Thailand: Slow jab rates and economic risk

The recent acceleration of vaccinations in parts of Asia could reduce the risk of setbacks to economic recovery and public finances associated with further waves of the Covid-19 pandemic, provided that the pace is sustained, says Fitch Ratings.

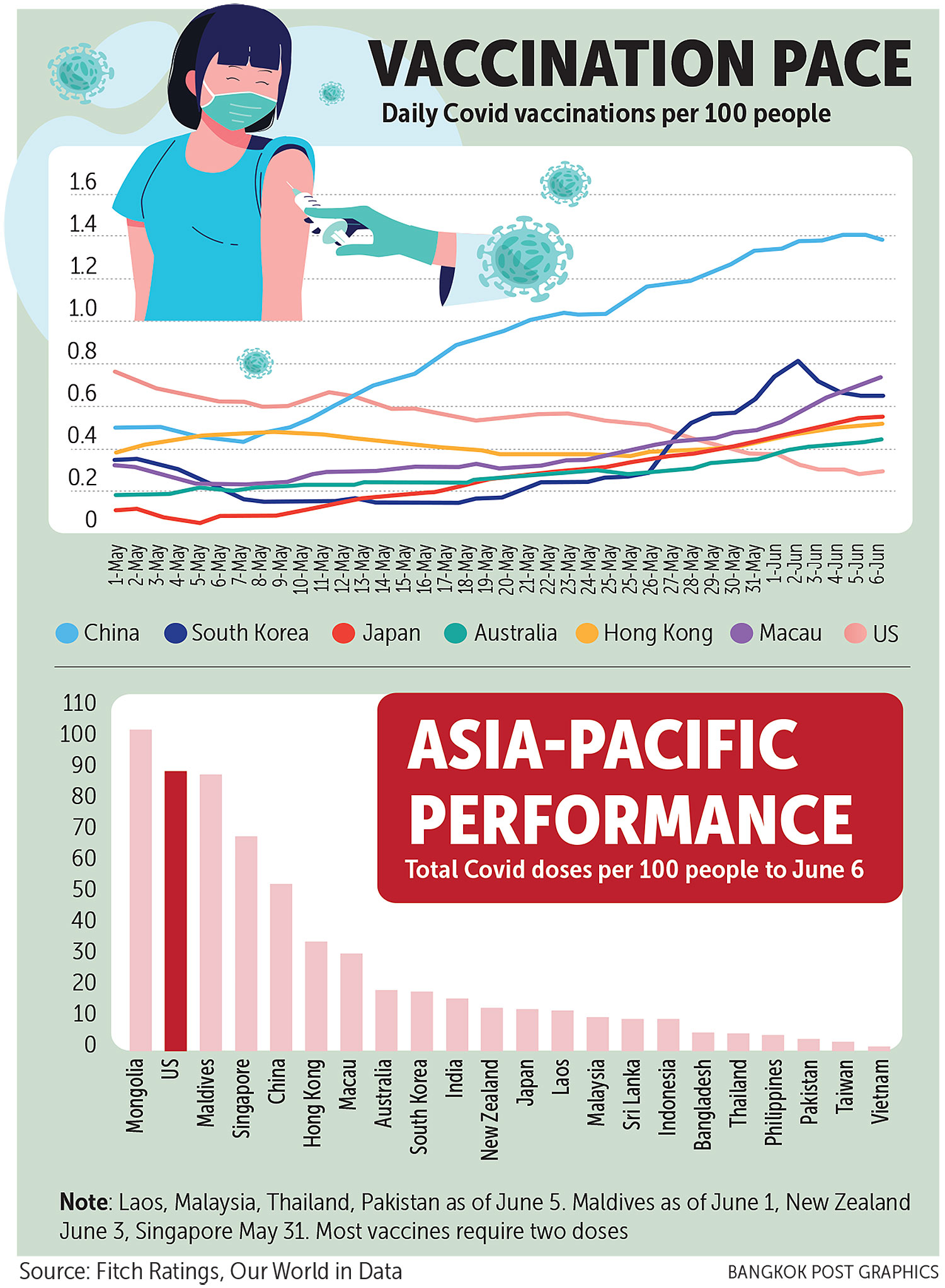

The Covid-containment response of the Asia-Pacific region was a relative global outperformer in 2020, but in 2021 its vaccine rollout has in aggregate lagged that of other regions, apart from Africa. The number of doses delivered relative to total populations remains low, compared with both the United States and with the levels necessary to achieve “herd immunity”.

Reasons for this vary. Some jurisdictions that had done well in containing the virus were slow to move on vaccine approvals and rollouts. Others have had difficulty procuring vaccine supplies, particularly where authorities did not prioritise this at an early stage.

Nevertheless, the pace of vaccination has begun to accelerate in recent weeks in several Fitch-rated economies in Asia, including China (with a sovereign rating of A+/Stable), South Korea (AA-/Stable), Japan (A/Negative), and Australia (AAA/Negative).

Vaccination rates remain very low in many other Asian nations, which could leave them exposed to pandemic setback risks. These were highlighted by an escalation of Covid infections in a number of locations in April and May.

Governments in India (BBB-/Negative), Japan and Malaysia (BBB+/Stable), Thailand (BBB+/Stable), Taiwan (AA-/Stable) and Vietnam (BB/Positive) all tightened restrictions on activity in response to new infections. There have also been recent outbreaks, albeit relatively small in terms of case numbers, in Guangdong province of China and the Australian state of Victoria.

The low rates of vaccination and outbreaks of new infections pose near-term downside risks to our economic growth forecasts, and could delay recoveries from the pandemic shock of 2020. However, relatively narrow applications of lockdowns, coupled with adjustments in societal and business behaviour, should help to cushion the economic impact.

Weaker economic outlooks may add to pressures on public finances, particularly where governments seek to offset the adverse effects of restrictions on the economy and households through fiscal stimulus packages. Thailand, Malaysia and Taiwan have all announced additional spending plans in the wake of their latest infection waves.

Medium-term public debt dynamics are a key consideration in our ratings assessments, particularly in countries such as Malaysia and India, where government debt levels to GDP are significantly higher than the median for BBB-rated peers.

There is a high degree of uncertainty over how quickly governments and societies will revert to pre-pandemic policies and behaviour as vaccination levels rise. The pace of recovery in travel will be particularly important where tourism was a key component of GDP prior to 2020, such as in Thailand and Sri Lanka (CCC), or the Maldives (CCC) where tourist inflows have recently picked up.

Pandemic setback risks may also linger even with relatively high rates of vaccination, given uncertainties about the efficacy against future new strains of Covid. Nonetheless, we anticipate jurisdictions with higher levels of vaccination will be better positioned for near-term recoveries than those where vaccination rates remain low.

Source: https://www.bangkokpost.com/business/2133203/slow-jab-rates-and-economic-risk

English

English