US fashion firms may source more from Cambodia

With more and more US fashion companies looking to go for expanding and diversify their garment sourcing base after the supply chain disruption caused by the Covid-19 pandemic, Cambodia is likely to emerge as one of the beneficiaries.

Around 40 percent of the US fashion companies have stated that they planned to “source from more countries and work with more suppliers” over the next two years, according to the Fashion Industry Benchmarking Study conducted by the US Fashion Industry Association.

Apart from the recent supply disruptions, American companies say that “Asian suppliers, such as Vietnam, Bangladesh, and Cambodia, as well as members of the African Growth and Opportunity Act, offered the most competitive prices. In comparison, sourcing from the US and Europe is the most expensive due to the much higher labour costs.”

At present, Asia accounts for more than 70 percent of the US apparel imports with Cambodia figuring at the fifth spot on the table, which is topped by China.

For Cambodian exporters, the US apparel market remains a major destination. The garment export to the US from Cambodia has been rising consistently and rapidly and is set to reach a new high in 2022. At $3.513 billion in shipments by Cambodia to the US in the nine months (January-September) of the last year, the garment export had almost reached the 2021 levels of $3.522 billion.

With the new inclination of the US garment importers, the Cambodian garment industry may land more and more varied orders. According to Fibre2Fashion’s market insight tool TexPro, jerseys, shirts and trousers, and shorts together accounted for more than half of the export value to the US in the nine months. Of this, shipment of shirts and trousers was worth $1.091 billion or 31 percent, and jerseys $759.570 million (21.62 percent), shows the TexPro data.

The garment export is the largest foreign exchange earner for Cambodia, accounting for almost 60 percent of the country’s total export value, according to a recent report from the General Department of Customs and Excise.

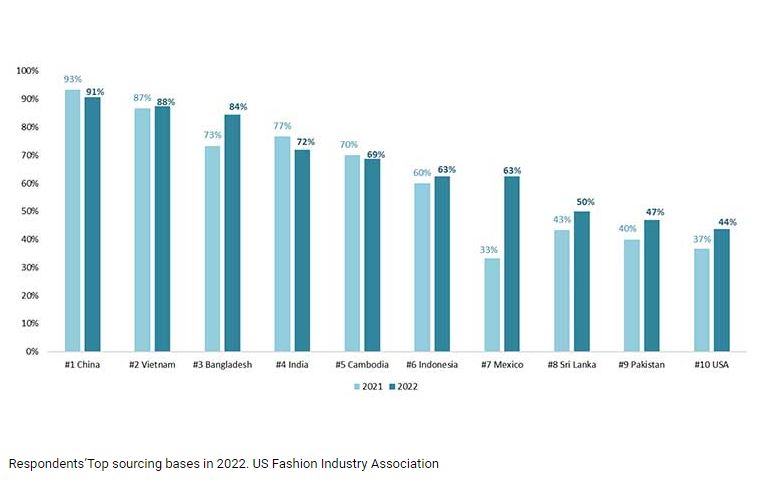

For the US fashion companies, eight out of the top 10 most-utilised sourcing destinations are Asia-based, led by China (91 percent), Vietnam (88 percent), Bangladesh (84 percent), India (72 percent), and Cambodia (69 percent), the report said.

More than half (53 percent) of the US apparel importing companies, which participated in the survey, reported sourcing apparel from over ten countries in 2022, compared with only 37 percent in the previous year.

Reducing “China exposure” is one crucial driver of the US fashion companies’ sourcing diversification strategy and around 33 percent of companies stated that they sourced less than 10 percent of their apparel products from

China in 2022, the report stated. Also, around 50 percent of companies said that they sourced more garments and related products from Vietnam compared with China in 2022.

Beijing’s lockdown measures also negatively affected the US apparel sourcing from other Asian countries that rely on China’s textile raw material supply, such as Vietnam, the report added.

The US fashion industry continues to rely on global sourcing. In 2022, it sourced apparel from as many as 48 countries against 43 in 2021.

“Some Asian suppliers, notably China, lost the competitive advantage of ‘sourcing flexibility and agility’ in 2022. For example, respondents used to praise China’s unparalleled production capacity, which allowed the US fashion companies to enjoy more flexibility and agility (which included quickly adjusting the delivery, volume, and product of the sourcing order upon customers’ requests) when sourcing from the country,” stated the Fashion Industry Association report.

Source: https://www.khmertimeskh.com/501215015/us-fashion-firms-may-source-more-from-cambodia/

English

English