Indonesia to Hold Key Rate Amid Price Pressures

(Bloomberg) — Indonesia is expected to continue bucking the trend of monetary policy tightening although signs that the government may boost fuel prices could convince the central bank to signal a readiness to act to tame inflation.

Bank Indonesia will keep its seven-day reverse repurchase rate at 3.5% on Tuesday, according to 24 of 31 economists in a Bloomberg survey as of Monday. The rest expect an increase of 25 basis points.

Bank Indonesia stands out as a rate holdout in the region amid a seven-year high inflation, with Governor Perry Warjiyo reiterating last week that he sees no need to increase just yet. His remarks came even after President Joko Widodo warned that the government won’t be able to sustain heavy subsidies.

Increasing the prices of widely-used automotive fuels “will push up inflation expectations, and that should certainly trigger BI to act to keep it anchored,” said David Sumual, chief economist at PT Bank Central Asia, who predicts a 25 basis point increase next month.

Here’s what to watch out for in Tuesday’s decision:

Fuel Price

The government is considering raising fuel prices as energy subsidies this year could exceed the 502 trillion rupiah ($33.7 billion) allocation, a budget that was already doubled from the initial plan this year.

“It’s only a matter of timing and magnitude as it will determine the impact on the inflation and economic growth trajectory,” Sumual said on the price increase.

Indonesia has kept the most-widely used Pertalite fuel at 7,650 rupiah a liter compared to the 18,150 rupiah that it should be selling for. Consumption of the subsidized gasoline is estimated to reach 28 million kiloliters by the end of this year, surpassing the 23 million kiloliters limit set in the subsidy plan.

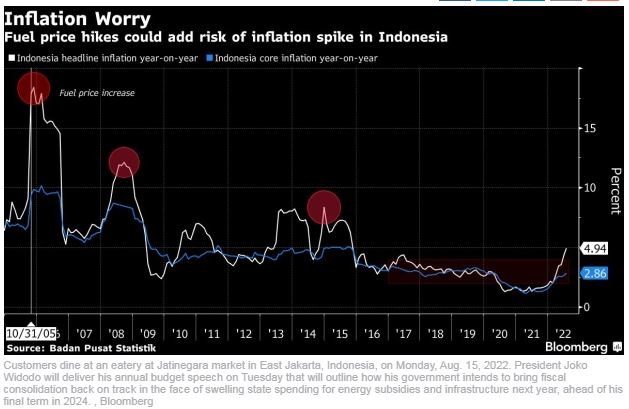

Inflation Risks

Fuel price increases would worsen inflation in Southeast Asia’s biggest economy, where price gains are already set to spike for the rest of the year. Bank Indonesia lifted its inflation outlook to 4.5%-4.6% last month, from 4.2%, overshooting its 2%-4% target range.

A 30% increase in Pertalite’s price could take inflation to 6%, said Josua Pardede, chief economist at PT Bank Permata. Consumer prices rose 4.94% in July, the fastest pace since October 2015.

While core inflation, Warjiyo’s preferred gauge that strips out volatile food and fuel items, remains manageable at 2.86% in July, it’s projected to hit closer to 3% this month, Barclays Bank Plc said in an Aug. 19 note. Barclays also forecasts a quarter-point hike at the September meeting.

September Cue

Analysts will closely watch Bank Indonesia’s language on whether it is becoming increasingly concerned about price pressures against the backdrop of an economic recovery that’s gaining traction.

Banks’ reserve requirement ratio would rise to 9% of deposits next month as part of Bank Indonesia’s steps to unwind some pandemic measures.

A more aggressive tightening by the Federal Reserve remains a downside risk for the rupiah that’s down more than 4% this year. Foreign reserves have fallen to the lowest level since 2020 to stabilize the currency.

Source: https://www.bnnbloomberg.ca/indonesia-to-hold-key-rate-amid-price-pressures-1.1809034

Thailand

Thailand