Cambodia expects its investor appeal to endure

Although traditionally overshadowed by its larger and more developed neighbours, Cambodia is determined to increase foreign investment in its rapidly growing economy.

Despite concerns about possible political turbulence over the next year, strong economic indicators and government incentives make the country an attractive prospect for foreign investors.

Speaking at the Bangkok Overseas Investment seminar last month, Visal Lim of the Council for the Development of Cambodia (CDC) pointed to strong economic growth as an alluring incentive. Over the past two decades, Cambodia has had an average gross domestic product (GDP) growth rate of 7.7%, making it the sixth fastest growing economy in the world. The 2020 forecast of 6.7% growth suggests that this success is going to continue.

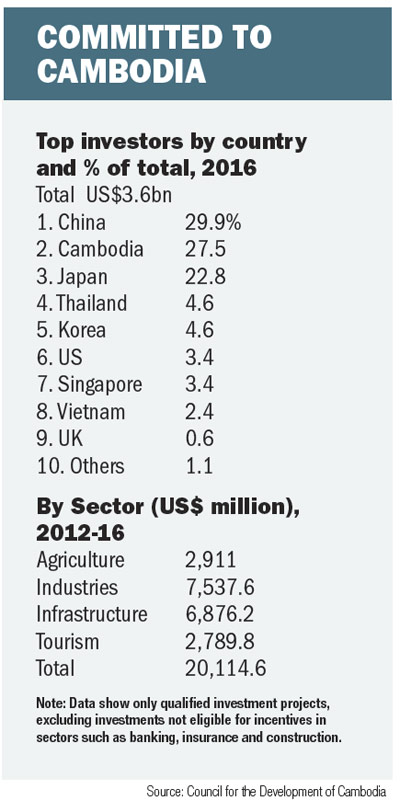

On top of these strong economic indicators, Mr Visal believes the CDC’s investment programme is very favourable to foreign investors. A venture that wins approval as a Qualified Investment Project (QIP) can receive a corporate tax holiday of up to nine years in combination with a full exemption on import duties.

It is important to note that the level of benefit is dependent on the size and sector of the investment. For example, a textile company would have to invest at least US$500,000 to become eligible. The sectors eligible for the longest tax holidays are agriculture and agro-industry, heavy industry and infrastructure.

“For me, the biggest advantage is the openness where foreign investors can invest in any sectors that Cambodian people can, without having to have local equity participation. Another point is that Cambodia is a dollarised economy. Thus, there is no such exchange rate risk for foreign investors,” Mr Visal said.

The director of the Cambodian Commercial Bank, Pachana Rujirek, commended the Cambodian government for creating a welcoming environment for foreign investment.

“It’s very open for investment because they [the government] are trying to draw it to the country — they have lots of incentives. Even if you are a small and medium enterprise (SME), you can do a lot of trading without regulation,” she said.

The QIP programme also provides businesses with a “one-stop meeting” to save them the time of knocking on the door of every relevant ministry to secure the necessary licences or registrations.

“Currently growth is shifting from agriculture to construction and building materials. It is a growing country and is building more infrastructure, a lot of road systems and connectivity,” said Ms Pachana.

While these developments are promising for the future, Cambodia is far from the investment paradise the government is aiming for. Political conditions remain unsettling with Prime Minister Hun Sen, who has been in power for 32 years, seeking to disband the opposition party and threatening violence on the streets if he doesn’t win the general election next year.

“To ensure the lives of millions of people, we are willing to eliminate 100 or 200 people because we have seen bitter past experience,” said the former Khmer Rouge commander.

Only last month, the leader of the opposition, Kem Sokha, was arrested and faces treason charges for allegedly conspiring with the United States to topple the government. Hun Sen, meanwhile, has said he will continue to rule for another 10 years.

Apiradee Synsukpermpoon, the head of the Greater Mekong region for Siam Commercial Bank, which owns Cambodian Commercial Bank, believes that investors are concerned about political uncertainty. However, she added that businesses in the country trust there won’t be fundamental change in the future.

On top of this political uncertainty, Ms Pachana points to the lack of skilled labour as a problem for foreign investors. “You need to have good people to set up a business. Skilled labour in professional areas such as accountancy is limited in the country.”

There has been some investment in public education but there remain large gaps, she added.

Investment in education will most probably increase once people’s incomes rise, according to Ms Apiradee.

Mr Visal believes that Cambodia’s place in Asean and the Asean Economic Community add to the attraction for investors. This allows businesses to incorporate their Cambodian investment into a regional and global plan.

A recent survey by the EU-Asean Business Council found widespread optimism about Asean’s economic future. According to the report, 86% of European businesses expect their level of trade and investment in Asean to increase over the next five years.

Source: https://www.bangkokpost.com/business/world/1347590/cambodia-expects-its-investor-appeal-to-endure

Thailand

Thailand