Invest Long-Term in Equities to Benefit From Indonesia’s Economic Boom: Sandiaga Uno

Jakarta. Today, the Indonesian young generation stands to benefit from its rapid growth and capital market development that present ample investment returns in the next few decades, Tourism and Creative Economic Minister Sandiaga Uno said on Wednesday.

Sandiaga, one of Indonesia’s richest people, urged the young people aspiring to become financially independent to become long-term investors in equities and focus their investment on major trends like digitization, life longevity, and green technology — instead of involving in speculative trades.

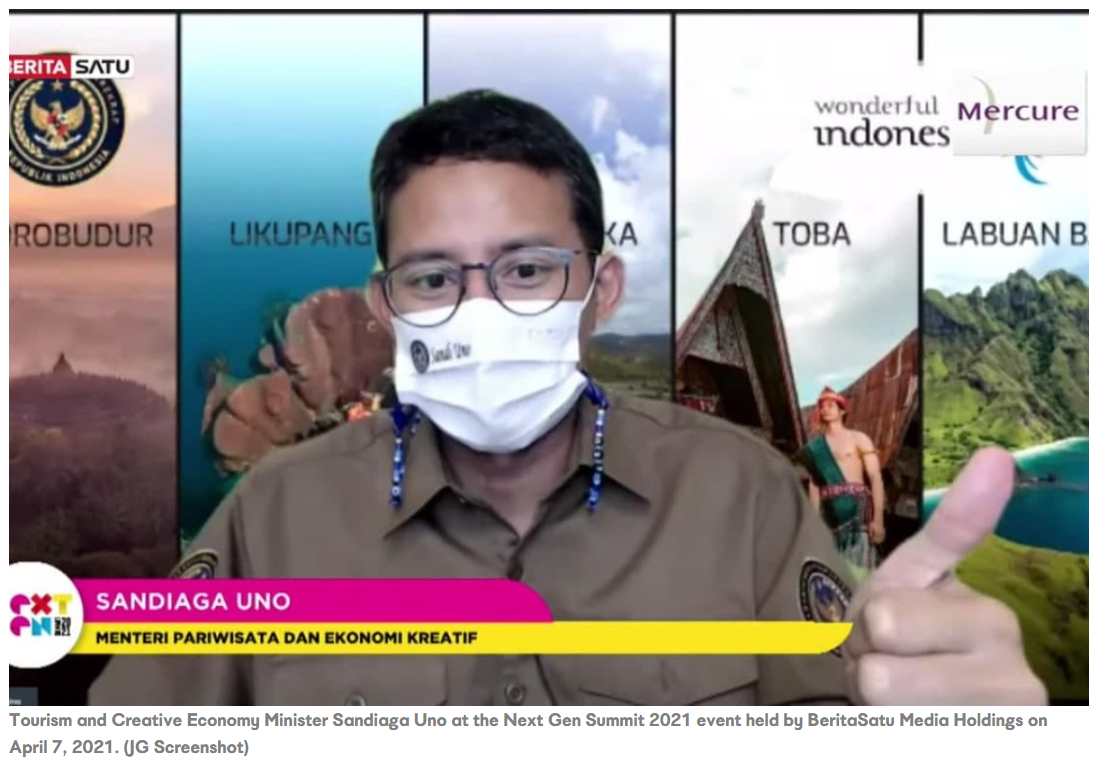

“Young people should invest. This is the right time and doesn’t wait any longer,” Sandiaga told the Next Gen Summit 2021 conference held by BeritaSatu Media Holdings on Wednesday.

“With Indonesia becoming the top five largest economies in 2045, companies in Indonesia will become global. Investing in equities with a long-term ability to deliver above-market performance would best suit the young people,” the businessman said.

Last year, a projection from Blomberg Economics saw Indonesia overtaking Germany as the fifth largest economy in 2045, just below China, the United States, and India.

On the other hand, for an economy of its size, Indonesia’s capital market still lagged behind its peers.

Less than 3 percent of the country’s working population invests in the stock market data from the Indonesia Stock Exchange (IDX) and the Central Statistics Agency (BPS).

In comparison, 14 percent of US families have a direct investment in the stock market. More than half have some level of exposure to the market, data from research organization Pew Research showed.

Indonesia’s listed companies’ total market capitalization sits at Rp 6.939 trillion ($477 billion), or around 44 percent of its gross domestic product (GDP), lower than G20 countries average.

Long-term trajectory aside, Sandiaga said that the young investors should resist the temptations of trying to make short-term gains.

“Never time the market. Do not become too speculative at the beginning. Avoid speculative stocks and focus on the fundamentals. “Avoid herd mentality when investing,” he said.

Offering his latest insight as a seasoned investor, Sandiaga said young investors should keep an eye on these three “long-term, unstoppable trends.”

“The first one is digitization. Everything will enter the digital realm in the future,” he said.

Another trend is live longevity, which opens doors for the rise of the silver economy, as people aged 60 years and above are financially independent.

“In two to three years, or maybe five, there will be silver economies gaining back. They have the time and financial freedom. They are healthy and can work from anywhere. They are worth up to $15 trillion and have the ability to spend,” Sandiaga said.

Last but not least is the green economy. “It is inevitable how we are moving towards that direction,” he said.

Source: https://jakartaglobe.id/business/invest-longterm-in-equities-to-benefit-from-indonesias-economic-boom-sandiaga-uno

English

English