade tensions should bring more FDI into Vietnam and create more jobs as firms move manufacturing from China.

Global manufacturers are speeding up their pace of FDI diversion and relocation from China to Vietnam as a result of the US – China trade war, according to HSBC in its latest report.

Vietnam remains an attractive market, stated the report. Trade tensions should bring more FDI into Vietnam and create more jobs as firms move manufacturing from China.

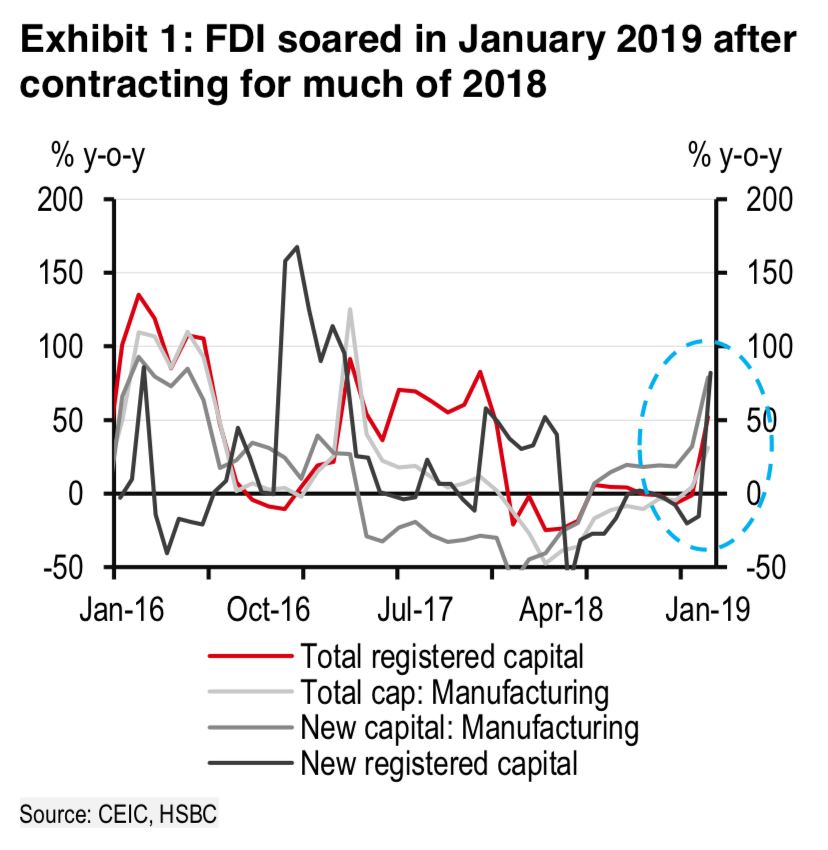

In January, FDI’s total registered capital rose 52% year-on-year and newly registered capital rose 82%, with a large majority of that (US$591 million) going to manufacturing, stated the report.

Moreover, the largest chunk of the FDI came from China, which suggests Chinese manufacturers are also shifting to Vietnam. Approximately US$222 million poured into Vietnam from China compared to the US$1.2 billion total that came in for all of last year. China’s total investment into Vietnam in 2018 trailed that of Japan (US$6.6 billion), South Korea (US$3.7 billion), and Singapore (US$1.4 billion).

Stronger FDI in light of rising trade tensions is one area that will support growth in Vietnam despite slowing global demand and the weakening electronics trade cycle, HSBC stated.

There is enough evidence that there is demand for Vietnam as a destination among companies. In fact, HSBC strategist Herald van der Linde argues that investors should build exposure to Vietnam as a way to play the theme of changing supply chains in Asia. This should continue to spill over into domestic demand and has been the crux of Vietnam’s story for the last few years, which may go further in the future.

According to HSBC, a combination of strong economic growth, stable currency, contained inflation and strong FDI flows should help domestic equities. 2018 was also a year of domestic selling as investors worried about the impact of trade tensions and knock-on effect of foreign selling in emerging markets on Vietnamese equities. However, this now seems to have played out and domestic investors’ sentiment should turn positive, boosting markets.

Given these factors, HSBC maintained positive stance on the market, despite valuations being slightly above their long-term average. It is expected that earnings growth should provide some support to valuations.

Vietnam’s dependence on exports for growth could make it vulnerable, if there is a broader based global slowdown in trade due to escalation of trade tensions. Exports have been a major engine of the economy in recent years but have already shown signs of slowing down. Investors would need to be cautious if a major slowdown in global trade materializes. However, as concluded, trade tensions may actually lead to more foreign investment in Vietnam.

Source: http://www.hanoitimes.vn/economy/2019/02/81E0D397/global-manufacturers-speed-up-fdi-diversion-and-relocation-from-china-to-vietnam/

Thailand

Thailand