Connecting the AEC

Southeast Asia in the digital era is more attractive than ever, thanks to a large young population and growing economies. Large businesses are embracing new technologies and competing with a more intense customer focus to be more relevant to their consumers.

As well, the benefits of regional integration under the Asean Economic Community (AEC) framework are becoming more apparent to companies seeking to expand across borders, business leaders say.

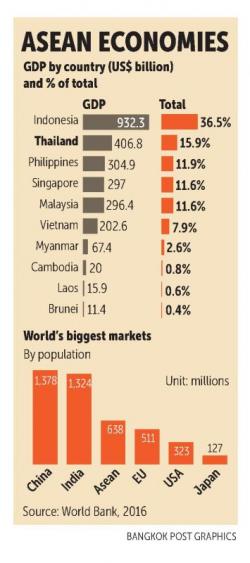

“Asean is an incredible market when you look at the numbers today. Half of the population is under the age of 30 so digital is going to be the key to success here,” said William Heinecke, CEO of Bangkok-based Minor International, one of the largest hospitality and leisure companies in Asia.

“We are using AI (artificial intelligence) to help us with various insights into consumers. We are using blockchain to distribute loyalty points. So we have to embrace the entire digital phenomenon in order to be competitive today,” he told the AEC Business Forum hosted by Bangkok Bank last month.

VinaCapital, a private equity and venture capital firm specialising in startups, has been investing in Vietnam for 15 years. Founding partner Don Lam says the company is “bullish” on the region for several reasons, especially since the AEC came into effect in 2015.

“It is not just the high economic growth that we have seen in the last few years but there is a large population living in close proximity to at least four major trading powers including China, India, Japan and South Korea, with low labour cost and abundant resources,” he said.

The Asean economy expanded by an average of 5.2% between 2007 and 2015. The Asian Development Bank says the region is “poised to sustain a higher growth path” with 5.2% expansion this year and next. At US$2.4 trillion, it was the sixth largest economy in the world in 2015 and is projected to be the fourth largest by 2050. The population of 640 million, 47.7% of them living in urban areas, has a median age of 28.9 years.

“From all these factors and from an investment perspective, this is the most exciting region to invest in for us,” said Mr Lam.

He said the AEC had already led to increased intraregional trade and investment involving Asean companies. Total intra-Asean trade reached $2.3 trillion in 2015, for a 24% share of all trade in the region, larger than with any other partner (see table). In the same year, Asean was the largest source of foreign investment in the region at 18% of the total, compared to the EU (16%), Japan (14%), the US (10%) and China (7%).

Thai companies active in mergers and acquisitions in Asean include ThaiBev, which recently acquired the brewer Sabeco through subsidiary Vietnam Beverage for $5 billion, while Central Group has also brought a number of assets in the country. Nawaplastic Industries, a subsidiary of Siam Cement Group (SCG), increased its ownership in Vietnam-based Binh Minh Plastic to 51% in May.

Thai companies active in mergers and acquisitions in Asean include ThaiBev, which recently acquired the brewer Sabeco through subsidiary Vietnam Beverage for $5 billion, while Central Group has also brought a number of assets in the country. Nawaplastic Industries, a subsidiary of Siam Cement Group (SCG), increased its ownership in Vietnam-based Binh Minh Plastic to 51% in May.

With copy.8 billion in assets under management, VinaCapital last month backed the listing of the entertainment group Yeah1 Group on the Ho Chi Minh City Stock Exchange at the highest reference price in local market history.

Mr Lam said that Yeah1, which is the largest YouTube platform in Asia, had just acquired a company in Thailand, which he did not name. “Coming from what (Mr Heinecke) was saying, this is how you can use technology to go transnational outside your own country and expand quickly,” he said.

Yeah1 runs various channels in Vietnam specialising in entertainment for young people including Yeah1TV, Yeah1family, Imovietv and SCTV2. Currently valued at $70 million, it posted revenue of $37.2 million in 2017 with after-tax profit $3.6 million, up 50% from the year before. It is Vietnam’s most popular media and entertainment website with over 1.3 billion views per month while 60% of its user base is aged between 15 and 25. It now aims to expand to Singapore, Malaysia, Thailand and the Philippines with local-language content.

VinaCapital, which invested in Yeah1 eight years ago, also sees good prospects for Timo, Vietnam’s only digital bank which was launched 18 months ago and is now eyeing expansion in the Philippines.

“With digital, you can expand faster and cheaper,” Mr Lam sid.

Timo, which stands for “time is money”, has no branches — its only physical presence is in a café in Ho Chi Minh City called the Timo Hangout. Customers can open accounts with no funds and use an app to track their transactions.

“We found that [Vietnamese customers] have lots of bank accounts; if there’s a new promotion or product, they’ll open another account,” Timo CEO Claude Spiese, who has lived in Vietnam for 20 years, told CNBC in May. “There’s not much loyalty, so our challenge is how do we get that loyalty? It’s not through competing at 1% interest on products. It’s on lifestyle.”

Mr Spiese said the idea for Timo grew out of frustration with conventional banking.

“First I had to open an account. Then I had to apply for a card. Then I had to apply for internet banking. I filled out a lot of forms during several visits to the branch over the course of a week,” he told Fintechnews. “That’s when I decided enough is enough, Vietnam is ready for a digital bank.

“Now, with Timo, all that is possible in 20 minutes at our Hangout over a cup of coffee.”

Timo does not have a banking licence but operates as a digital arm of the conventional financial services provider VPBank.

Mr Heinecke said the hospitality business also was undergoing a “huge change” as hotels now had to find better ways to market themselves to “compete with the online agents”.

In the food delivery business, another big sector for Minor, new players such as Grab, Uber and Line are making inroads but he believes customer care differentiates Minor from its competitors.

“We pioneered the 30-minute guarantee when we deliver pizza but today we can see many new competitors driving this industry and making it very competitive, but one thing that has not changed through all this technology is the focus on the customers,” he said. “If you are chasing dollars instead of quality, I think you are going to end up suffering.

“[New technology and new competitors] are not going away and they are going to be extremely involved in our industry, so we have to find better ways to combat them and that means you have to be better and more customer-focused. Sometimes, customer focus has to take the lead over profitability.”

Source: https://www.bangkokpost.com/business/news/1500222/connecting-the-aec

Thailand

Thailand