Container ships facing longer wait times at Singapore port amid global surge in cargo demand

SINGAPORE – Container ships arriving to berth at Singapore’s port are facing longer waiting times in a situation seen in other key ports due to the sudden surge in cargo volume fuelled by the Covid-19 pandemic, The Business Times reported.

Ms Ng Baoying, the global managing editor for container shipping at S&P Global Platts, told BT that the daily average number of vessels staying at Singapore’s port for more than two days in January and February both jumped over 60 per cent year on year to 47 and 52 respectively. The upward trend was already observed last year as the virus outbreak spread.

Meanwhile, the turnaround time for container vessels has more than doubled to an estimated five to seven days, from a maximum of two days earlier.

A spokesman for port operator PSA told BT: “This exceptional situation is due to a confluence of factors, including an unprecedented and volatile surge in cargo demand, congestion across all nodes in the global supply chain (including depots, warehouses and seaports) due to renewed lockdowns, a lack of usable empty containers while laden ones are held up longer at these nodes, and shipping lines’ vessel sailing schedule reliability dropping to 10-year historical lows, causing further delays at almost every seaport worldwide.”

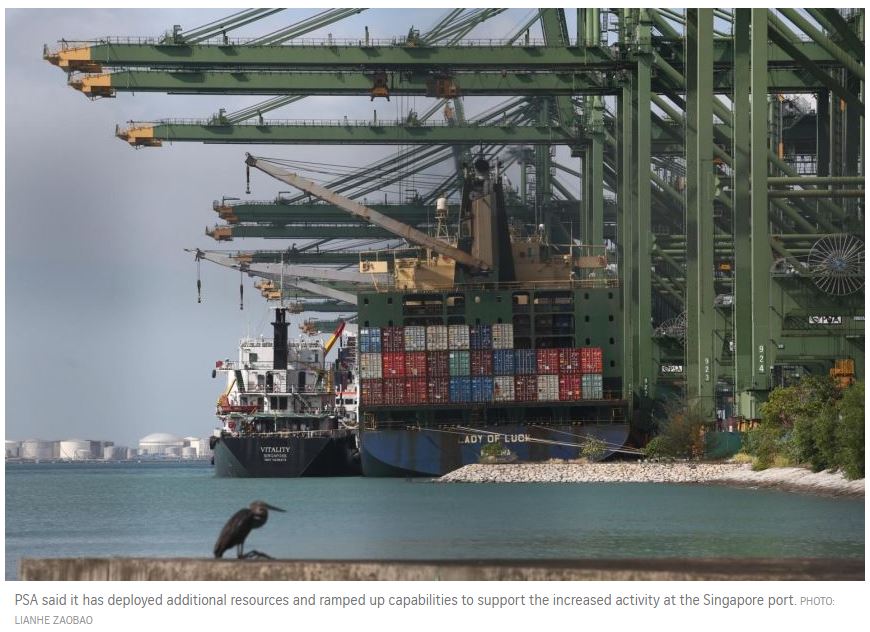

PSA said it has deployed additional resources and ramped up capabilities to support the increased activity at the Singapore port, and is also working with shipping line customers and cargo owners.

As PSA observed, the situation is not unique to Singapore.

Data from IHS Markit 23 key Northern Hemisphere ports showed that average port time rose 13 per cent in the second half of last year against the same period in 2019, Joc.com reported this week. This was equivalent to an extra 3.5 hours per port call. The ports covered included Los Angeles, Long Beach, Rotterdam, Felixstowe, Yantian and Yangshan

The report said sudden growth in demand was one of the main catalysts for the delays, as container volumes rebounded in the second half of the year, driven by growth in spending on household goods and other equipment as people were forced to stay at home due to Covid-19 travel restrictions, plus massive purchases of medical equipment used to control the virus outbreak.

Mr Peter Sand, the chief shipping analyst at industry lobby group Bimco, said that by far the largest volume growth was seen on the Far East to North America trade. On this route, volumes rose by 3.6 million TEUs (20ft equivalent unit) in the second half of 2020 compared with the first, and by 2.1 million TEU compared with the second half of 2019.

While cargoes from Colombo and other ports reportedly diverted to Singapore have partially contributed to the congestion, Ms Ng told BT that Singapore’s role as a key transshipment hub and a port where crew changes take place are other factors.

CTI Consultancy director Andy Lane told BT that the congestion in Singapore port is “far from being a critical situation”.

Singapore also appears to be coping better than other ports, and has a greater ability to flex capacity to meet peak demands as needed, he said.

PSA did not say when it expects the congestion here will be resolved, said BT. But its unit is offering a host of value-added services including priority discharge, top stowage, express delivery and timely updates, in response to the situation.

Source: https://www.straitstimes.com/business/companies-markets/container-ships-facing-longer-wait-times-at-spore-port-amid-global-surge

Thailand

Thailand