Thailand: NLA committee slashes draft land bill tax rates

The National Legislative Assembly’s (NLA) standing committee on the land and buildings tax has largely watered down the new property tax rates.

The version proposed by the Finance Ministry and approved by the cabinet had set the tax-free threshold at 50 million baht, with an aim at alleviating people’s tax burden.

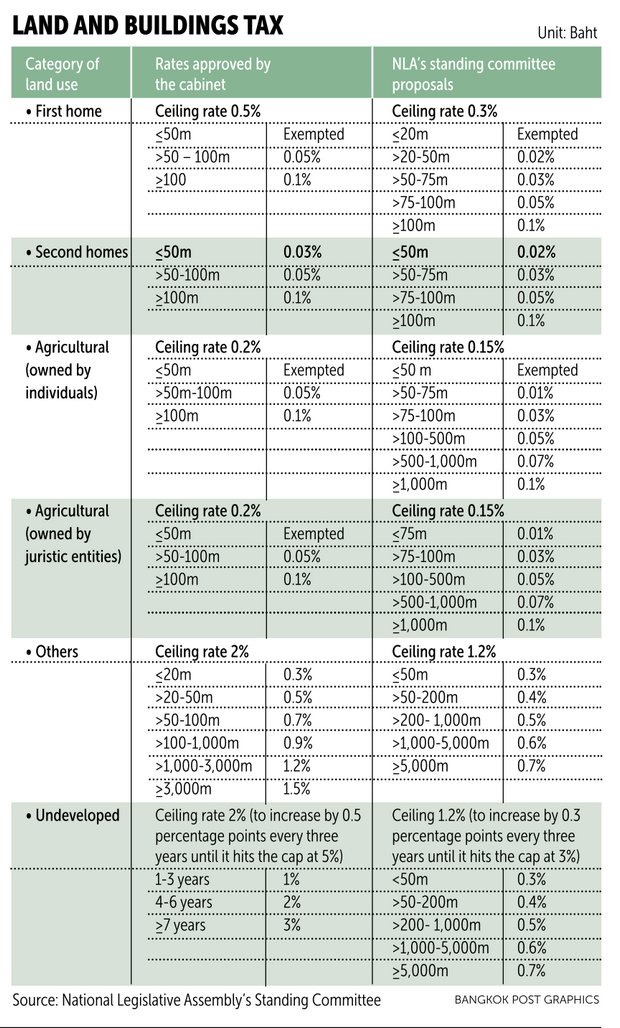

The NLA committee has proposed cutting the Finance Ministry’s proposed land and buildings tax’s ceiling rates by 40% in many instances, said Pornchai Thiraveja, a financial policy adviser to the Fiscal Policy Office.

The NLA’s proposal calls for a ceiling rate for homes of 0.3%, down from 0.5%; an agricultural use rate of 0.15%, down from 0.2%; and other use and undeveloped land at 1.2%, down from 2%.

The NLA’s version also proposes to trim the exemption ceiling for the first homes to 20 million baht from 50 million as proposed by the Finance Ministry. The committee’s proposal requires owners of first homes appraised at over 20 million to 50 million baht to pay a property tax rate of 0.02%, or 200 baht for every million baht that exceeds the exemption threshold, and 0.03% for houses valued over 50 million to 75 million baht, 0.05% for those more than 75 million to 100 million, and 0.1% for houses appraised at more than 100 million.

If building owners do not possess land but their names are registered in the household registry, starting from Jan 1, 2019, the tax-free threshold will be cut to 10 million baht, he said. (Continued below)

Second-home owners will be taxed 0.02% for property with appraisal value of up to 50 million baht, 0.03% for value of more than 50 million to 75 million, 0.05% for value of more than 75 million to 100 million and 0.1% for more than 100 million.

The draft bill proposed by the Finance Ministry called for the tax to be levied on first-home owners and farmland appraised at more than 50 million baht. A tax rate of 0.05% would be applied to first homes and agricultural land worth between 50 million and 100 million baht, and a 0.1% rate for homes above 100 million. People owning second homes would be taxed 0.03% for homes with appraisal value of no more than 50 million, 0.05% for value more than 50 million to 100 million and 0.1% for more than 100 million.

The draft bill on land and buildings tax is being vetted by the NLA standing committee after passing the first reading. According to the process, the draft needs the NLA’s approval for three readings before being sent back to the cabinet.

The new property tax, which will replace the outdated house and land tax and the local development tax, is expected to come into force from Jan 1, 2019.

Mr Pornchai said the NLA standing committee’s version also proposed the gradual implementation of the newer tax over the course of four years. The relief measures will apply to all landowners who are subject to larger tax burdens.

Owners of land and buildings will be allowed to gradually meet the increase in tax burden each year, with a 25% increase over four years.

Local administration organisations would be able to levy taxes at higher rates than those set by the government but must not exceed the ceilings.

Local bodies are required to seek approval from a committee on land and buildings tax in each province. In Bangkok, committee approval is not required.

Mr Pornchai estimates that local administration organisations will garner 37 billion baht annually from the land and buildings tax, based on the NLA’s standing committee version, up from 29-30 billion collected.

Despite a small increase from the land and buildings tax’s implementation in the initial stage, the tax income is expected to be raised in the future as the appraisal price is re-evaluated every 4-5 years, he said.

Sakon Varanyuwatana, an adviser to the NLA’s standing committee, said that the new proposal will help decentralise land ownership and lower market prices as those who hold land without utilisation will be subject to higher tax burden.

There is an estimated 1-2 million rai of undeveloped land.

Dussadee Suwatvitayakorn, a member of the NLA standing committee, said that those who are liable under the new property tax will be due to pay in April and those whose tax burden is over 9 billion baht will be able to pay in three installations.

Atip Bijanonda, director of the Thai Chamber of Commerce, said the recent tax rates for the Land and Buildings Tax Act proposed Tuesday by the NLA still had some complications regarding starting rates, ceiling rates, exemptions and deductions.

“For vacant land, the proposed ceiling rate is 3% as it aims to accelerate use of land as the NLA wants. But there are many kinds of vacant land. Some cannot be used as the tax is designed because they are located where land use is limited,” he said.

“Tax rates should be simple and easy to pay for everyone,” said Mr Atip.

“If appraisal prices can rise, the tax rate should not be raised.”

Source: https://property.bangkokpost.com/news/1382171/nla-committee-slashes-draft-land-bill-tax-rates

English

English