Asean more positive about outlook for trade, says HSBC survey

KUALA LUMPUR: Companies across the Asean bloc remain more positive about the outlook on the global trading environment despite evidence that growth has slowed recently,according to a HSBC survey.

The HSBC Navigator survey showed vast majority (86%) reporting a positive view on the outlook for trade, more than any other trade bloc and higher than the global average.

“Their key reasons for optimism: consumer confidence and global economic growth. Meanwhile, companies with a negative outlook were most likely to cite the US-China trade dispute amongst their key concerns,” it said.

The survey found that investment in digital capabilities and a focus on productivity and skills development are supporting competitiveness and enhancing long-term growth prospects.

“Despite this, the Asean bloc has the highest proportion of corporates who expect protectionism to rise, and who see regulations as positive for their business,” it said.

Economic activity in the Asean bloc remained robust in the first half of 2018, supported by continued export growth. Although Asean currencies have weakened this year against the US dollar, the moves have been relatively moderate compared to the sell-off in other emerging market currencies, reflecting Asean countries’ relatively solid external and macroeconomic fundamentals.

“However, growth momentum is likely to ease in coming months reflecting cooling Chinese demand and increased global trade protectionism,” according to HSBC.

Indeed, the latest Nikkei Asean Purchasing Managers’ Index showed growth in manufacturing output slowed to its weakest rate for six months in September. Notably, the survey indicated a decline in export sales for a second consecutive month.

HSBC said the threat posed by global protectionism may be underappreciated.

China has so far borne the brunt of the US administration’s protectionist trade policy, but these actions will also have an indirect impact on the Asean bloc given the region’s high level of exports to China and dependency on exports.

Moreover, the US has shown that it is willing to threaten higher tariffs across multiple countries

with which it has bilateral trade deficits, which raises the risk that the US could also impose higher import tariffs on other Asian economies.

The United States Trade Representative (USTR) has already announced that it is reviewing the eligibility of Indonesia in the Generalized System of Preferences (GSP) based on “concerns” about compliance with the program.

Additionally the large US trade deficit with Vietnam – more than double the size of the US deficit with Canada in 2017 – suggests that it could also draw attention from the US administration.

“At the other end of the spectrum, Singapore appears least at risk of direct US actions, reflecting its low tariff regime and the US trade surplus with the economy.

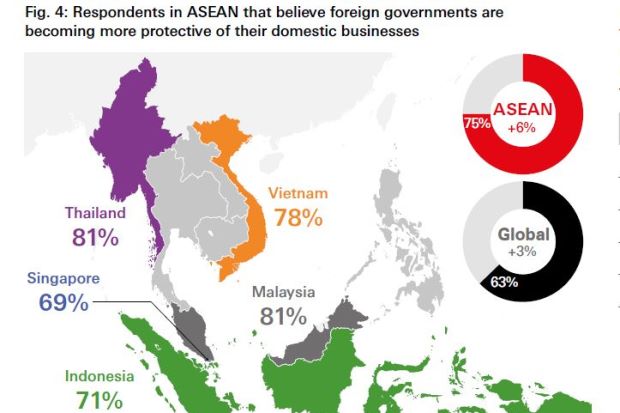

“Not surprisingly, three-quarters (75%) of respondents to the HSBC Navigator survey in the Asean bloc believe that governments are becoming more protectionist, which is higher than the global average (63%).

“Views regarding the impact of regulations were more nuanced though, with 34% of firms seeing them as adding to the cost of doing business, but 36% viewing regulations as helping their

competitiveness,” said HSBC.

On the impact of global policy developments, HSBC said the survey results showed less than a quarter (22%) of Asean businesses expect the US-China trade dispute to hinder their business prospects in the next three years, compared to 31% globally.

While this may reflect perceived opportunities to capture market share, it may also suggest that businesses have not fully examined the potential direct and indirect impacts of the dispute on their supply chains.

A majority of respondents (60%) viewed relevant free-trade agreements as having a positive impact on their business. In line with this view, Asean itself was viewed favourably by 69% of firms, while current and prospective ASEAN free-trade

agreements with third-party countries also ranked highly.

“In the near future, growing market share is identified as the key focus (38%) of shaping company direction in the Asean bloc. Firms also intend to focus on productivity and skills development, as well as increasing emphasis on long-term performance,” said HSBC.

At the country level, a high proportion of respondents in Thailand (41%) reported an emphasis on increasing digitisation, a share that was well above the average for both Asean (24%) and globally (20%).

This likely reflects both increased demand within Thailand for better connectivity and applications, as well as the emphasis by the government on supporting the development of technology through initiatives such as Thailand 4.0.

HSBC said the survey found that more than one third of Asean firms (37% goods, 34% services) say increased use of technology is the top change planned in their supply chain, with doing business in new markets the second, compared to the global averages of 27% and 21% respectively.

Increasing profits and cost reduction were the most frequently cited objectives behind these changes. The results demonstrate that both goods and services firms across the region increasingly view technology as central to their business strategies.

Source: https://www.thestar.com.my/business/business-news/2018/11/07/asean-more-positive-about-outlook-for-trade-says-hsbc-survey/#QPOrcY6L15Mv8SjZ.99

Thailand

Thailand