Oil importer Philippines is sitting in a lot of fuel

MANILA, Philippines — Large stocks of oil are sitting idly in the country’s storage facilities with nowhere to go as nationwide and localized lockdowns crippled demand for fuel, triggering an unlikely problem in one of Southeast Asia’s top oil importers.

While beneficial for the Philippine economy as a whole, an oil price slump is fanning concerns at the energy department oil firms may need some state support if community quarantines that halted public transport continue and fuel demand remains tepid. This is a scenario outrightly rejected by the finance department.

“There is no supply problem. What we have is a price problem and companies say they are doing everything to absorb and manage losses,” said Rino Abad, director of the energy department’s oil industry management bureau.

“The second layer of financial support is for companies to use their retained earnings to absorb losses. If not, we would have to tell them to have access to a credit line. We are really trying to delay a bailout because that would be too costly,” he explained.

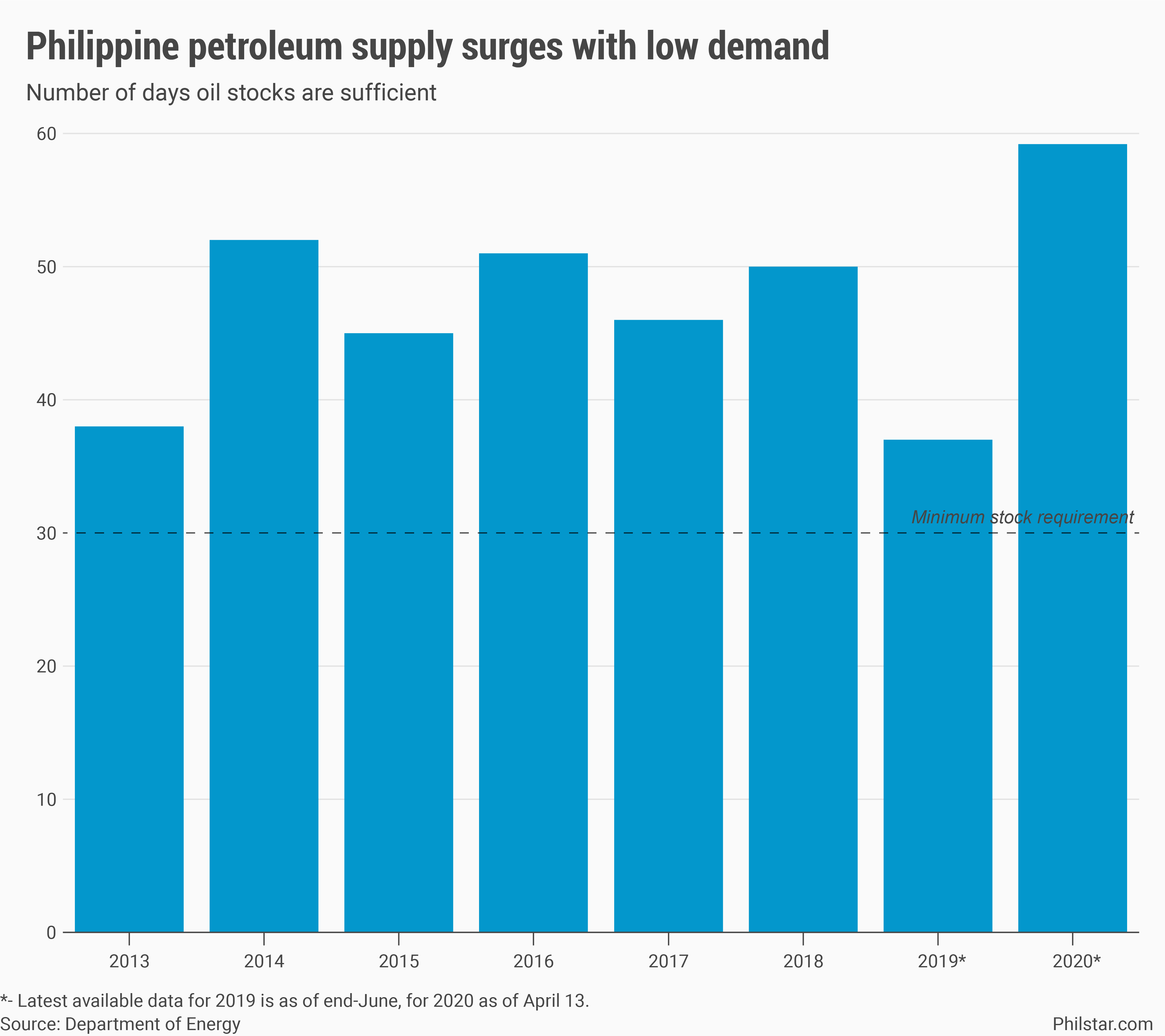

As of April 13, 3.4 billion liters of oil are stocked up in the country’s 133 depots, refineries and storage facilities, filling up 58.6% of 5.8-billion-liter capacity. Facilities may not be completely filled up, however, as companies have tapered off imports starting March when diesel and gasoline shipments dropped 67.2% and 63.2%, respectively.

But the lower import bill is getting offset by rising inventory costs as the country’s oil stockpile reached nearly twice the minimum level required of 30 days sufficiency. Retail oil prices were slashed by P14.52 per liter as of April 10 for gasoline, P13.94 for diesel and nearly P20 per liter of kerosene, energy data showed.

Investors have dumped some stocks of major oil firms Petron Corp. and Pilipinas Shell Petroleum Corp. since March, as Abad said the government expects Asian oil benchmarks to follow the slump in US oil prices. Despite this, regional oil prices are unlikely to reach negative territory like in the US since oil-rich Gulf nations already agreed to a supply cut.

Fernando Martinez, president of the Independent Philippine Petroleum Companies Association, an industry group, declined to comment on how oil firms are managing their ballooning supply. Shell declined to comment, while Petron have not responded to request for comment as of this posting.

“With the current price of oil, we think oil companies can still finance their unavoidable costs like maintenance of facilities, security and other overhead costs. But if the slump persists, we do not know. Oil firms do not share with us this information because they said it’s confidential,” Abad said.

Nicky Franco, research head at brokerage Abacus Securities Corp., said losses are inevitable. “There is some effect on carrying costs on the balance sheet. Working capital and short-term debt might be significantly higher for several months or quarters depending on how long travel restrictions are in place,” he said in an online exchange.

In a Viber message, Finance Secretary Carlos Dominguez III shot down any direct government rescue for big firms, including petroleum players, saying he would instead ask the central bank “to help the banks that help” these companies secure credit.

Subsidies were instead directed to employees of the oil sector through the finance department’s P50.8-billion aid program for workers of small enterprises, Finance Undersecretary Gil Beltran said. Petron, Shell, and Chevron Philippines Inc. alone, the so-called big-three players, employ around 50,000 employees on their retail outlets.

“This is a temporary problem and they will recover,” Beltran said in a phone interview.

Source: https://www.philstar.com/business/2020/04/22/2009044/oil-importer-philippines-sitting-lot-fuel

English

English