Malaysia: Economy grows 4.5% in first quarter

KUALA LUMPUR: Malaysia’s economy performed above expectations in the first quarter of 2019 (1Q19) and the country’s foreign investments staged a strong improvement, amid elevated external challenges. However, despite these positive developments, more warnings signs on the economy have begun to crop up.

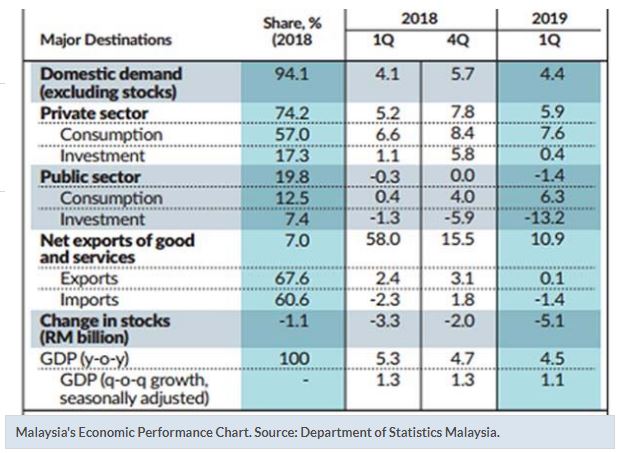

The country’s gross domestic product (GDP) grew 4.5% year-on-year (y-o-y) in the first quarter, even as all economic sectors except agriculture recorded either a slower growth or a contraction. A poll by Bloomberg earlier among 22 economists expected a median GDP growth of 4.3% for the January-to-March period.

While Bank Negara governor Datuk Nor Shamsiah Mohd Yunus described the first-quarter growth as “commendable”, the country’s domestic investment performance has come under scrutiny.

Private investment growth fell to a multi-quarter low in the first quarter, as it grew by only 0.4% y-o-y. In comparison, the country’s private investment expanded by 1.1% in 1Q18 and 5.8% in 4Q18.

The major reasons for the slump in private investment activities were the heightened uncertainty surrounding global trade negotiations and the prevailing weakness in the broad property segment.

Meanwhile, public sector investment continued to contract for the sixth consecutive quarter, as it fell 13.2% in 1Q19 (4Q18: -5.9%), caused by lower capital spending by the federal government and public corporations.

As a result of the weaker private and public sector investment, the country’s gross fixed capital formation (GFCF), which is an important indicator for investment, contracted for the first time since the 2008 global financial crisis.

Bank Negara said that the GFCF contracted by 3.5% in 1Q19 after registering a slower growth of 0.6% in 4Q18.

“By type of assets, investment in structures declined by 1.3% amid subdued property market activity. Capital expenditure on machinery and equipment registered a larger contraction of 7.4%, affected mainly by a decline in transport equipment spending.

“Investment in other types of assets also declined 2.2%, due mainly to lower research and development spending,” said the central bank in its latest quarterly bulletin.

Socio-Economic Research Centre (SERC) executive director Lee Heng Guie told StarBiz that the subdued private investment growth warrants urgent policy attention to rejuvenate its momentum.

“The time has come to draw a National Investment Policy Framework to look into the underlying issues and calibrate initiatives to drive private investment, especially domestic investment.

“The issues to investigate include the cost of doing business, incentives and tax system, economic and investment prospects and the cost of capital and returns, among others,” he said.

Despite the weak domestic private investment trend on the back of moderating business sentiment, Malaysia recorded a strong surge in foreign direct investment (FDI) in the first quarter.

In 1Q19, the FDI flows amounted to RM21.7bil, with advanced economies such as Japan, Austria and Hong Kong being the largest contributors. In comparison, FDI flows in 1Q18 and 4Q18 were lower at RM11.2bil and RM12.9bil, respectively.

In addition, non-resident portfolio investments also saw a turnaround in 1Q19 with a net inflow of RM13.5bil, as compared to a net outflow of RM2.5bil in 4Q18.

Moving forward, Alliance Bank chief economist Manokaran Mottain said that the revival of mega-infrastructure projects such as the East Coast Rail Link, MRT3 and LRT3 would likely lead to favourable domestic demand conditions that would support Malaysia’s investment growth in the near term.

In a statement issued yesterday, Economic Affairs Minister Datuk Seri Azmin Ali said that the government would continue to emphasise on spurring investments in the country.

“Malaysia’s proactive involvement in the ‘Belt and Road Initiative’ is expected to deliver a large spillover effect on the economy by increasing FDI and improving the connectivity with global economies. Malaysia has the potential to become the gateway to the regional market that has a population of over 650 million, whose purchasing power has been increasing.

“In order to support economic growth and ensure the rakyat’s well-being, the government has allocated RM54.7bil for development expenditure this year and will ensure the implementation of more than 3,700 projects, including the development of schools, hospitals, roads and infrastructure facilities,” said Azmin.

In 1Q19, the country’s agriculture sector rebounded by 5.6%, up from a growth of 3.1% in the previous corresponding quarter. The recovery was driven by significant improvements in crude palm oil and natural rubber production.

The services sector grew 6.4% in 1Q19 as compared to 6.5% a year earlier. The manufacturing and construction sectors grew 4.2% (1Q18: 5.2%) and 0.3% (1Q18: 4.9%), respectively.

However, the mining and quarrying sector contracted by 2.1% in 1Q19, as compared to a decline of 0.6% in 1Q18.

Commenting on the country’s banking segment performance, which is the bedrock of the national economy, Nor Shamsiah said total outstanding loan growth had moderated to 4.5% in the first quarter, from 5.1% in 4Q18.

This was mainly because of slower loan growth in the business and household segments at 3.3% and 5%, respectively, in 1Q19.

However, within the business segment, the wholesale and retail trade, hotels and restaurants segment recorded a higher loan growth of 7.5% in 1Q19 (4Q18: 6.8%) and the manufacturing sector’s total outstanding loans increased by 8.3% (4Q18: 7.1%).

Meanwhile, total loan applications declined by 8% in 1Q19 and loan approvals fell by 1.3%.

For full year 2019, Nor Shamsiah said GDP growth forecast has been maintained between the range of 4.3% and 4.8%.

“Risks to the outlook remain tilted to the downside, mainly emanating from external sectors. However, Malaysia is expected to remain on a steady growth path.

“Private sector demand is expected to remain the anchor of growth amid lower public sector spending. The external sector is likely to grow marginally in tandem with modest global demand.

“Going forward, consumer spending is likely to moderate but remain firm on the back of favourable labour market conditions and supportive government policies,” she rold reporters during a briefing yesterday.

Source: https://www.thestar.com.my/business/business-news/2019/05/17/economy-grows-45-in-first-quarter/#8XFlrCOCRbVRYQEx.99

English

English