Eight trends shaping e-commerce in Asean

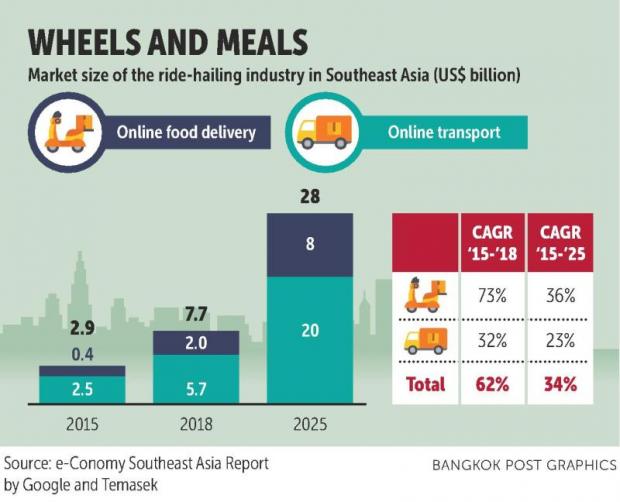

The e-commerce market in Southeast Asia is forecast to be worth at least UScopy02 billion by 2025, according to the latest “e- Conomy of Southeast Asia” report by Google and Singapore-based Temasek.

The report also notes the growing confidence among investors in the region, with startups raising $9.1 billion in the first half of last year, almost as much as in all of 2017.

As the momentum continues to build, it’s timely to look at anticipated trends for online retailers and brands in Southeast Asia.

1. Brands shift focus from data gathering to data utilisation: The biggest differentiator between online and offline retail is the ability to track, collect, monitor and manage information, all in real time.

Brands can access customer data through chats, social media and their own websites. But while data collection is easy, having the analytics capability to use it is a completely different ball game.

A survey by e-commerceIQ identified data analysis as one of the most difficult skills to find among the digital talents in Southeast Asia. Brands are constantly searching for data aggregators to consolidate information for convenient retrieval and use to target, re-target and personalise products and services.

Reagan Chai, head of regional business intelligence and business development at Shopee, said data acquisition had enabled the company to optimise buyer and seller user experience while pre-empting customer demand and anticipating future potential. Its website traffic growth in the past year surpasses that of its peers.

In China, Alibaba and JD.com have taken this a step further by utilising the data gathered online to improve inventories and experiences at their physical stores. Alibaba says it wants to help brands find the right consumers by tracking them throughout Alibaba’s system.

In China, Alibaba and JD.com have taken this a step further by utilising the data gathered online to improve inventories and experiences at their physical stores. Alibaba says it wants to help brands find the right consumers by tracking them throughout Alibaba’s system.

Last year, the regional e-commerce enabler aCommerce launched the data analytics platform BrandIQ to help brands centralise customer data and offer customised products or services to each target group.

2. Social commerce channels are brands’ new sales outlets: Facebook groups have long been established as an online space where people connect to buy and sell goods, even before the launch of the Marketplace feature. Other social platforms such as Instagram and Pinterest have also developed their own shoppable features.

The chat app Line recently acquired the social commerce management startup Sellsuki in Thailand, where it has the second biggest user base, to power its e-commerce business. The company has also formed a joint venture with three local banks to offer personalised loans to SMEs.

A few big brands such as L’Oreal have already equipped their social media pages with a “shop” feature that allows consumers to purchase the order directly on the page.

3. E-marketplaces launch new services: Looking at the successful existing e-commerce players in more developed markets, one thing they have in common is full control over their supply chain.

3. E-marketplaces launch new services: Looking at the successful existing e-commerce players in more developed markets, one thing they have in common is full control over their supply chain.

JD.com’s investment in the development of its own supply chain allows it to scale technology and offer a retail-as-a-service proposition to help other retailers or brands sell online. Alibaba is unrivalled for its ecosystem beyond commerce, including the logistics network Cainiao and the payment firm Ant Financial.

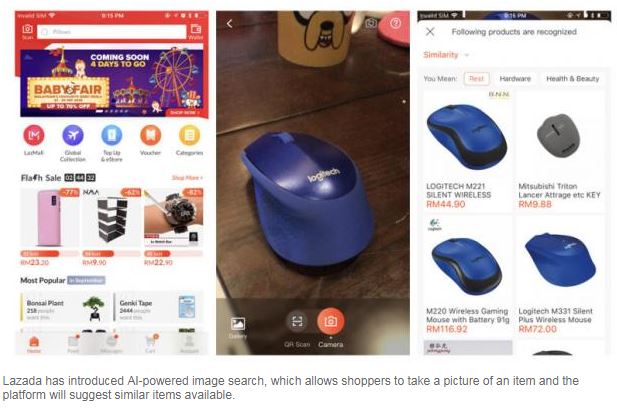

In Southeast Asia, Lazada has strengthened its logistics arm FBL (Fulfilled by Lazada), and Shopee has expressed the intention of building its own logistics network.

More e-marketplaces are coming up with new services to get more sellers onboard. Singapore’s Qoo10 is set to launch its blockchain-based e-commerce site QuuBee this year, using blockchain technology to eliminate transaction and listing fees, which in turn increases retailers’ profit margins and enables a more sustainable commerce approach.

In Indonesia, Tokopedia is set to offer “infrastructure-as-a-service” with copy.1 billion in new funding. It also plans to use AI for customer care services and to run credit checks on merchants seeking loans to expand their businesses.

The fashion e-marketplace Zilingo, meanwhile, has scored $226 million in funding due to its new focus on building a fashion supply chain that anyone, small merchants or big retailers, can tap into.

4. Brands reinforce reviews and fund user-generated content: Online consumers begin their purchasing journeys by searching for product information or reading reviews, usually on e-marketplace platforms, before making purchase decisions.

Platforms such as ReviewIQ are used by brands to increase their ratings and review engagement on their e-marketplace listings to help consumers make decisions. While chatbots can help to smooth the online customer experience, they’re more suitable for generic questions such as “where is my order?” or “is this product available?” instead of personalised questions such as “will this lipstick look good on a yellow-undertone skin?”

Th community-crowd model used by travel platforms such as Airbnb might also be suitable for e-commerce in the region to help consumers get past their apprehension about online shopping.

5. Brands employ direct-to-consumer strategies: Eighty-nine percent of companies are now competing mostly on a customer experience playing field. The direct-to-consumer (DTC) approach allows them to gain more insights into their end users and anticipate their needs.

The subscription model is one way to boost DTC engagement. From a consumer perspective, it is a convenient, personalised and often cheaper way to buy what they need. For brands, it can create more customer loyalty.

Nescafe Dolce Gusto, for example, offers free coffee machines in exchange for a minimum 12-month subscription. Besides witnessing sales growth, Nescafe Dolce Gusto also noticed consumers continued to purchase goods from its brand even after dropping out of the subscription plan.

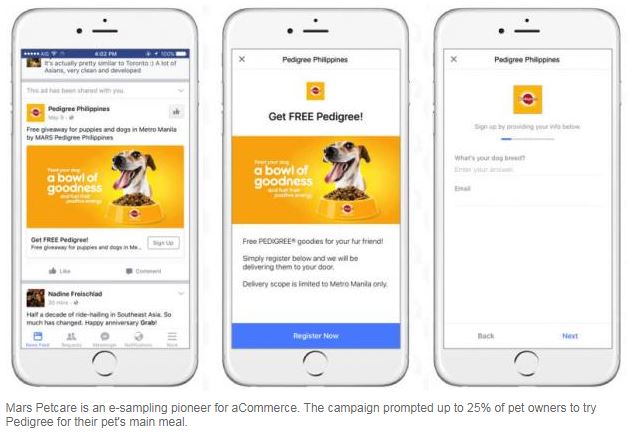

E-sampling is a popular strategy employed by brands to evaluate demand, according to Mandy Arbilo, regional director of project management with aCommerce.

While normal sampling techniques used by offline retailers are expensive, e-sampling saves brands up to 40% as well as providing essential customer data.

6. 2019 will finally see regulation of e-commerce: E-commerce practices in the region have remained largely unregulated. But it is only a matter of time until governments step in to tax this fast-growing segment and also level the playing field for foreign companies.

6. 2019 will finally see regulation of e-commerce: E-commerce practices in the region have remained largely unregulated. But it is only a matter of time until governments step in to tax this fast-growing segment and also level the playing field for foreign companies.

Asean economic ministers recently signed an agreement to facilitate cross-border e-commerce transactions. And while nothing is written in stone, predictions abound concerning the impacts of e-commerce tax on imported goods. In Indonesia and Thailand, a proposed e-commerce tax is predicted to bolster the growth of social commerce because, unlike e-marketplaces, they are uncontrolled.

Singapore might also see a decrease in cross-border shopping as prices increase with the introduction of Goods and Service Tax on e-commerce goods and services from overseas. Currently, 89% of all cross-border transactions in Asia Pacific are conducted by Singaporeans.

7. Grab and Go-Jek pursue super-app status: Since Uber’s exit last year, the Grab monopoly in Thailand, the Philippines and Malaysia has led to complaints about services and higher prices.

However, Indonesia-based Go-Jek has now gained a foothold in Vietnam, Singapore and Thailand, and Grab’s competitor in Malaysia, Dacsee, is also looking at Thailand.

While Grab and Go-Jek race to be the best ride-hailing providers, they also aspire to be regional super apps, with a growing presence in food and e-commerce delivery. Google and Temasek predict a compound annual growth rate of 36% for online food delivery by 2025, versus 23% for app-enabled transport.

8. Brands and retailers double down on omni-channel: The omni-channel shopping experience is not a new concept, but companies have diverse interpretations of it.

Alibaba, for example, has ventured out of online to solve core problems with the shopping experience, such as scattered operations and lack of payment transparency.

JD.com pipped Alibaba for once by opening the first unmanned convenience store in the region in Jakarta to exploit its enormous database by offering beneficial insights to brands such as the best products to stock and advertise. Its joint venture with Central Group plans a similar launch in Thailand by 2020.

Pure-play e-commerce retailers and brands have recognised drawbacks in online marketing channels with fragmented infrastructure and a limited pool of shoppers. They see offline as an attractive option to push sales growth.

Elsewhere in Southeast Asia, companies are slowly adopting this strategy across all categories. E-commerce fashion players like Thailand’s Pomelo and Singapore’s Love, Bonito have opened physical stores in their respective countries.

In 2018, Pomelo opened five new outlets, moving away from prime Bangkok shopping areas to locations such as Asok and residential areas of Bang Na. Love, Bonito has 17 retail outlets spread across Singapore, Malaysia, Indonesia and Cambodia.

Rachel Lim, co-founder of Love, Bonito told Peak Magazine, “Data can tell you what’s selling but being on the ground tells you why something is not selling and what the customer is looking for.”

Visiting malls is a popular social activity in Southeast Asia and this trend is not set to disappear anytime soon. Brands should take advantage of dual physical and online presence.

Source: https://www.bangkokpost.com/business/news/1673960/eight-trends-shaping-e-commerce-in-asean

Thailand

Thailand