SET plans CLMV stock trade

The Stock Exchange of Thailand (SET) plans to set up a new equity market to trade stocks from neighbouring countries as these stocks have good growth potential based on buoyant economic growth in Southeast Asia.

These neighbouring countries are Cambodia, Laos, Myanmar, and Vietnam (CLMV). The first three countries have many large caps and interesting stocks with good growth potential, said SET senior executive vice-president Pakorn Peetathawatchai.

These stocks cannot list on the SET index, mainly because of differences in the auditing process and banking regulations between Thailand and CLMV countries, said SET senior executive vice-president Santi Kiranand.

The SET, the Securities and Exchange Commission, and all relevant market regulators of CLMV stock exchanges have studied the plan together, with trading expected to commence in three years.

He said the SET will also launch a CLMV index calculated from SET listed firms having revenue related from their businesses in CLMV countries. The index is expected to be launched in the middle of this year.

“It is not only stocks, as depository receipts can also be listed on the CLMV index,” said Mr Pakorn.

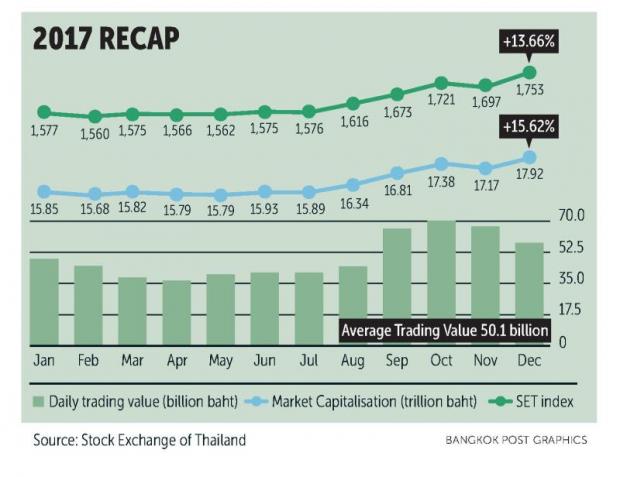

Mr Santi said the bourse has a target to increase market capitalisation to around 550 billion baht in 2018, of which 250 billion baht will come from newly listed firms, whereby there are IPOs in the pipeline worth 220 billion baht.

The remaining sum will be derived from how existing listed firms raise capital and share price increases, said Mr Santi.

The target for IPOs this year excludes the much-touted Thailand Future Fund.

Mr Santi the SET also plans to use the caution symbol (C) for stocks that are considered a risk for investment, have received no opinion from an auditor on financial statements, and shareholders’ equities are reduced to 50%. The C sign will be effective on May 2018.

Mr Santi said the SET plans to open the LIVE platform, the trading platform for startup stocks, in the second quarter and will set up the Corporate Venture Capital (CVC), the venture capital initiated by the SET.

The SET will invest 1 billion baht in the fund and the bourse will set up a professional management team to oversee the startup project, which is expected to start the investment process by the end of this year.

SET president Kesara Manchusree said that the SET also plans to implement T+2, a clearing and settlement period of two days, from the current three days (T+3) on March 2.

Other new infrastructures that will start this year include the FundConnext and Settrade Streaming or Fund, which are real-time fund trading platforms, will become effective this year, said Mrs Kesara.

As the process of the SET operation restructuring will be separated into the exchange function and the capital market development, the process remains under consideration by the Ministry of Finance, she said.

Once the Finance Ministry gives its approval, the process will be forwarded for cabinet consideration and later pass onto the National Legislative Council to approve the amendment, said SET chairman Chaiyawat Wibulswasdi.

Source: https://www.bangkokpost.com/business/finance/1392498/set-plans-clmv-stock-trade#cxrecs_s

English

English