Record FDI outflow from emerging markets could leave Cambodia exposed

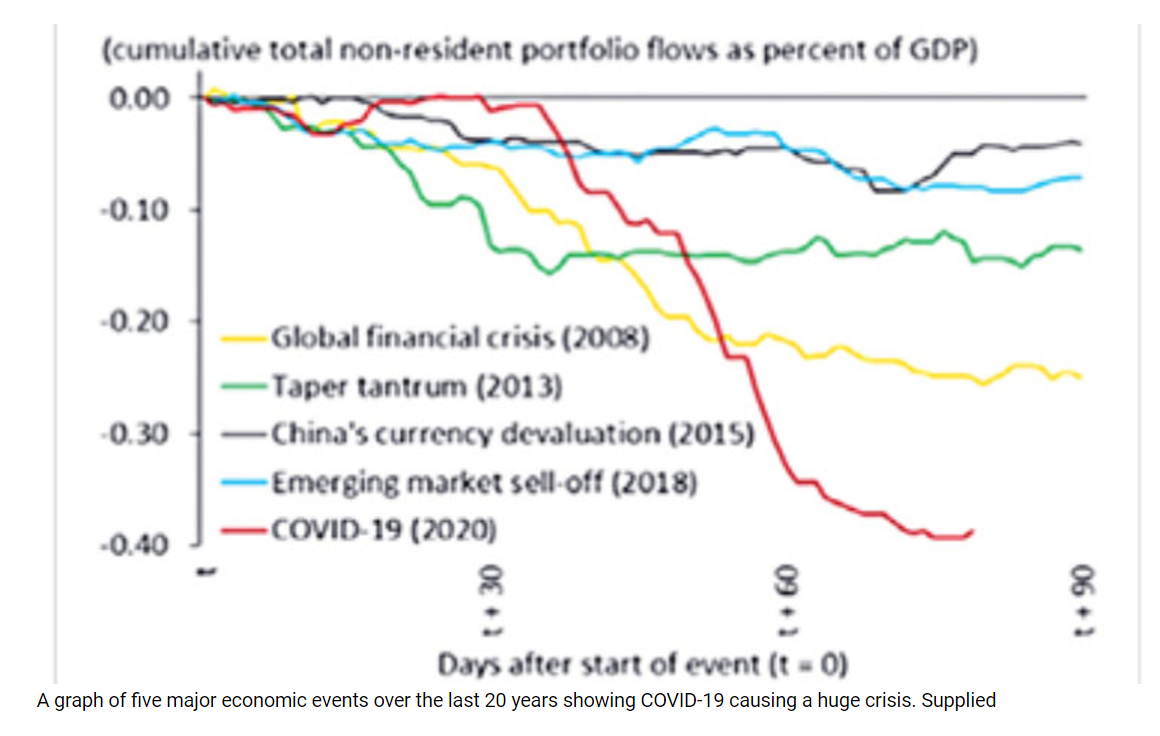

The outflow of Foreign Direct Investment (FDI) from emerging market economies – such as Cambodia – have been recorded at their greatest levels in recent history, according to data collated by the International Monetary Fund (IMF).

The impact has been attributed to the adverse effects on financial markets, consumption, investment confidence, international trade and weakened commo- dity prices from the impact of extreme COVID-19 health measures.

So far, during the COVID-19 pandemic, FDI outflow from emerging markets has been almost twice as high than the now second-worst FDI withdrawal during the Global Financial Crisis in 2007/8.

FDI is defined as an investment made by a non-resident individual, company or government arm into the local economy and is considered to be a major driver for economic growth in emerging economies.

Economists consider this extreme drop could pose a serious risk for Cambodia because the withdrawal of large and sudden amounts of capital can cause liquidity concerns for both the central bank and large corporations, as well as affecting the country’s potential for growth through a lack of generated jobs and lower export potential.

Over the past few years Cambodia has been attracting record levels of FDI inflows, predominantly from China, with investment concentrated in the manufacturing

and services sector, plus the development of special economic zones throughout the country, providing much-needed funding for two of the Kingdom’s economic pillars: garment manufacturing and real estate construction.

In response to liquidity concerns, the Kingdom’s central bank – the National Bank of Cambodia (NBC) – has implemented a series of economic measures to improve liquidity in the market.

Amendments have included removing the capital conservation buffer, cutting interest rates and decreasing banks fund costs, reducing the collateral needed by lenders to encourage banks to disburse loans and lowering required reserves that banking and financial institutions must maintain at the NBC both for local currency (riel) and foreign currencies.

However,these measurements have been limited in their monetary effectiveness because of the Kingdom’s high level of doll- arisation as outlined by previous comments made by the NBC.

“While the NBC has implemented measures, its efficiency and effectiveness are limited. This is because the NBC only has access to lower interest rates effective on riels and, of course,

cannot have influence over US-issued dollars,” NBC Director-General Chea Serey said.

On a positive note, while emerging economies are typically defined as having high levels of external debt, according to an IMF report, Cambodia’s debt-carrying capacity had improved from “medium” in 2018 to “strong” in 2019, recording a relatively low external debt to GDP ratio of 28.5 percent.

While Cambodia may be in a better position than other emerging economies to weather this crisis, there is no doubt that much-needed FDI will become limited as developed and established economies take time to recover from this unprecedented global health and economic crisis.

Cambodia attracted more than $3.588 billion of FDI during 2019, up 11.7 percent from $3.212 billion in 2018. Chinese investment accounts for 43 percent, South Korea for 11 percent, Vietnam for 7 percent, Japan and Singapore for 6 percent each and other countries 27 percent, according to the Macroeconomic and Banking Progress 2019 Report and 2020 Outlook.

The report also expected FDI to grow a further 10 percent in 2020 to $3.951 billion, however, because of the current climate, this figure is sure to be revised down.

Source: https://www.khmertimeskh.com/50715485/record-fdi-outflow-from-emerging-markets-could-leave-cambodia-exposed/

English

English