Malaysia’s Next Rate Move Is Too Close to Call

(Bloomberg) — Economists are almost evenly split on whether Malaysia’s central bank will hold or hike interest rates on Thursday, amid looming risks to inflation and slowing global growth.

Eleven of the 20 economists surveyed by Bloomberg expect Bank Negara Malaysia to stand pat for a third straight meeting, while the remaining see the Overnight Policy Rate lifted by 25 basis points to 3%.

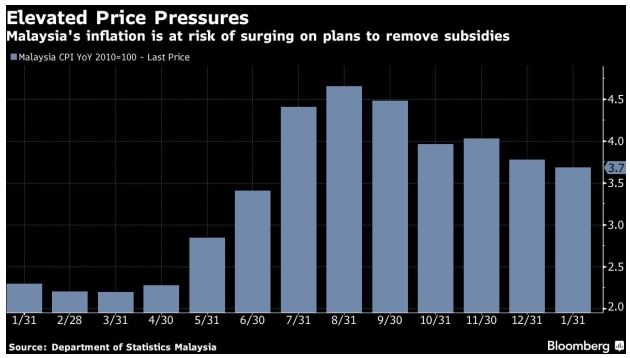

The mixed views reflect the central bank’s quandary under the new government. Malaysia’s growth slumped last quarter and is set to moderate in 2023. At the same time, price pressures — already elevated — could spike due to Prime Minister Anwar Ibrahim’s plans to reduce subsidies to check the government’s ballooning debt.

To be sure, the government’s stance on price controls remains cautious, and a date hasn’t been set yet on removing fuel subsidies for the rich — a move that the Finance Ministry said could save the administration up to 17 billion ringgit ($3.8 billion). Without “major surprises on domestic growth or inflation,” BNM is unlikely to hike rates on Thursday after such a brief pause, Maybank Securities economists Winson Phoon and Se Tho Mun Yi wrote in a note Monday.

Analysts at RHB Bank Bhd. see things differently. BNM has three main reasons to hike by a quarter basis point on Thursday, Chin Yee Sian and Wong Xian Yong wrote in a note Friday. These are: elevated core inflation, the nominal effective exchange rate’s downward trajectory, and rising risks the government will announce targeted fuel subsidies and new taxes, they wrote.

What’s clearer is that Malaysia still has scope to hike rates this year, if not on Thursday. Anwar last month expressed confidence that gross domestic product will exceed the revised official forecast of 4.5%, driven by measures in the 2023 budget and renewed confidence among international investors. The government recently announced investment from Tesla Inc. and Amazon Web Services, which is set to create jobs and further lift Malaysia’s outlook.

What Bloomberg Economics Says…

Looking ahead, the government’s tax cut for middle income households will support consumption this year, along with its social support measures. China’s reopening and relatively firm commodity prices will underpin exports.

— Tamara Mast Henderson, Asean Economist

For the full note, click here

Source: https://www.bnnbloomberg.ca/malaysia-s-next-rate-move-is-too-close-to-call-1.1892932

English

English