Cambodia: Oil sale deal divides revenue amid new exploration negotiation

Even as a new negotiation is in progress for further commercial exploration into the Block A of Cambodia, a crude oil sale agreement was recently signed between government officials, the shipment company and the buying firm to divide the revenue from the sale as a percentage to each party of the deal, according to senior officials at the Ministry of Mines and Energy (MME).

The Cambodian government signed the sale-purchase agreement with a representative of Singaporean oil buyer Trafigura Group on 10 September to divide 70 percent of revenue to Cambodia, 24 percent to a representative of MT-Strovolors and 6 percent to a representative of KrisEnergy’s creditors, said the officials.

Cheap Sour, Director General of the General Department of Petroleum of MME, told Khmer Times yesterday that even though the sale-purchase agreement was already signed, an exact amount of cash will be calculated based on the actual quantity of the sold crude oil and the average international market price in September as a whole.

“Based on the agreement, the oil was already transferred from the storing ship to a ship of the buyer,” said Sour, adding that the payment will be made a month after the date of signature, which means it will be made around 10 October 2022 by transferring the cash into the account of Cambodia’s National Treasury.

Meng Saktheara, secretary of state of MME, also confirmed with Khmer Times yesterday that the conflict was fully resolved. He said that a group of Cambodian officials have been negotiating with a Canadian-owned firm for further oil extraction that would take some more time before reaching an agreement to proceed with the extraction in Block A. “Yes, it is. It is completed … and we are negotiating with another company,” Saktheara said.

The basket price of crude oil in the international market has generally been in the downtrend in September 2022, especially in week four of this month—from about $100 per barrel early this month to about $90 per barrel at the end of this month, according to price data of the Organization of the Petroleum Exporting Countries (OPEC).

At the projected $90 per barrel—the OPEC Basket Price, Cambodia is expected to generate its first revenue of about $27 million by selling nearly 300,000 barrels of crude oil to a Singaporean firm Trafigura Group.

The second quarter of 2022 is revised higher amid better-than-anticipated oil demand in the main Organisation for Economic Co-operation and Development (OECD) consuming countries, while the third and fourth quarters of this year have seen offsetting revisions. For 2023, the forecast for world oil demand growth also remained unchanged from the previous month’s assessment to 2.7 million barrels per day, while the OECD is expected to grow by 0.6 million barrels per day and the non-OECD by 2.1 million barrels per day, according to OPEC.

The OPEC report pointed out that oil demand in 2023 is expected to be supported by a still-solid economic performance in major consuming countries, as well as potential improvements in COVID-19 restrictions and reduced geopolitical uncertainties.

Non-OPEC liquids supply growth in 2022 remained broadly unchanged from last month’s assessment at 2.1 million barrels per day. A downward revision in Other Eurasia and OECD Americas was offset by an upward revision in Latin America and Other Asia. The main drivers of liquids supply growth for 2022 are expected to be the US, Canada, China, Brazil and Guyana, while the main production declines are expected in Indonesia and Norway.

Recently, Cambodian officials, World Tank, owner of MT-Strovolors and Singaporean oil buyer Trafigura have reached a consensus to bring back the oil Cambodia ‘lost’ last year, Saktheara said, adding that Trafigura had examined the quantity and quality of the oil stored on MT-Strovolors currently in Thailand after it was purchased from bankrupt KristEnergy that did not pay the shipment fee to World Tank.

“The agency has already confirmed that there is no loss of quantity and quality of oil as the ship has maintained the oil very well,” said Saktheara, who is also the head of Block A Project Implementation.

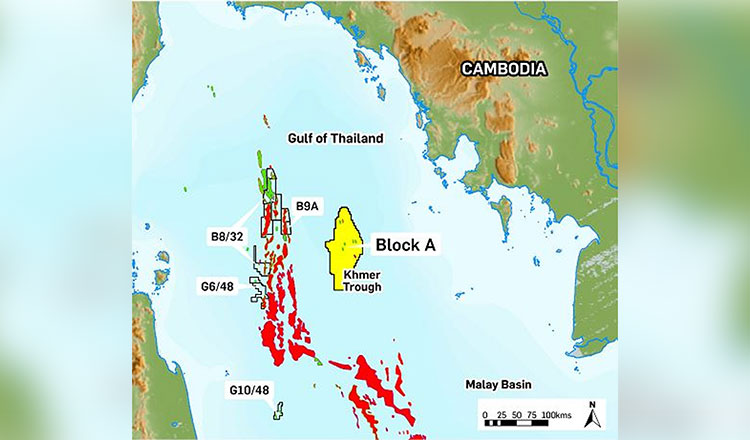

Angkor Resources Corp announced Angkor’s energy subsidiary, EnerCam Resources Corp., (EnerCam) advances potential Cambodian energy with inspection of production facilities in the offshore Khmer Basin.

Executive VP Operations of Angkor, and President of EnerCam, Mike Weeks, at the request of government officials of the Ministry of Energy in the Kingdom of Cambodia, has led a technical assessment and inspection of the offshore production facilities and drilling platform, located 160 km from Sihanoukville at the offshore oil field in the Khmer Basin of the Gulf of Thailand.

Source: https://www.khmertimeskh.com/501159646/oil-sale-deal-divides-revenue-amid-new-exploration-negotiation/

Thailand

Thailand