Indonesia Seen on Hold as Rupiah Depreciates: Decision Guide

(Bloomberg) — Bank Indonesia is expected to keep its benchmark interest rate unchanged for a second straight month as volatility in global financial markets continues to weigh on the nation’s currency.

All 35 economists surveyed by Bloomberg say Bank Indonesia will keep its seven-day reverse repurchase rate at a record low of 3.5% on Tuesday. The central bank has said it believes the rupiah is “very undervalued” at the moment, but could strengthen going forward with the economy improving and price pressures subdued.

Bank Indonesia “is likely to be mindful not to exacerbate rupiah depreciation pressures through further rate cuts,” TD Securities strategists including Mitul Kotecha wrote in a research note. “Improving growth prospects should give BI some space to keep rates on hold this month.”

Here’s what to look out for in Tuesday’s decision:

Currency Drop

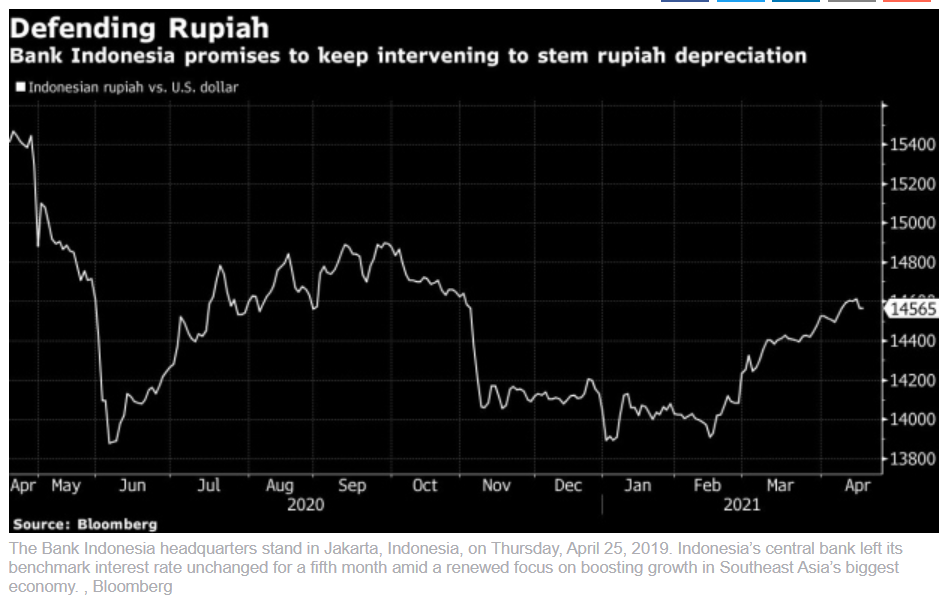

The rupiah tumbled as low as 14,635 against the dollar last week, its weakest level since November, and is down 3.4% so far this year.

Bank Indonesia has pledged to defend the currency and has been intervening continuously in the FX and bond markets. Amid the intervention, Indonesia’s foreign reserves declined in March from February’s record high.

Recovery Advancing

The recovery in Southeast Asia’s largest economy is showing signs of accelerating, with some high-frequency indicators strengthening. The manufacturing purchasing managers’ index rose to an all-time-high in March and consumer confidence has continued to climb, though retail sales — key to the consumption-led economy — remain weak.

Trade is also showing signs of revival, with exports and imports both beating expectations in March. While the data are boosted to some extent by comparisons to a year ago, when the pandemic had brought the world economy to a standstill, they’re also buoyed by stronger demand from advanced markets, and shipments of raw materials to Indonesia.

“Trade prospects will continue to strengthen in line with the economic growth rebound in trading partner countries, especially China,” said David Sumual, chief economist at PT Bank Central Asia.

President Joko Widodo recently said the economy should grow 7% this quarter, after having likely contracted 0.5% in the first quarter.

Keep It Low

Deputy Governor Dody Budi Waluyo said earlier this month that Bank Indonesia doesn’t want to take any “premature” tightening steps that could undermine the recovery. Monetary authorities have signaled that when the time comes for policy changes, an interest-rate hike likely won’t be the first step.

“Governor Perry Warjiyo has been downplaying the likelihood of further rate cuts,” with the central bank instead highlighting its focus on macroprudential policy, Barclays Bank Plc regional economist Brian Tan said.

Source: https://www.bnnbloomberg.ca/indonesia-seen-on-hold-as-rupiah-depreciates-decision-guide-1.1592449

English

English