Malaysia: Spotlight on banks’ provisions

PETALING JAYA: All eyes continue to be focused on the provisions made by the banking sector as the earnings season for the second quarter of 2020 comes to a close.

There are expectations that the banking and lending sector should increase its provisions as a precautionary measure as the fallout from the Covid-19 pandemic continues.

The view is that the movement control order, now extended to Dec 31 as a result of the pandemic, is expected to further impact the overall economy and job market.

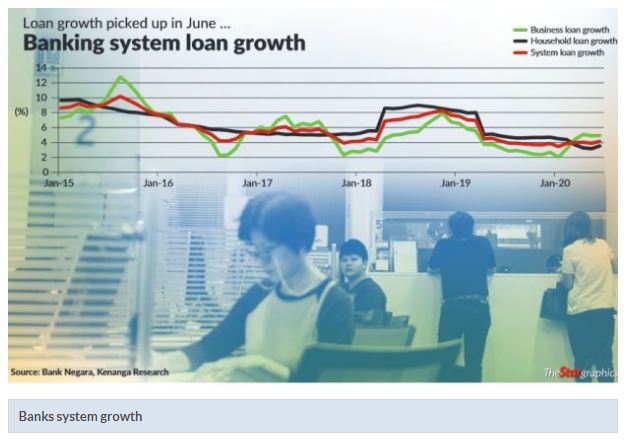

The most recent banking statistics released by Bank Negara for the month of June saw impairments rising slightly from the previous month by 1.1%.

The month of May saw total provisions for the whole banking sector increasing by 3.5% month-on-month to RM844mil.

In its recent report, Kenanga Research said banks earnings remain uncertain and volatile while the path to recovery is unlikely to be clear cut.

It expects the most recent banking statistics to suggest that pre-emptive loan provisioning may see an acceleration in the second quarter period.

“The reopening of the economy and significant cuts to the overnight policy rate have helped to clear some overhang for the sector.

“Also, the day one modification losses may not be as bad as feared, ” Kenanga Research said. This impact of heightened provisions is seen in Malayan Banking Bhd (Maybank), the biggest bank in the country, as its net profit fell to RM941.73mil in the second quarter from RM1.94bil a year ago due to these provisions. Maybank recorded impairment losses for the quarter of some RM1.74bil.

(Maybank), the biggest bank in the country, as its net profit fell to RM941.73mil in the second quarter from RM1.94bil a year ago due to these provisions. Maybank recorded impairment losses for the quarter of some RM1.74bil.

This is a big rise from RM391.64mil recorded in the same quarter a year ago, according to its announcement to Bursa Malaysia.

“Maybank’s net profit for the first half declined 20.2% year-on-year (y-o-y) due to ballooned provisions.

“Net impairment losses increased more than 100% with the bulk of it coming in the second quarter, ” MIDF Research said in its report.

It said that Maybank’s higher provisions were due to additional provisioning on macroeconomic variable adjustments and management overlays which amounted to about RM500mil and RM1bil, respectively.

“The management overlay was for specific business and corporate borrowers in home markets displaying weakness, ” MIDF Research said.

“While we believe that the Group had been prudent to increase its provision levels, we are concern that it is not over. Our concern stems from the lack of visibility of the situation post the loans moratorium period, ” it added. It is maintaining a neutral call on Maybank at a target price of RM7.90.

MIDF is expecting Maybank’s credit costs to remain elevated and this may spill over into the financial year 2021 as the latter’s management has maintained a net credit cost guidance of 75 basis points (bps) to 100 bps.

Meanwhile, Alliance Bank Malaysia Bhd, the smallest bank in Malaysia reported a rise in net profit which surprised some analysts.

Alliance Bank reported a net profit of RM104mil for the first quarter ending March 31 for financial year 2021. This is +36% YoY and +6% quarter-on-quarter, which was above our expectations but which is in line with consensus, at 34%/26% of our respective forecasts, ” Maybank Research said.

“The variance to ours was primarily due to much stronger investment income during the quarter as well as lower-than-expected expenses, ” it added.

It noted that Alliance Bank’s gross impaired loans ratio was a lower 1.89% as at end-June compared to 2% end-Mar 2020 while loan loss coverage was decent at 102.6% as at end-June.

“Credit costs remained elevated at 87 bps in the first quarter of FY21 versus 90 bps in the previous quarter, as the group put through a hefty 54 bps worth of pre-emptive provisions, ” Maybank Research said.

Maybank Research had raised Alliance Bank’s FY21/22/23 earnings forecasts by 14%/12%/11% respectively to mainly factor in lower operating expenses.

It upgraded its call to a hold with a target price of RM2.20.

Source: https://www.thestar.com.my/business/business-news/2020/08/31/spotlight-on-banks-provisions

English

English