Philippines: Understanding Taxation of 13th Month Pay and Christmas Bonuses in the Philippines

With the Christmas season and year-end fast approaching, annual issues surrounding 13thmonth pay and Christmas bonuses in the Philippines raise their head once again. One key topic that often prompts questions is the distinction between 13th month pay and Christmas bonuses, also known as a year-end bonuses, and the tax rules surrounding them. Though the two systems of bonus payments are distinct, they can interact to create diverse tax outcomes. Effectively optimizing bonus structures not only reduces employers’ overall tax burden, but also fosters an environment in which employees are rewarded for their labor and given incentives for strong productivity.

Distinction between 13th month pay and Christmas bonuses

Due in part to the fact that 13th month pay and Christmas bonuses more or less coincide in their timing, there is often confusion over how the two are different. The key distinction between 13th month pay and Christmas bonuses is that the former is mandatory by law for all ‘rank-and file employees’ (i.e. non-managers), whereas the latter is at the discretion of the employer. Employees excluded from 13thmonth pay fall into the following categories:

- Managers;

- Employees covered by civil service law;

- Housekeepers and persons in the personal service of another; and

- Employees paid on purely commission, boundary, or task basis.

13th month pay can be calculated as one twelfth (1/12) of the basic salary of the employee within one calendar year. Alternatively, if the employee is paid on a monthly basis, the following equation can be used:

(Basic Monthly Salary x Number of Months Worked) / 12

There is no legally set amount for Christmas bonuses. However, if a set level of bonus can be judged by a court to have become ‘company practice’, the court can rule that the Christmas bonus can no longer be withdrawn. Despite this, there is no specific rule determining how many years constitutes ‘company practice’.

The final distinction is that 13th month pay must be paid on or before December 24th each year. It has become common for employers to pay half at the beginning of the school year and half during the run up to Christmas. In contrast, there is no set date for Christmas bonuses to be paid; as with the amount, it is at the discretion of the employer to decide.

Taxation of 13th month pay

13th month pay is exempt from tax, up to a limit. In 2015, this limit was raised to PHP 82,000. If 13thmonth pay exceeds this limit, the excess will be added to the salary of the employee and included in the income tax calculation.

Taxation of Christmas bonuses

Taxation of Christmas bonuses must be split into two parts: non-performance based bonuses (also known as ‘Other Benefits’) and performance-based incentives.

Taxation of ‘Other Benefits’

‘Other Benefits’ fall into the same category as 13th month pay and are subject to the same PHP 82,000 limit. In other words, if ‘Other Benefits’ and 13th month pay combined total less than PHP 82,000, no tax needs to be paid. If the combination of ‘Other Benefits’ and 13th month pay exceeds the limit, the excess will be subject to income tax.

Taxation of performance-based incentives

Collective Bargaining Agreements (CBAs) and productivity incentive schemes are subject to a PHP 10,000 tax-free limit. If the performance-based bonus exceeds PHP 10,000, the whole amount (not just the excess) will be counted as ‘Other Benefits’ and included in the PHP 82,000 tax-free limit. Any excess over PHP 82,000 will be taxable. If ‘Other Benefits’ (13th month pay and non-performance based incentives) already exceed the tax free limit, the performance based incentives will automatically be subject to normal income tax. For example:

- An employee earns PHP 10,000 in performance related incentives – no tax is payable on this bonus.

- An employee earns PHP 15,000 in performance related incentives, as well as PHP 20,000 in ‘Other Benefits’ – no tax is payable.

- An employee earns PHP 20,000 in performance related incentives, as well as PHP 80,000 in ‘Other Benefits’ – tax is payable on the PHP 18,000 excess (20,000 + 80,000 – 82,000).

- An employee earns PHP 30,000 in performance related incentives, as well as PHP 100,000 in ‘Other Benefits’ – tax is payable on the PHP 30,000 bonus, and the PHP 18,000 excess.

Optimizing employee bonuses

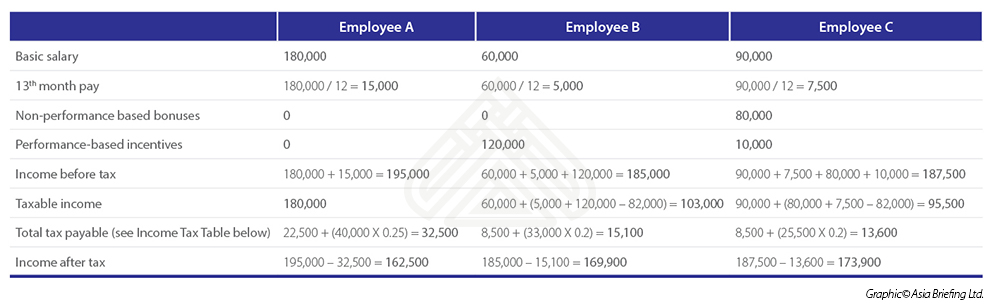

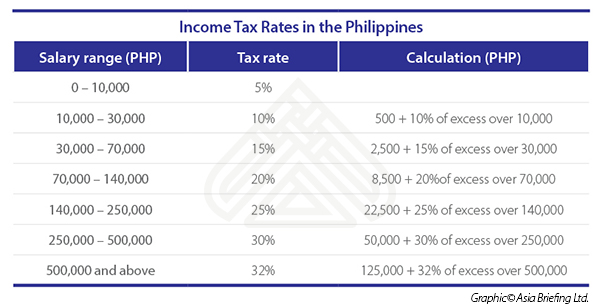

The following table shows three examples of employees with similar overall earnings before tax but different income structures (click to enlarge). All values are in Philippine Pesos and social security and other such payments have been excluded. A table outlining income tax rates can be found at the end of this article for reference.

Despite having a significantly higher income before tax, Employee A ends up taking home the smallest paycheck after tax is deducted. Conversely, Employee C has half the basic salary of Employee A, but uses the tax exemption on bonuses to its fullest; this results in over PHP 10,000 extra income after tax. Further, Employee B highlights that incentive and commission-based structures can lower costs for employers, without dramatically affecting the employee’s post-tax earnings.

The examples above show that it is important to use tax-free allowances wisely when structuring employee payments. Employers should consider using bonuses, both performance based and non-performance based, to maximize employees’ take-home salary and, hence, satisfaction. Furthermore, this may be the final year that such tax-free bonuses are available, as discussions have taken place to remove the exemptions. The revocation has yet to be confirmed, so employers should take advantage of these tax rules while they still can.

Source: http://www.aseanbriefing.com/news/2016/12/20/understanding-taxation-of-13th-month-pay-and-christmas-bonuses-in-the-philippines.html

English

English