Indonesia cracks down on used clothing imports as lower prices hurt local producers

JAKARTA – Since she was a senior high school student, Jakarta-based freelance writer Anindya Miriati Hasanah, 25, has favoured second-hand clothes.

The avid fan of Japan’s Harajuku street style used to visit thrift stores across Jakarta, but she now hunts for bargains at online shops on Instagram. For her, it feels like a treasure hunt.

Once every two or three months, she buys her favourite Lolita dresses, spending between 50,000 rupiah (S$4.40) and 500,000 rupiah on each piece.

“If I buy new clothes, the prices are very expensive. That’s why I prefer buying second-hand items of good quality,” Ms Anindya said.

“Clothes express our personal style. It’s very difficult to find Japanese fashion that is locally produced.”

Another Jakarta resident, housewife Ghea Askara, often buys imported used clothing, particularly from Japan and South Korea, as she likes their unique designs.

“They have products that we don’t have locally,” said the 38-year-old mother of two. Her preference for a more sustainable lifestyle often sees her modifying the clothes – such as converting a pair of denim pants into a skirt – to prolong their life cycle.

Thanks to customers such as Ms Anindya and Ms Ghea, Indonesia’s thrifting business is gaining steam, with digital platforms opening doors to more customers.

Foreign second-hand clothes have been traded in the country for many years.

In 2015, the Trade Ministry issued regulations banning their import. However, it did not stipulate any penalties for violations, resulting in the rules being ineffective.

The vast archipelago is prone to smuggling due to the many entry points.

The recent influx of such items is a headache for the local textile and garment industry, which is still struggling to recover from the Covid-19 pandemic, as well as the government.

Second-hand clothing legally imported into the country was valued at US$272,146 (S$362,500) in 2022, more than five times what was brought in the previous year, according to Statistics Indonesia.

Mr Nandi Herdiaman, chairman of a union for home-based clothing makers, which has 500 members, said the massive availability of imported used clothes has affected many local producers that supply to traditional markets and retailers.

Customers’ weak purchasing power means that the imports have a price advantage.

Orders to produce new clothes ahead of Hari Raya Aidilfitri, for instance, fell sharply, he added. “The impact is already visible. Home-based clothing makers who used to produce clothes under certain brands now only fulfil orders to sew civil servant and party uniforms,” he noted.

The impact is also being felt by producers of raw materials used in manufacturing clothes.

Indonesian Textile Association chairman Jemmy Kartiwa Sastraatmaja said fewer orders by small and medium-sized clothing producers have resulted in a decline in raw material purchases.

“The utilisation of (textile) factories on the upstream side is also affected,” he added, referring to fibre and filament yarn production facilities, among others.

In mid-March, President Joko Widodo ordered the authorities to clamp down on the import of used clothing as it was “very disruptive” to the local textile industry.

The Trade Ministry has stepped up scrutiny, confiscating and destroying about 20 billion rupiah worth of imported used clothing in some regions, including Mojokerto, East Java, and Pekanbaru, Riau.

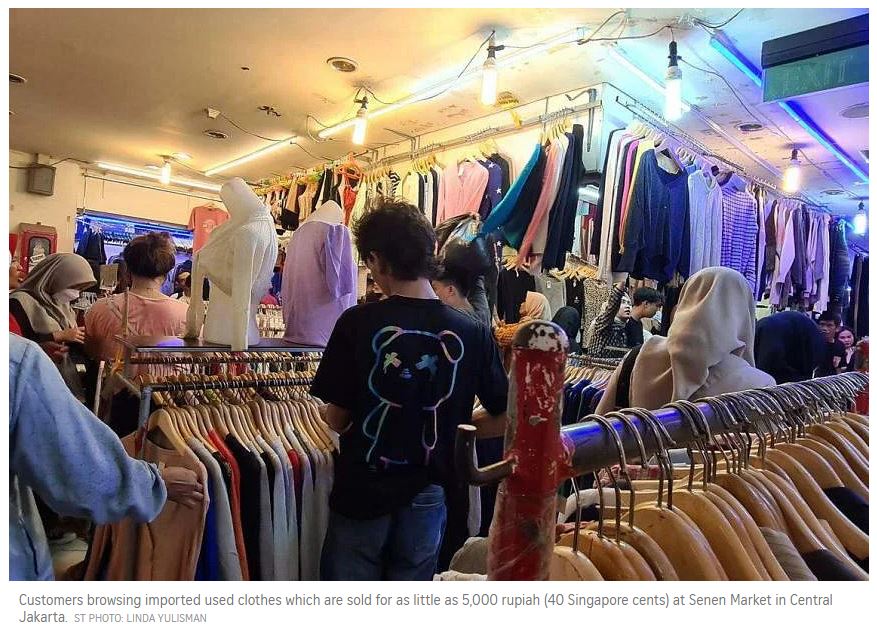

But it is business as usual at Jakarta’s Senen Market – well known for used clothing, shoes and handbags – even though traders fear the recent moves by the authorities.

Imported used clothes, mostly from Japan and South Korea, are sold for as little as 5,000 rupiah. Some items have fake tags of renowned brands such as Uniqlo and Gap.

A vendor, who has been in the business for three years and did not wish to be named, said he is able to garner a profit margin of more than 10 per cent from the sales of used clothing, over and above the rent he pays and other operational expenses.

He usually buys a bulk package worth between three million rupiah and 10 million rupiah, consisting of 100 to 500 pieces of foreign clothing, which he then sorts out before sending to a laundry shop.

Three-quarters of the consignment can fetch prices between 35,000 rupiah and 100,000 rupiah at his 3.5 sq m stall, while the rest is sold to fellow vendors at lower prices.

“Here, my customers can get goods that they want at prices they can afford. They feel satisfied,” he said, noting that he is aware of the competition between imported used apparel and locally made clothes.

On the recent crackdown on the second-hand clothing business, the 23-year-old senior high school graduate added: “If we are asked to change our business, we will lack the capital needed to do so.”

Rather than blame second-hand clothing vendors, Mr Nandi identified smuggling as the main culprit behind the recent influx of imported items.

“The supervision over imported goods must be enhanced in the future,” he said.

Ms Anindya said she is aware that her purchasing decisions may have a negative impact on local producers.

“On the other hand, if the clothes made by our producers do not match what we like to wear, why should we buy them?” she said.

Source: https://www.straitstimes.com/asia/se-asia/indonesia-cracks-down-on-used-clothing-imports-as-lower-prices-hurt-local-producers

Thailand

Thailand