Thailand: Central bank steps in to slow baht slide

The Bank of Thailand has moved to curb the baht’s rapid retreat against the greenback as the local currency hit a nine-month low.

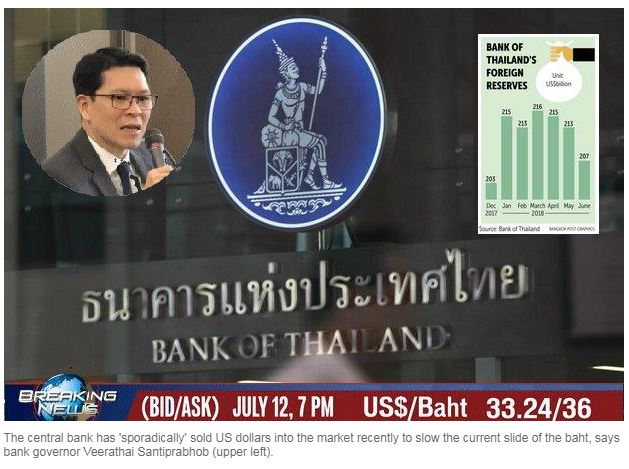

The central bank has sporadically taken action against the currency’s weakness by selling the US dollar to smooth out the baht’s movement after it depreciated at a faster pace, lowering foreign reserves, said Bank of Thailand governor Veerathai Santiprabhob.

He said the move is normal practice for the central bank.

The baht, which was the second-best performing currency in Asia last year, depreciated around 2% so far this year to 33.26 to the dollar, compared with an almost 7% decline in India’s rupee, a 6.5% weakness in the Philippines’ peso, a 5.8% drop in the Indonesian rupiah and almost a 5% fall in the Korean won.

Bank of Thailand data reported foreign reserves fell to US$215 billion (7.15 trillion baht) in April, $231 billion in May and $207 billion last month from $216 billion in March.

Capital outflows have been spotted in Thai shares and bonds over the past few months, accelerating recently as investors fret over the US Federal Reserve’s more hawkish stance on its monetary policy by signalling two more rate hikes this year, the European Central Bank’s plan to end its bond purchase by the year-end and the tit-for-tat trade tariffs between the US and China.

Mr Veerathai said it was the central bank’s duty to manage the baht for both upward and downward movement.

“We’ve prepared [built up foreign reserves] over the past two years,” he said.

The lower foreign reserves could also be attributed to other foreign currencies’ retreat against the dollar, as the Bank of Thailand typically allocates money into several major currencies for risk management and portfolio diversification purposes, he said.

“We’ve forecast that global uncertainties, especially monetary policy manoeuvring by major central banks, would have an impact on the country’s offshore capital flows and local currencies. We’ve prepared sound international reserves to cushion against any shocks,” he said.

The Thai economy has adequate buffers to withstand any immediate challenges, with ample international reserves covering 3.5 times short-term external debts; low dependency on external borrowing; and current account surplus of around 8-9% of GDP, he said.

Moreover, local banking sector is robust, with high capital adequacy ratio and stable domestic funding.

For the January-to-March quarter, the capital adequacy ratio of the banking system averaged 18%, among the highest in the region.

Mr Veerathai said the Sino-US trade spat has not yet had an impact on the country’s exports as increased tariffs have been imposed on some industries and goods that do not directly harm Thailand, but an impact on the country’s manufacturing supply chains is expected.

In the meantime, the incumbent governor said on the sidelines after the 2018 Asean business summit held by Bloomberg on Thursday that the Bank of Thailand is collaborating with other central banks to develop a regional financial system.

The cooperation spans several areas, including promoting regional currency use to facilitate higher Asean intra-trade.

Qualified Asean Bank (QAB) is another key policy regional central banks are collaborating on. The Bank of Thailand made its first Heads of Agreement on a reciprocal bilateral arrangement regarding QAB with Bank Negara Malaysia in March 2016. The bilateral arrangement is part of an umbrella agreement for the 10-member bloc called the Asean Banking Integration Framework, which provides greater access for indigenous Asean banks to other members’ banking sectors, as well as operational flexibility on a reciprocal basis.

Source: https://www.bangkokpost.com/business/finance/1502314/central-bank-steps-in-to-slow-baht-slide

English

English