Cambodia: Government approves new draft law on taxation

The Cambodian government on Friday approved a new draft taxation law which is said to contribute to promoting and enhancing the Cambodian business sector, increase the favorable investment environment, and strengthen fiscal compliance.

The approval was made at a weekly cabinet meeting, chaired by Prime Minister Hun Sen, according to a press release.

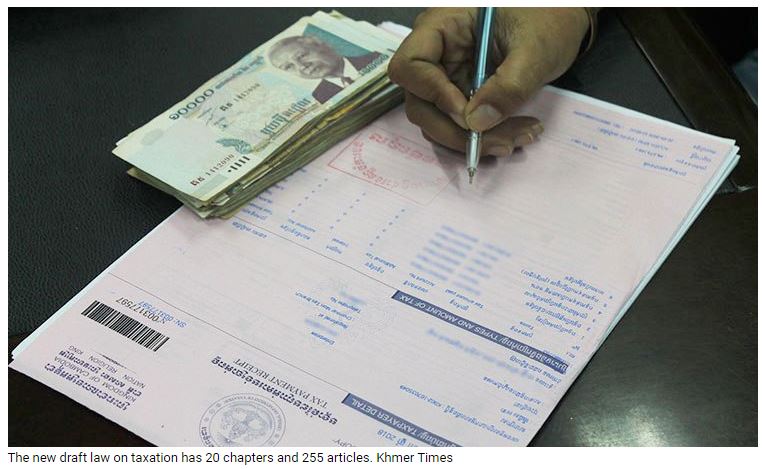

The new draft taxation law is comprised of 20 chapters and 255 articles which was approved at the cabinet meeting.

“The draft law on taxation will contribute to the promotion of the Cambodian business sector, increase the favorable investment environment, and strengthen the level of fiscal compliance,” the release said.

It will also help ensure fair competition and boost the Cambodian economy in all areas, especially providing support to the small and medium enterprises (SMEs), it added.

The adoption of the new fiscal law is in line with the fourth phase of the Rectangular Strategy, the Public Financial Management Reform Program, the Cambodian Digital Economic and Social Policy Framework and the government’s revenue collection strategy, said government spokesman Phay Siphan.

The tax law is not a complete overhaul, but is designed to facilitate, improve, fill gaps and ensure consistency by compiling a set of tax laws and regulations under the decree, he said, adding that the law is amended and supplemented with gaps in the provisions on the basis of the implementation of laws and regulations on taxation in force, the implementation of agreements on the avoidance of double taxation and other international practices.

“The draft law will help Cambodia achieve its goal of becoming a high-middle-income country by 2030 and a high-income country by 2050,” he said in a Facebook post on Friday.

The current Law on Taxation was originally formed in 1997.

The draft law on taxation is designed to compile a number of tax laws and regulations that are scattered, concentrated and consistent, ensuring a smoother and easier implementation, Kong Vibol, director-general of Taxation at the Ministry of Economy and Finance said recently.

The drafting of the law on taxation is aimed to respond to the international excellence of Cambodia’s economic integration in the region and the world in line with the development of society, national and international economy and the development of information technology in the digital age.

The GDT collected $3.45 billion in revenues last year, exceeding the $2.81 billion annual target by 22.54 per cent and marking a 24.20 percent jump over the total that it had reported for 2021.

The 2023 target has been increased by 26.68 per cent to $3.57 billion, which is just 3.37 per cent more than the amount collected in 2022.

Separately, the cabinet also approved the draft law on public procurement aimed to ensure reliability, transparency, efficiency, competitiveness and savings, as well as compliance by turning the role of the Ministry of Economy and Finance into a regulator and auditor on procurement.

Source: https://www.khmertimeskh.com/501266503/government-approves-new-draft-law-on-taxation/

English

English