Thailand: Listed banks to see lower Q3 net profit on fee waiver

SET-listed banks are estimated to deliver lower quarter-on-quarter net profit for the third quarter but higher year-on-year earnings, say analysts, noting the waiver of transaction fees for digital banking dealt a blow to their fee-based income and net profits.

Ten listed banks covered by Phillip Securities Thailand are forecast to post a combined net profit of 53 billion baht for the three months through September, down 0.9% from the previous quarter, largely because of the decline in fee-based income after banks ended digital transaction fees from late March.

Thanachart Capital (TCAP) resuming paying the fully effective tax rate was expected to result in the decline in the quarter-on-quarter net profit, it said.

However, TCAP’s quarterly net profit likely surged 11.6% from a year earlier, thanks to lower impairment charges for credit loss and the higher interest income resulting from the increase in lending, the broker said in a note.

The 10 banks are Bangkok Bank (BBL), Siam Commercial Bank (SCB), Kasikornbank (KBank), Krungthai Bank (KTB), Bank of Ayudhya (BAY), TCAP, TMB Bank (TMB), Tisco Financial Group (Tisco), Kiatnakin Bank (KKP) and LH Financial Group (LHFG).

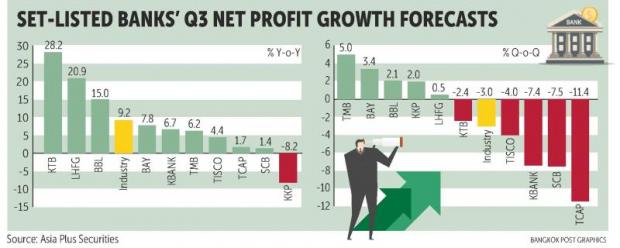

Phillip Securities predicted LHFG would be the best performer by year-on-year among its industry peers, rising 28.1% due mainly to the decline in loan-loss provision, while Tisco likely delivered the largest earnings growth from the previous quarter due to the surge in interest-based income.

Asia Plus Securities (ASP) forecast the 10 banks would post the third quarter earnings at 51.8 billion baht, down 3% from the second quarter but up 9.2% from a year earlier.

The transaction fee waiver over digital channels, and the softer profit from investments and foreign exchange business were likely blamed for the lower quarter-on-quarter net profit, the brokerage house said.

The 10 banks’ net interest margin (NIM) likely averaged at 3.09% for the third quarter, up slightly from the previous three months on the back of the higher yields from lending, it said.

SCB, KBank and Tisco were predicted to be in the same camp as TCAP. The lower fee-based income and high investment in information technology, albeit at quite a steady pace from the April-to-June quarter, took a bite out of SCB’s earnings.

KBank’s quarter-on-quarter net profit was likely hit by the decline in fee-based income and profit from investment, while Tisco was expected to be show lower NIM and fee-based income.

Tisco is expected to be the first bank that announced the third quarter net profit. It is due to release earnings on Thursday.

ASPS forecasts that TMB, BAY and KKP will likely outperform peers in light of the increase in their interest income in the second quarter.

The broker is optimistic that banks’ lending growth will continue into next year, given the ramped up state and private investment, while the upward interest rate trend is expected to come as a boon to bank’s NIM.

The study found that every quarter-point hike in interest rates will raise the banking sector’s net profit forecast for 2019 by 0.8 percentage points, it said.

Kasikorn Research Center (K-Research), a research house under KBank, estimated local commercial banks will record a 7.7% year-on-year increase in net profit to 48 billion baht.

However, the quarterly net profit was predicted to fall by 9.1% for the three months to June.

“This scenario reflects the pronounced effect of commercial banks’ fee cancellation for digital transactions compared with the previous quarter. Given the fee waiver, consumers have conducted more transactions via digital channels, causing a considerable contraction in fee income,” it said.

Concurrently, certain commercial banks have to focus on their provisions for loan losses amid non-performing loans (NPLs) that need more time to be resolved.

In the meantime, commercial banks still have to implement careful cost management strategies, in line with attempts to generate other types of income, including interest income (amid satisfactory loan growth) and other fee income, to sustain their profitability, K-Research said.

Apart from debt quality and adverse impacts from the fee cancellation policy, the other immediate issue is commercial banks’ management of other non-interest income, specifically the sales of investments that may help support the overall performance of Thai commercial banks in the quarter.

The Bank of Thailand’s recent measures to supervise the property sector may also affect home loans and the overall loan growth in the final quarter of this year, it said.

Source: https://www.bangkokpost.com/business/finance/1555202/listed-banks-to-see-lower-q3-net-profit-on-fee-waiver

English

English