Malaysia: Economic resilience plan

PETALING JAYA: The medium- to long-term economic recovery plan, slated to be presented in October, will pave the way for Corporate Malaysia to withstand headwinds, ensure sustainable economic growth and boost investor confidence, economists said.

The move, they said, is timely in view of the headwinds and uncertainties compounded by the Covid-19 pandemic, geopolitical tensions, disruptions from Industrial Revolution 4.0, etc, which would over time derail economic growth.

Sunway University professor of economics Yeah Kim Leng (pic below) told StarBiz that such a plan was necessary in light of the new normal global environment brought about not only by the global pandemic, but also disruptions arising from Industrial Revolution 4.0, US-China decoupling and climate change.

Domestically, he said the public acceptance and politicians’ commitment to a credible and viable short and medium to long-term economic recovery plan would reduce the risk of the country’s march to high income, developed nation status from being derailed by administration changes and political instability.

Yeah, a former external member of the central bank’s monetary policy committee (MPC), said that the confluence of both external and internal risk factors has raised the importance and urgency of further strengthening the private sector as the main engine of growth and economic resilience.

Its role in leading industrial upgrading, technology adoption, industrial R&D and innovation should be made a core policy pillar, he said.

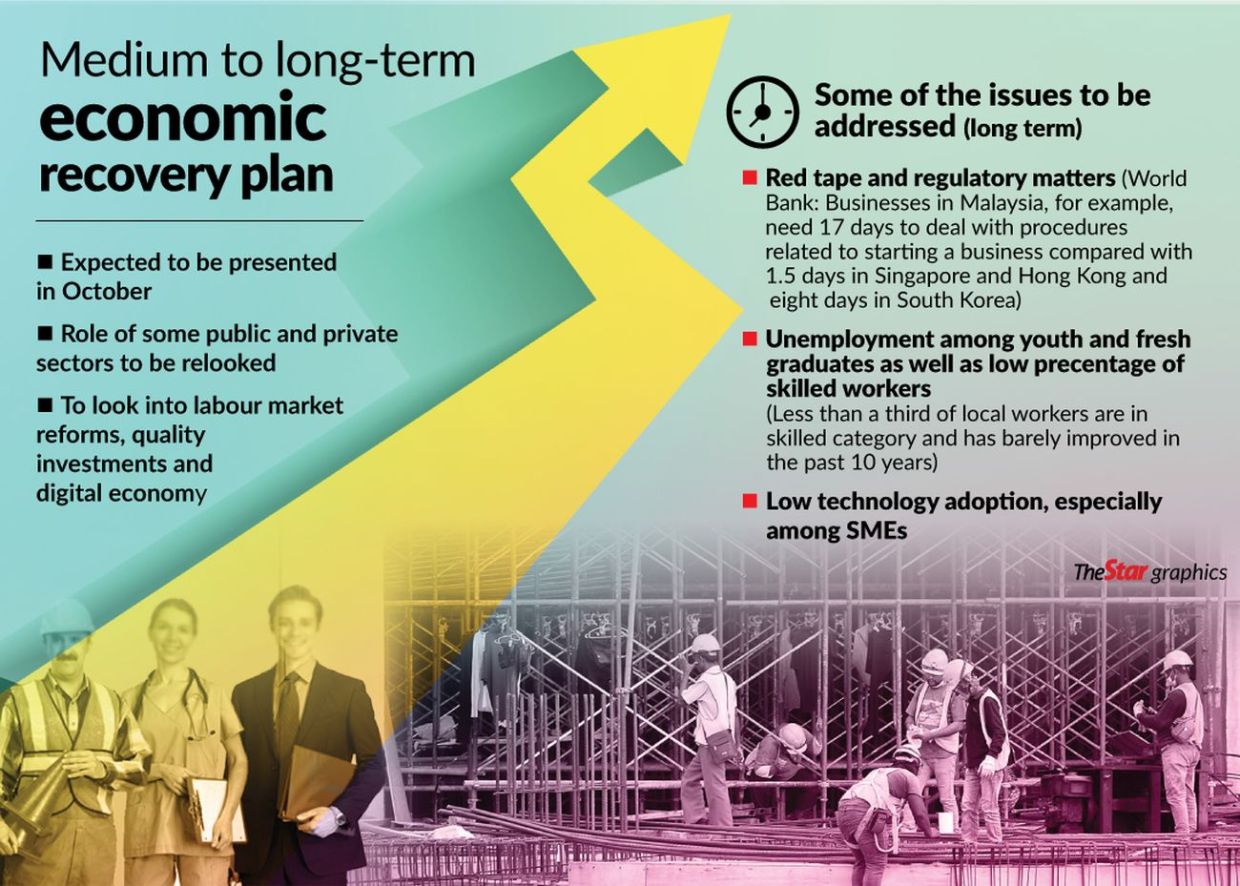

Speaking at the recent Invest Malaysia 2020 (Series 2), Minister in the Prime Minister’s Department (Economy) Datuk Seri Mustapa Mohamed was reported as saying that the role of certain public and private sectors would be relooked under the medium- to long-term economic recovery plan. He added this was to spearhead Malaysia’s developments going forward.

The economic plan is expected to be revealed in October and would provide guidelines for the long-term growth and sustainability of the country’s economy and would address a number of reform measures.

He said the government would also look at the future of workforce, labour market, quality investments as well digital economy, as part of the reform processes.

Besides the economic recovery plan, two other major documents, Budget 2021 and 12th Malaysia Plan (12MP), are expected to be announced in the coming months.

Budget 2021 is expected to be presented on Nov 6 while the 12MP by next year.

In his keynote address a few days later at the Malaysian Banking and Finance High Level Meeting and Virtual Conference, Mustapa said the government would address three issues in the long-term economic recovery plan including red tape and regulatory reform.

Another critical issue to address, he said, was the low technology adoption among firms, especially small and medium enterprises (SMEs).

While welcoming the recovery plan, Malaysian Rating Corp Bhd (MARC) chief economist Nor Zahidi Alias told StarBiz the move was not a surprising one.

He said much of this was related to some findings in recent years of public investments declining. “For example, studies have shown that development expenditures or allocations under various Malaysia Plans had shrunk from roughly 23% of GDP during the Fourth Malaysia Plan in the 1980s to around 4% in recent years.

“In the past few decades, Malaysia’s medium-term development plans (eg Malaysia’s five-year plans) were primarily used to draw the roadmap for medium-term development and investment plans. However, in recent years, large scale projects in the country were primarily spearheaded by government-linked companies (GLCs), rather than the federal government, hence making the differentiation between private and public investments rather difficult.

“In fact, studies have shown that since the 1990s, there was already a trend of rising NFPEs (non-financial public enterprises) development expenditures vis-à-vis federal government development expenditures, ” he noted.

AmBank Group chief economist Anthony Dass (pic below), who is also member of the economic action council secretariat, said there would continue to be challenges that could impact the economy amid the pandemic and external headwinds.

Towards this end, he said there is a need to rethink the country’s existing economic model.

“The economic model should be able to pre-empt, to remedy and to surge ahead.

“It is to ensure the economy successfully emerges from the crisis and is able to re-position itself as an important destination for businesses, investments and trade from both global and domestic. It needs to be able to withstand the future crisis. It is necessary to carefully review targets and plans by taking into account the impacts of this pandemic, ” Dass noted.

Economists are also stressing on some pertinent areas that they hope would be embodied in the economic recovery plan.

Yeah said a rationalisation of the role and mandate of GLCs should also be part of the medium- to long-term recovery plan with the focus centred on complementing private sector growth rather than crowding out or diminishing private sector dynamism, especially in industries that are prone to monopolies and regulatory capture.

Another critical area in the public sector space is the continuation of institutional reforms to strengthen governance, public financial management and government delivery systems.

Source: https://www.thestar.com.my/business/business-news/2020/08/03/economic-resilience-plan

English

English