Malaysia: Inflationary pressures remain on challenges

PETALING JAYA: While inflationary pressures seem to have eased based on the latest consumer price index (CPI) figures, economists are not discounting the fact that headline inflation may pick up in the coming quarters.

Speaking with StarBiz, AmBank Research Group chief economist and member of the Economic Action Council Secretariat Anthony Dass attributed the uptick in inflation to external and domestic headwinds.

External headwinds such as escalating geopolitical tensions and trade blocks would likely have an impact on prices. Such events could result in supply disruptions, thus pushing up prices, and could also impact the ringgit where the US dollar becomes more favourable, and hence fuelling imported inflation.

On the domestic side, upside pressure could come from the higher minimum wage, impact from the labour shortage and higher input costs, he added.

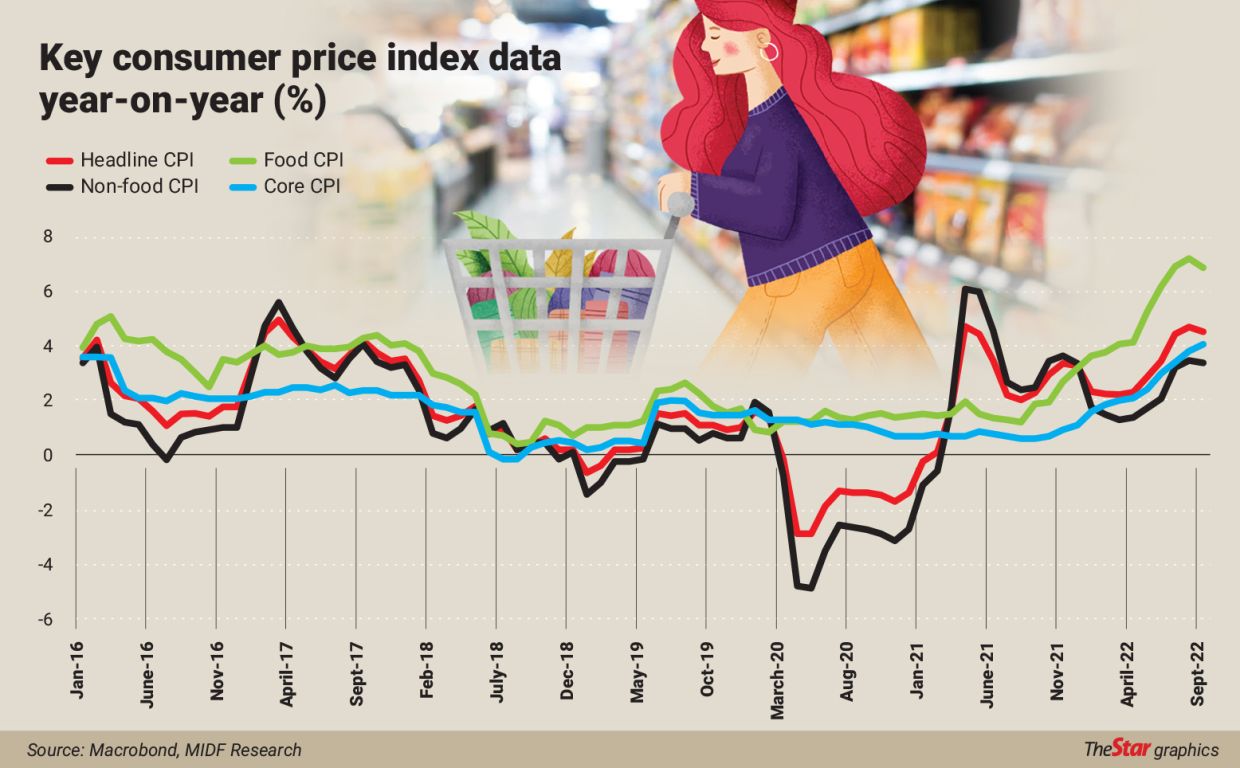

Malaysia’s headline inflation rate rose 4.5% year-on-year (y-o-y) in September this year, compared with 4.7% in August.

The increase in the consumer price index (CPI) was less than the 4.6% growth forecast by 16 economists in a recent Reuters poll.

The faster-than-expected abatement was primarily due to the lower prices of food, non-subsidised fuels and the maintenance and repair of dwellings despite a weaker currency and year-ago low base effects.

The core inflation rate touched its new peak 4% y-o-y in September. And on a sequential month basis, core prices still recorded a growth of 0.3% month-on-month (m-o-m).

Headline inflation, as measured by the CPI, takes into account the whole basket of goods and services produced in a country for a specific period. Core inflation, on the other hand, excludes items such as food and energy (ie, petrol) due to the volatility of their prices.

According to Dass, “Inflationary pressure still remains driven by cost pressures coming from higher freight charges, labour costs, materials and other input costs, as well as the weak ringgit which adds on to the import bill.

“But with the improving global supply chain, freight chargers plus global commodity prices are gradually improving, and that should potentially ease some pressure on the cost side.

“Besides, the mismatch between supply and demand that once added strong pressure on prices is expected to be rebalanced,” he noted.

In addition to the slower global outlook and a moderate domestic economic growth in 2023, plus expectations of a strong ringgit driven by the weaker dollar, all these points to a correction in prices.

On that note inflation in 2022 is likely to be at the toppish level of 3.2% but is expected to ease to 2.5% in 2023.

Economist Geoffrey Williams said the inflation numbers showed us what happened in the past, not what would happen in the future.

“We are seeing many input costs falling, including transport and logistics costs and wholesale food production costs. So, this should help inflationary pressures ease.

“However, there is now a general rise in prices and embedded inflationary expectations made worse by government spending.

“So, we have moved from a period of specific price rises in oil, food and utilities into a world of general price rises and these are passed on to consumers in uncompetitive markets,” he added.

Williams, who is an economics professor at Malaysia University of Science and Technology or MUST, expects inflation to have peaked in the final quarter of the year and would fall to 3% to 3.5% for the full year.

For 2023, he said with the extra pre-15th General Election (GE15) government spending and the prospect of removing subsidies too fast, there would be higher inflationary pressure.

“The removal of subsidies will also push inflation if it happens too quickly without the supply-side reforms necessary to improve competition, productivity and business growth.”

Williams said the 8.9% gross domestic product (GDP) growth in the second quarter (2Q22) and the forecast above 10% growth for 3Q22 is not sustainable and puts pressure on inflation.

The pre-election spending is also likely to push inflation next year, as higher demand on the supply-side is still very constrained due to the lack of reforms. This raises the prospect of a rise in the overnight policy rate this year, he said.

Meanwhile, MIDF Research said in the environment of elevated global commodity prices, inflationary pressure in the country is affected by higher food inflation.

It expects food price growth to record 5.5% this year, among others, attributed by further depreciation of the ringgit against the greenback. As for the fuel subsidy, it believes the government would maintain the current mechanism at least until the year-end.

With domestic demand firming, we upgrade our headline CPI forecast slightly by 0.2% point to 3% for 2022, the research house said.

“Moving into 2023, supply-push factors on inflation are expected to soften, among others, underpinned by the appreciation of the greenback against the ringgit, the moderation in food prices, the further easing in global supply chain pressures and lower commodity prices.

“However, Malaysia’s inflation outlook remains cloudy for next year, awaiting the post-GE15 government’s approach on the fuel-subsidy mechanism.

“If the new government keeps the status quo on the fuel subsidy, hence headline inflation will hover between 2.3% and 2.5% for 2023.

“If the subsidy mechanism is abolished entirely, headline inflation could touch 10% while a gradual increase in domestic retail fuel prices would result in 4%-5% for next year,” MIDF said.

Source: https://www.thestar.com.my/business/business-news/2022/10/31/inflationary-pressures-remain-on-challenges

English

English